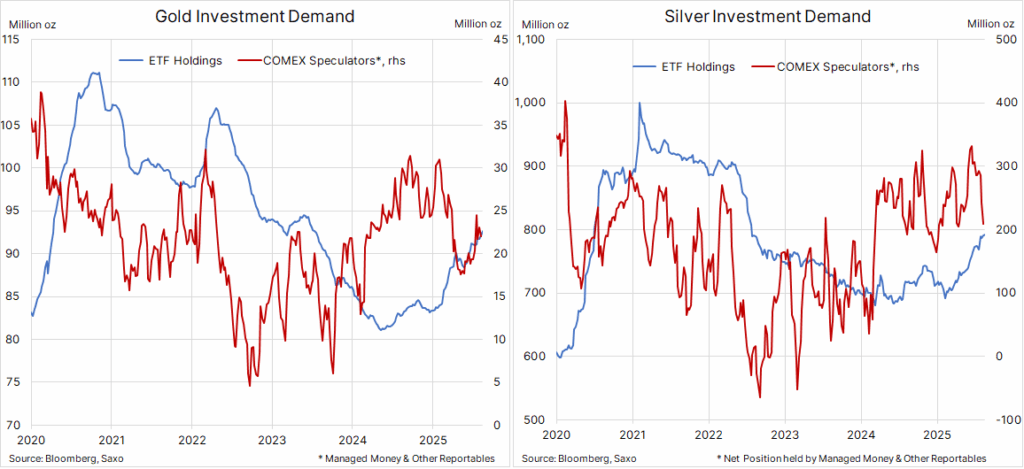

Gold and silver are holding steady despite strong year-to-date gains, with prices boxed in by a lack of fresh catalysts. Gold has pivoted around $3,350 in recent months, supported by record ETF holdings (25-month high) and central bank accumulation, while silver benefits from industrial demand and ongoing supply deficits. Still, rallies are capped by firm Treasury yields and fading dollar strength.

Attention now turns to Jackson Hole and Fed Chair Powell’s keynote, with markets pricing a September rate cut but uncertain about the path ahead. A dovish Fed pivot, weaker labor data, or renewed geopolitical tensions could provide the spark for an upside breakout. Until then, both metals are expected to remain in a holding pattern.