Daily News Nuggets | Today’s top stories for gold and silver investors

October 22nd, 2025

Government Shutdown Hits Workers — Presidential Wishlist Marches On

It’s Day 22 of the federal government shutdown. Food programs for women and children are running out of funding, federal workers are filing for unemployment, and essential services are grinding to a halt. Yet somehow, demolition work started this week on a $250 million ballroom addition to the White House — a 90,000-square-foot glass-walled space Trump says will accommodate 999 people.

Oh, and Trump is also demanding that the Justice Department pay him $230 million for investigations he faced while out of office. The White House claims the ballroom is privately funded, but the broader picture is hard to ignore: government can’t keep the lights on for essential programs, yet vanity projects and self-dealing somehow find a way forward.

That kind of institutional chaos doesn’t just erode confidence — it raises major questions about the reliability of the data coming out of Washington.

Friday’s Inflation Report Comes With an Asterisk

September’s CPI data drops Friday, but Wall Street is approaching the numbers with more skepticism than usual. The Bureau of Labor Statistics is already under fire after massive downward revisions to jobs data led to the commissioner’s ouster in August. Now, with the government shutdown limiting staffing during data collection, investors are openly questioning whether the inflation reading will be reliable.

“Skeptics like me are going to be focused on how clean is this data,” says Vishal Khanduja of Morgan Stanley Investment Management. If investors lose confidence in official inflation metrics — or if the data shows surprises either way — it could fuel volatility across markets. For gold, which thrives on inflation fears and policy uncertainty, doubts about the trustworthiness of government data only add to the metal’s appeal as an objective store of value.

With trust in official metrics wobbling, investors are taking a fresh look at assets that don’t depend on government statisticians for their value.

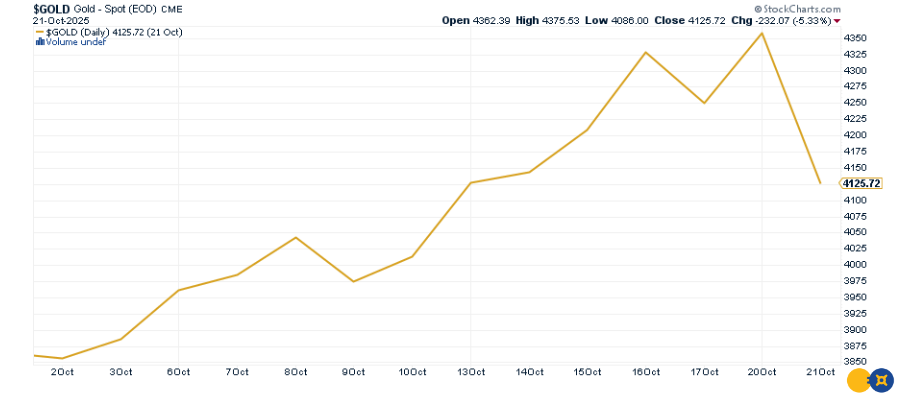

Gold Slides as Investors Book Profits

Spot gold dipped below $4,080 an ounce this week, snapping a remarkable run that’s pushed prices up 55% this year. The pullback looks like classic profit-taking after one of gold’s strongest stretches in recent memory — the metal has been on a tear since mid-August.

The drivers behind gold’s surge are still very much in play. Concerns about unsustainable government debt are pushing investors toward hard assets and away from traditional bonds and currencies. Meanwhile, expectations for aggressive Fed rate cuts are keeping downward pressure on real yields.

Those fundamentals haven’t changed. If you’ve been waiting for an entry point or looking to add to your position, a temporary dip after a historic rally could be exactly that. And if you want real-world proof that the bull case is intact, look at what’s happening in Sydney this week.

Queues Around the Block for Bullion in Sydney

A modern‑day gold rush is unfolding in Sydney’s financial district. As many as 1,000 people a day are lining up — sometimes for four hours — outside ABC Bullion to buy physical gold and silver. Management reports September storage demand nearly tripled year‑over‑year. With gold near record highs around A$6,700/oz and silver breaking a 45‑year record, buyers cite insurance against U.S. political dysfunction, geopolitical flare‑ups, and expectations for further Fed easing.

The takeaway: When uncertainty spikes, investors often want something they can hold. The sight of long queues are a visceral reminder of the broader shift toward tangible hedges — supportive for bullion prices even as futures traders take profits.

That rush for physical metal isn’t an isolated phenomenon—regulators in the world’s second-largest gold market are reinforcing gold’s central role in their financial system.

India Tightens Gold Loan Rules — And Signals Deeper Trust in Physical Metal

India’s central bank issued comprehensive new rules in June for lending against gold and silver collateral, consolidating decades of scattered regulations into a unified framework effective by April 2026. The changes include tiered loan-to-value ratios—up to 85% for small loans, dropping to 75% for larger amounts—and strict bans on lending against bullion, bars, or gold ETFs. Lenders must return collateral within seven days or pay ₹5,000 per day in penalties.

The bigger picture: India accounts for roughly 25% of global gold demand, and gold loans there exceed $50 billion annually. Regulators aren’t restricting gold-backed lending—they’re tightening it, which signals that physical gold remains absolutely central to financial security in the world’s most populous nation. For Western investors, India’s regulatory focus on physical metal over paper proxies sends a clear message about where lasting value resides.

![Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]](https://goldsilver.com/wp-content/uploads/2026/01/gold-silver-performance-2025-300x200.jpg)