The ETF Illusion: What Gold Investors Must Know

Most investors think they own gold. But according to expert Alan Hibbard, much of it might not be what it seems. In this revealing Big Biz interview, Alan breaks down the quiet — but growing — divide between paper gold (like ETFs) and true physical bullion. He also outlines how a shift to digital currency and a long-overdue audit of U.S. gold reserves could shock the system and ignite a massive revaluation. If you want real protection, real value, and real gold — you need to watch this.

Gold Pulls Back After Record Run — What Comes Next?

Gold is still up 44% YoY — but after hitting $3,500, it’s cooling. Is this a reset… or a rare buying window?

US-China Tensions Could Trigger the Next Monetary Reset

Discover how US-China tensions could spark the next monetary reset—and how to protect your wealth before it’s too late.

Gold to $12,000? The Mar-a-Lago Accords Could Spark the Rally

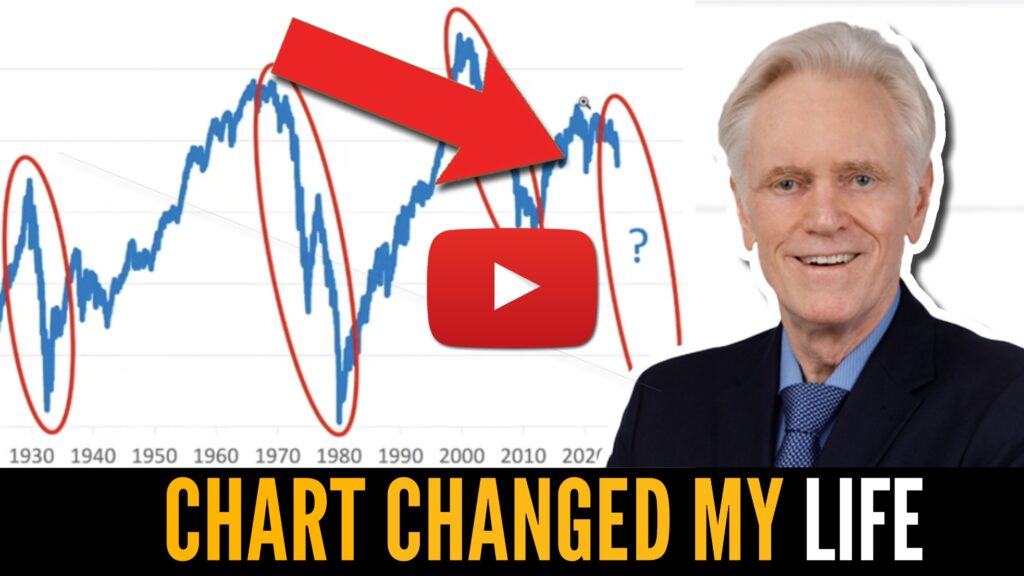

The Mar-a-Lago Accords are coming — and they could transform the global financial system overnight. We may be witnessing the early stages of a historic monetary reset, with gold and silver positioned at the center. Mike and Alan came together for an urgent update to discuss this remarkable situation: The patterns are clear: just as Nixon’s departure from the gold standard reshaped the financial landscape, today’s monetary crisis signals another seismic shift. A once-in-a-lifetime financial transformation appears to be in motion. This rare window of opportunity to safeguard your wealth could close faster than most realize.