Daily News Nuggets | Today’s top stories for gold and silver investors

October 29th, 2025

Gold Claws Back Above $4,000 After Trade Talk Selloff

Gold rebounded above $4,000 an ounce Tuesday after plunging as much as 3.2% on Monday as US-China trade progress reduced demand for haven assets. By Wednesday, gold traded at $4,016 — still well below its record high near $4,400 earlier this month.

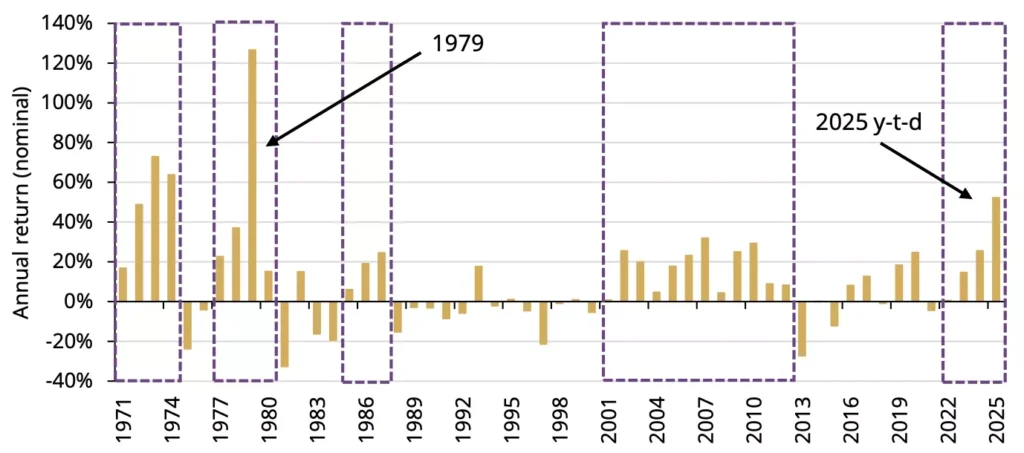

Gold has surged more than 54% this year, fueled by strong investment demand amid geopolitical tensions, dollar weakness, and Fed rate cut expectations. That puts 2025 on track to be gold’s best year since 1979 — when the metal surged 125% amid soaring inflation and the Iranian hostage crisis.

Annual Gold Return in Nominal Terms

Source: Bloomberg, World Gold Council | Data as of 10/9/25. Based on the LBMA Gold Price PM.

The chart above shows gold doesn’t move in straight lines: sharp rallies are often followed by multi-year corrections. But higher Treasury yields following the trade announcement also weighed on the non-interest-bearing metal, reminding investors that even historic rallies face headwinds when bond returns improve.

Silver Bounces Back 2.5% After Trade Talk Whipsaw

Silver mirrored gold’s wild ride this week, rebounding 2.5% Tuesday after getting hammered 3.8% on Monday. The selloff came as optimism over US-China trade talks sapped demand for haven assets. Senior officials from both countries announced a framework agreement on tariffs over the weekend in Malaysia, with Treasury Secretary Scott Bessent saying Trump’s threat of 100% tariffs on Chinese goods is “effectively off the table.”

But silver found support heading into Wednesday’s Fed meeting. With a rate cut nearly guaranteed, the metal is benefiting from the same forces lifting gold — lower rates reduce the opportunity cost of holding non-yielding assets. Silver’s industrial demand also makes it more sensitive to economic optimism: if trade tensions genuinely ease and manufacturing picks up, the metal could see demand from both investors and industry.

So, what’s driving the precious metals rebound? All eyes are on the Federal Reserve.

Fed Set to Cut Rates Again — Despite Flying Blind on Jobs Data

The Federal Reserve is widely expected to cut its benchmark rate by a quarter point Wednesday, marking the second cut in six weeks. Markets are pricing in a 99% probability, which would lower rates to 3.75%–4.00%. The twist? The government shutdown that began October 1 has left the Fed without official jobs data for September or October.

Policymakers have grown more concerned about preventing unemployment spikes, even as inflation remains elevated. Major corporations including Amazon and Target have announced thousands of job cuts. Lower rates typically weaken the dollar and reduce the opportunity cost of holding gold—both supportive for precious metals. With markets pricing in near-certainty of another December cut, the easing cycle may extend well into 2026.

Those job cuts the Fed is worried about? They’re hitting one sector particularly hard.

America’s White-Collar Workers Face a Silent Recession

One in four American workers who lost their jobs in 2024 worked in professional and business services — what are considered white-collar jobs. Unemployment in the professional and business services sector has climbed from 3.1% to 4.0%, while blue-collar industries like manufacturing and healthcare continue hiring steadily. Amazon announced plans to cut 14,000 corporate positions, while Target said it’s cutting about 1,000 corporate jobs.

The main culprit appears to be the advancement of generative AI, with 70% of tasks in white-collar roles potentially “transformed” or “replaced” by artificial intelligence. According to LinkedIn’s January 2025 report, hiring for roles with salaries over $125,000 dropped 32% compared to the previous year. Job searches now average six to nine months for senior professionals, and 40% of white-collar applicants didn’t land a single interview in 2024.

Yet despite these economic warning signs, speculation in the markets is reaching fever pitch.

Nvidia Races Toward $5 Trillion as AI Bubble Debate Intensifies

Nvidia is on track to become the first $5 trillion company, with shares rising 3.5% Wednesday morning. CEO Jensen Huang dismissed bubble concerns at the company’s Washington conference, saying Nvidia’s latest chips are on track to generate half a trillion dollars in revenue.

But skeptics aren’t convinced. The IMF and Bank of England have warned that markets could be in trouble if investor appetite for AI turns sour. Critics point to “circular revenue deals” and debt-fueled spending, with over 1,300 AI startups now valued above $100 million — drawing parallels to the dotcom bubble. If the AI trade unwinds, it could trigger a broader selloff and renewed flight-to-safety demand for gold and silver.

Massive tech valuations built on speculative future earnings — rather than current profits — have historically ended poorly. For precious metals investors, watching Nvidia’s trajectory offers a real-time gauge of risk appetite and whether markets are overheating.