Daily News Nuggets | Today’s top stories for gold and silver investors

September 19th, 2025

Gold Notches Fifth Straight Weekly Win

Gold is having quite a run. The metal is heading for its fifth consecutive weekly gain, sitting pretty near record highs after Wednesday’s Fed rate cut. Up 39% this year, gold has been the standout performer while stocks and bonds struggle with mixed signals.

Why the momentum? Simple math: when the Fed cuts rates, holding non-yielding gold becomes less of a sacrifice. Traders are now watching to see how aggressive the Fed will get with future cuts. With recession fears growing and real yields still negative, gold’s role as portfolio insurance is looking like a smart buy.

The Triple Threat Pushing Gold to Records

Three forces are converging to send gold prices skyward: escalating tariffs, stubborn inflation, and an increasingly dovish Fed. Trade tensions are adding fuel to the inflation fire just as the Fed tries to support a weakening economy — creating what analysts call a “stagflation cocktail.”

It’s the kind of environment where traditional assets struggle but gold shines. The metal has outperformed both stocks and bonds this quarter, proving once again that when policy makers are caught between a rock and a hard place, investors vote with their wallets for gold’s certainty.

India’s Wedding Season Sparks Gold Buying Spree

India’s gold market is buzzing as the festival season approaches. Premiums just hit a 10-month high as jewelers prepare for Dussehra and Diwali — the country’s peak gold-buying season. What’s interesting is the contrast with China, where dealers are actually offering discounts. This split between Asia’s two gold giants shows just how powerful cultural demand remains.

For the global market, India’s seasonal appetite couldn’t be better timed. When the world’s second-largest gold consumer goes shopping at already tight supply levels, it tends to put a floor under prices.

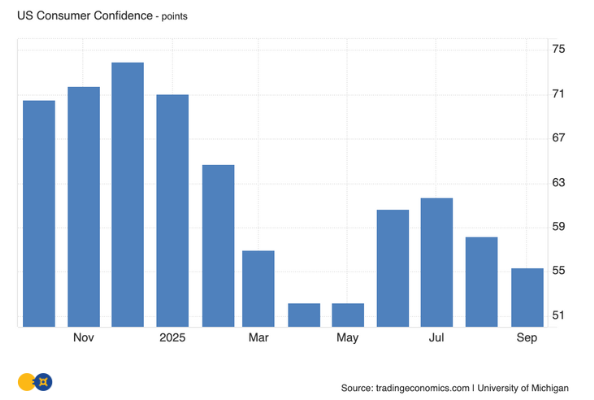

Consumer Confidence Takes a Dive

Main Street isn’t buying the soft landing story. Consumer sentiment dropped to 55.4 in September from 58.2 in August, catching economists off guard and highlighting the disconnect between Fed policy and kitchen table economics. The decline marks the lowest reading in six months, with middle-class Americans especially worried about job security and persistent inflation eating into paychecks.

This pessimism matters for gold because nervous consumers often become nervous investors. When faith in the economy wobbles, the appetite for “real” assets like gold and silver typically picks up. It’s a pattern we’ve seen before: Wall Street celebrates rate cuts while Main Street buys protection.

Ray Dalio’s Gold Warning Goes Mainstream

Ray Dalio isn’t mincing words about America’s debt problem. The billionaire investor told CNBC that gold and other hard assets will be the clear winners as the U.S. debt burden becomes unsustainable. With national debt topping $33 trillion and no spending restraint in sight, Dalio sees echoes of past currency crises.

His point echoes GoldSilver’s long-held view: when governments print their way out of debt problems, smart money moves into assets they can’t print. Coming from the founder of the world’s largest hedge fund, it’s a view that’s gaining serious traction among institutional investors who remember what happened to currencies throughout history.