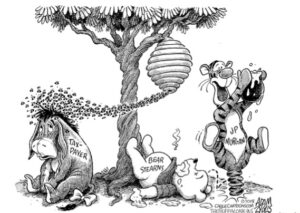

There are occasions you have to be patient with technical analysis. Seldom do you have to wait four decades for a chart to fully form, but with this one, it appears as if the wait will have been well worth it.

Could Silver be about to end its 7-year bear market? Are commodities about to enter into a long-term upward cycle?

The chart above looks at Silver over the past 40-years. It is possible that it is forming a bullish multi-decade “Cup & Handle” pattern.

Silver currently remains inside of a 7-year falling channel, which could be the handle of the long-term bullish pattern. If Silver would breakout at (1), it would send a bullish price message and should attract buyers.

The top of the handle pattern comes into play as resistance right now so this is a very important test for Silver! Big test friends to see if its “Hi-Yo Silver” time!

ORIGINAL SOURCE: Silver; Mother of all bullish “Cup & Handle” patterns? by Chris Kimble at Kimble Charting Solutions on 2/25/18