Nearly One in Four Americans Choosing Between Debt and Necessities

A recent Experian survey reveals the depth of America’s credit crisis, with 23% of adults facing “unmanageable” debt that requires choosing between debt payments and essential needs. However, the data also shows encouraging signs: 45% of respondents have overcome previously unmanageable debt, experiencing improved mental wellbeing as a result. Many Americans are actively addressing their financial challenges by taking on additional work, using strategic debt repayment methods, and employing budgeting tools. The Experian survey also uncovered that a significant misconception about debt is that making minimum payments is sufficient, with more than 2 in 5 respondents identifying this as their […]

Credit Card Crisis: Fed Warns of Highest Consumer Distress in 12 Years

Consumer financial distress is at its worst level in 12 years according to the Federal Reserve Bank of Philadelphia, with over 11% of Americans making only minimum payments on credit cards and delinquencies hitting record highs. This crisis stems from years of above-target inflation that has outpaced wage growth, forcing many to rely on credit cards for essential expenses. A recent survey found one-third of Americans use credit cards to make ends meet, with many maxing out their cards. With interest rates averaging 21.37%, minimum payments barely cover interest charges.

Silver’s Time to Shine: Why the Forgotten Metal May Soon Catch Gold’s Momentum

Gold has recently hit record highs, up 41% over the past year and 113% this decade, outperforming the S&P 500’s 78% return. Historical patterns suggest silver may soon follow and potentially outperform gold. Silver typically lags gold during market downturns but often outshines it during recoveries due to its dual role as both a precious metal and industrial commodity used in electronics and solar energy. The current gold-silver ratio of 98:1 far exceeds the 30-year average of 68:1, indicating silver may be undervalued. This pattern has consistently repeated after previous market crises. Following the 2020 COVID panic, silver surged 73% […]

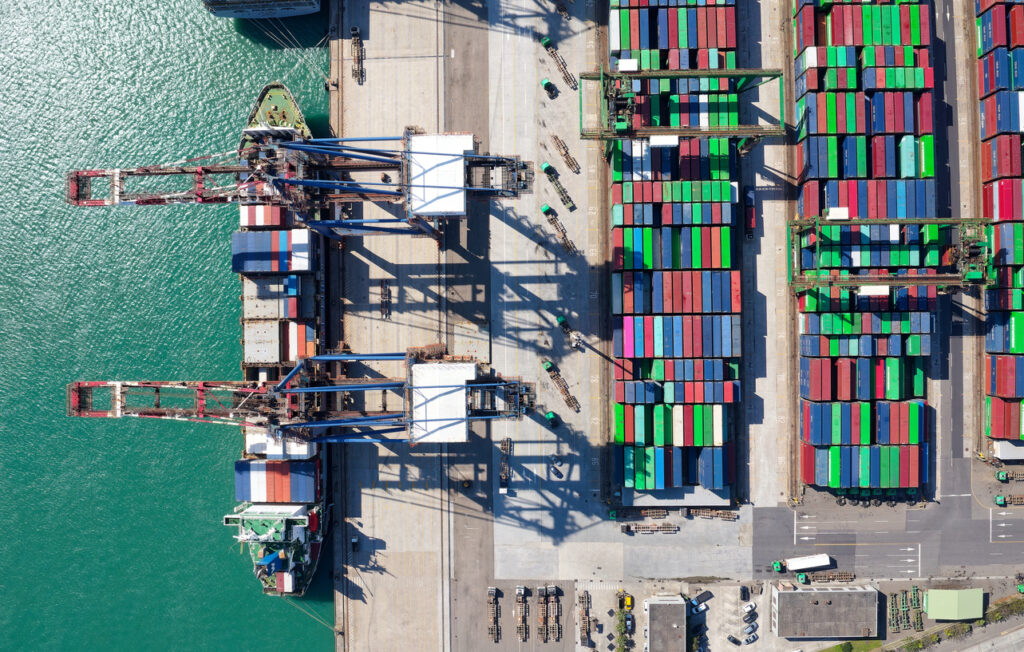

US Supply Chains Brace for Impact as Trump’s China Tariffs Begin to Bite

Trump’s 145% tariffs on Chinese goods have slashed cargo shipments by 60% since early April. A supply shock looms by mid-May when companies must restock inventories, with retailers warning of empty shelves and higher prices. Economists predict “Covid-like” shortages and significant layoffs across multiple sectors. The timing is critical as suppliers prepare for back-to-school and holiday shopping. Businesses describe being “paralyzed” with paused orders. The shipping industry’s reduced capacity means any trade resumption would overwhelm logistics networks, creating pandemic-like bottlenecks. Ship tracking shows 40% fewer vessels from China to the US, carrying a third fewer containers. US importers are pivoting […]

The Stagflation Threat: How Trump’s Trade Wars Could Cripple Economic Growth

In a recent Opinion piece on MarketWatch, columnist Stephen Roach argues that Trump’s “America First” protectionism is leading the US toward prolonged stagflation – a combination of slow economic growth and high inflation. Unlike the temporary supply chain disruptions during COVID-19, Trump’s trade policies represent a permanent decoupling from global trade networks, especially with China and potentially even with North American partners. This reversal of supply chain efficiencies could eliminate the 0.5 percentage point reduction in inflation that the US has enjoyed annually over the past decade. Reshoring manufacturing to the US won’t be quick or easy, as production platforms […]

Oil Faces Worst Monthly Drop Since 2022 Despite Steadying Prices

Oil prices remain steady as traders monitor two key situations: the US-China trade tensions and US-Iran diplomatic talks. Brent crude trades near $67 after China announced plans to support exporters affected by US tariffs while maintaining confidence in reaching its 5% economic growth target. The oil market faces its worst monthly performance since 2022 due to fears that trade disputes will hurt demand, compounded by OPEC+ increasing production. Upcoming US economic data and oil company earnings reports could provide direction for the market, while progress in US-Iran nuclear talks continues despite a deadly explosion at a strategic Iranian port.

100 Days In: Trump’s ‘Strategic Uncertainty’ on Tariffs Leaves Markets Guessing

President Trump’s first 100 days back in office have been marked by significant uncertainty around tariffs, which appear to be his administration’s top economic priority but also the biggest drag on his popularity. Despite promises of quick deals, negotiations with foreign nations remain unclear, with Trump and his team offering contradictory statements about progress. Treasury Secretary Scott Bessent recently described this approach as “strategic uncertainty,” highlighting a pattern that extends beyond trade to other policy areas where progress has been slower than initially promised.

China’s Q1 Gold Consumption Dips 6% While Investment Demand Surges 30%

High gold prices are reshaping China’s gold market, with Q1 2025 showing a 5.96% decline in overall consumption to 290.492 metric tons. Consumers are pivoting away from gold jewelry (down 26.85%) toward investment products like gold bars and coins (up 29.81%), seeking safe-haven assets amid economic uncertainty. Despite consumption changes, China’s gold production increased modestly, with total output reaching 140.830 tons when including gold from imported materials.

Despite Recent Pullback, Analysts Remain Bullish on Gold’s Long-Term Prospects

Gold has retreated about 6.5% from its all-time high as investors responded to signs of de-escalation in US-China trade tensions. This pullback follows President Trump’s statement about substantially cutting tariffs on China, which triggered a recovery in global stock markets. While gold has been a top performer in 2025—rising more than 25% on safe-haven demand and dollar weakness—analysts identify several short-term risks: – fading risk-off sentiment – technical overbought signals – potential slowdown in purchases – and changing liquidity conditions Despite these challenges, many experts believe gold remains positioned for continued long-term strength due to persistent global economic uncertainties.

Gold Pulls Back 6% as Markets Stabilize Following Tariff Threats

Gold prices have fallen about 6% from their recent record high of $3,500 per ounce as trade war tensions ease. The market has calmed following President Trump’s April 2 tariff announcements, with Asian economies making progress in trade talks. Analysts suggest the selloff accelerated as traders recognized the rally had become overextended. Hedge fund managers have reduced their gold positions to the lowest level in 14 months, and options trading patterns indicate an overheated market. Despite this correction, gold has still gained about 25% this year, supported by ETF inflows, central bank purchases, and speculative demand in China, even as […]