Daily News Nuggets | Today’s top stories for gold and silver investors

January 27th, 2026

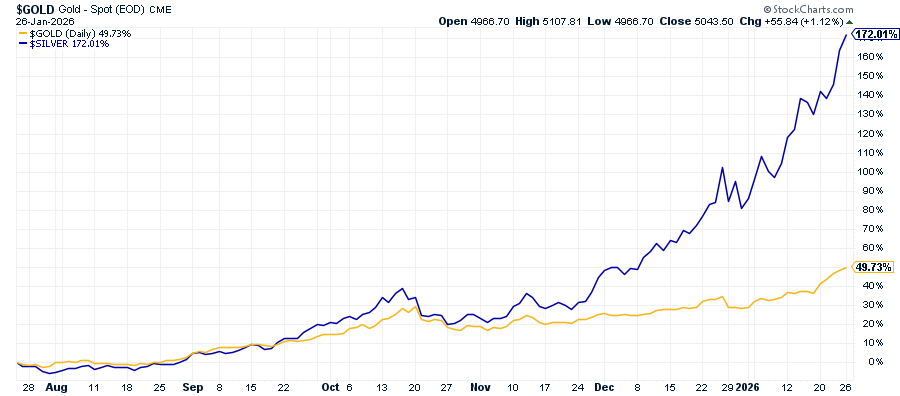

Gold and Silver Surge to New Record Highs

The price of gold blasted past $5,100 per ounce on Monday, hitting an all-time high of $5,110.50. Silver followed suit, reaching $117.69 — both metals shattering previous records in a stunning rally.

Gold and Silver, Six Month Chart

The move reflects growing anxiety about global debt levels and whether governments can manage them without triggering inflation or default. Robin Brooks, senior fellow at the Brookings Institution, called the rise “breathtaking and profoundly scary.”

“We’re at the start of a global debt crisis,” Brooks wrote, “with markets increasingly fearful governments will attempt to inflate away out-of-control debt.”

Investors are rushing into gold and silver as hedges against the risk that central banks print money to reduce debt burdens — a strategy that could devalue currencies and erode purchasing power.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Markets Navigate Fed Meeting and Rising Uncertainty

Wall Street opened mixed Tuesday as investors await the Federal Reserve’s rate decision Wednesday. The Fed is expected to hold steady, caught between inflation that remains above its 2% target and pressure to support economic growth.

Adding to uncertainty: new tariff threats against South Korea, a government shutdown impacting corporate earnings, and sharp declines in health insurers on Medicare rate concerns.

When investors face this many conflicting signals — monetary policy paralysis, trade volatility, sector-specific shocks, geopolitical tension — safe-haven assets typically thrive.

The message: uncertainty itself drives demand for assets that don’t depend on policy decisions or economic forecasts.

Part of that uncertainty stems from what the Fed does — or doesn’t do — about inflation.

Former Fed Official Warns Inflation Likely to Accelerate

Thomas Hoenig, former Kansas City Fed president, believes inflation will rise after the midterm elections as aggressive stimulus measures catch up with the economy.

Despite current economic strength, Hoenig warns policymakers are “mostly stepping on the gas.” Real interest rates remain below 1% and the Fed is conducting quantitative easing at $40 billion monthly.

The combination of fiscal stimulus and accommodative monetary policy is creating conditions for higher prices. Hoenig cautioned that inflation develops slowly but becomes difficult to contain once it takes hold.

He noted rising gold prices and dollar weakness will likely be discussed at the Fed’s next meeting — signs markets are already pricing in inflation risks.

Inflation fears aren’t the only pressure on the dollar.

Yen Strengthens as Dollar Comes Under Pressure

The Japanese yen is rallying against the dollar, raising concerns that Tokyo may intervene to slow the currency’s rapid appreciation. Japan has historically stepped in when the yen moves too quickly in either direction.

A stronger yen creates challenges for Japan’s export-heavy economy by making Japanese goods more expensive abroad. But the move also underscores broader dollar weakness — a dynamic that tends to support gold and silver prices.

When the dollar declines, precious metals become cheaper for foreign buyers, boosting global demand. It also reflects eroding confidence in the greenback as a stable store of value, particularly as debt concerns mount worldwide.

For investors, this matters. Currency instability rarely stays contained. And when faith in fiat currencies wavers, hard assets like gold and silver often benefit. With all these tailwinds in place, Wall Street is taking notice.

Deutsche Bank Raises Gold Target to $6,000

Deutsche Bank lifted its gold price target to $6,000, citing lessons learned from previous rallies. The bank’s analysts warn that underestimating gold’s momentum has been a costly mistake in past cycles.

What’s significant here isn’t just the $6,000 figure — it’s that a major Wall Street institution is making such an aggressive call. When mainstream banks raise targets this dramatically, it reflects recognition that structural drivers are real and intensifying.

Those drivers include unsustainable debt levels, currency debasement fears, and geopolitical instability.

For investors, institutional forecasts like this can validate conviction and broaden the buyer base beyond traditional precious metals advocates. When Wall Street catches up to gold’s fundamentals, momentum tends to accelerate.