Saxo Bank Predicts Silver to Outshine Gold Amid Industrial Boom

Silver’s impressive performance in 2024, as reported by Saxo Bank, highlights its dual role as both a precious and industrial metal. This year, silver has benefited from rising industrial demand, particularly in sectors like renewable energy and electronics, while also mirroring gold’s upward trajectory due to macroeconomic uncertainties. Analysts suggest that silver could outperform gold in the coming year, driven by continued industrial demand and a structural supply deficit that keeps prices buoyant.

$5,851 vs. $468,000: If 1870-Hidden Treasure Was Invested in Dollars vs. Gold

Today, would you hope to find 148-year-old treasure in actual dollars or the gold that had been purchased with that amount of 1870 dollars at the time? Effectively, the question is “Would you rather find $5,851 or $468,000?”

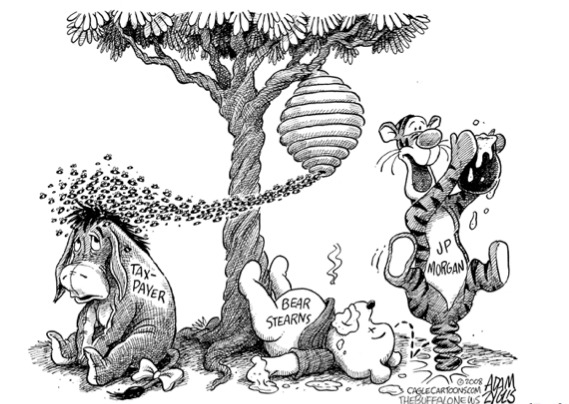

Why the Collapse of Bear Stearns Changed the Silver Market Forever

Very few people know exactly what was said, promised, discovered, obfuscated, threatened, etc. in the dark and high-tension days surrounding the collapse of Bear Stearns and its taxpayer-subsidized subsequent digestion by JPMorgan. What is irrefutable is that JPMorgan inherited Bear’s enormous and disastrous short silver position. How they would deal with it in response has fundamentally altered the silver market, while simultaneously setting it up for a historic rally. Bear Stearns’ failure coincided, to the day, with gold hitting all-time highs (over $1000) and silver hitting 30 year highs ($21). It’s easy to calculate that Bear lost more than $2 […]

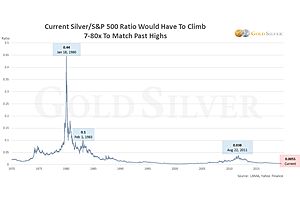

Silver’s 40-Year Cup-and-Handle Pattern Finally Complete?

If silver breaks out, it would send a bullish price message around the world.