Daily News Nuggets | Today’s top stories for gold and silver investors

October 3rd, 2025

Central Bank Gold Buying Rebounds in August

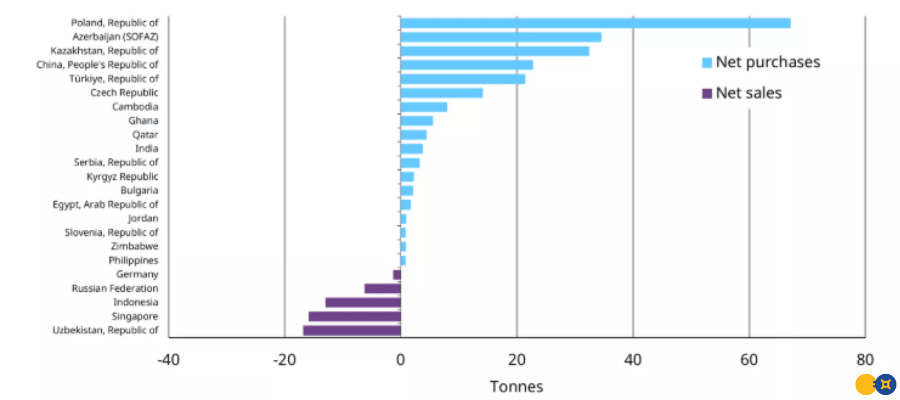

After stepping back in July, central banks resumed gold purchases in August, adding a net 15 tons to global reserves. Kazakhstan led the buying, followed by Bulgaria and El Salvador. Notably, Poland — 2025’s largest buyer — reaffirmed its commitment by raising its gold reserve target.

Year-to-Date Central Bank New Purchases and Sales

Why this matters: Central bank demand remains a critical pillar of gold’s strength, especially in a world where Western investors are still catching up to the “new gold playbook”.

With that central bank demand in the background, the market’s response has been emphatic…

Gold Extends Seven-Week Rally

Gold is on track for its seventh consecutive weekly gain, holding near $3,870/oz in Friday trading as investors digest turmoil at the Federal Reserve and a government shutdown that has frozen key economic data. Silver is also steady at $47.75/oz, maintaining its best levels in over a decade.

What makes this streak remarkable is gold’s resilience in the face of higher real interest rates. Traditionally, that environment would pressure the metal — but instead, political instability and doubts about Fed independence are driving a powerful flight-to-safety bid. Traders say physical demand in Asia and strong ETF inflows are adding fuel to the rally.

The momentum isn’t confined to bullion itself — mining stocks are riding the same wave.

Gold Stocks Outshine AI Giants

Gold miners are stealing the show from Wall Street’s favorite tech names. MSCI’s index of global gold miners is up 135% year-to-date, dwarfing the 40% rise in leading semiconductor stocks. Heavyweights Newmont and Agnico Eagle have more than doubled in New York, while China’s Zijin Mining has surged 130% in Hong Kong. London-listed Fresnillo has nearly quadrupled, making it the single best performer in the FTSE 100 this year.

The rally reflects not just higher bullion prices but also improved cost discipline and investor appetite for “real” assets over speculative growth stories. The question now: can momentum hold if economic data cools further?

U.S. Government Shutdown Silences Jobs Report

For the first time in years, investors are flying blind on the U.S. labor market. The government shutdown has halted the Bureau of Labor Statistics’ marquee jobs report, leaving Wall Street without its most closely watched economic release. In its place, private data from ADP and Revelio Labs paints a picture of a labor market cooling at the edges — hiring is slowing, layoffs remain low, and wage growth continues to ease.

So, what does that mean for investors? The economy looks like it’s shifting into a lower gear just as political dysfunction in Washington ramps up. That combination could corner the Fed into cutting rates sooner than planned — the kind of backdrop that has historically fueled gold and silver rallies.

With official data missing, every Fed comment suddenly carries more weight.

Fed’s Logan Urges Caution on Rate Cuts

Dallas Fed President Lorie Logan has urged extreme caution on further interest rate cuts, even as the Fed recently trimmed rates to guard against a sharper labor‑market decline.

Speaking at UT Austin, she warned that inflation remains above target and could become more persistent if policy eases too quickly. Logan emphasized the need to calibrate policy carefully — easing too fast, she argued, risks derailing price stability and forcing a painful reversal. She noted that while the labor market is cooling, it’s doing so gradually, and overcorrecting too soon would be imprudent.

The question now is how the Fed balances support for jobs with anchoring inflation expectations.