Precious metals investors often blame inflation, geopolitics, or Federal Reserve policy for sudden price swings. But one of the most powerful — and least understood — drivers of short-term volatility is margin hikes.

When exchanges raise margin requirements, markets don’t simply “adjust.” They can lurch violently. Prices that were climbing steadily can suddenly plunge. Rallies can accelerate into spikes. And corrections can turn into cascading selloffs.

If you’re investing in gold or silver (especially through futures markets) understanding how margin hikes work could help you avoid being caught in the crossfire.

Let’s break it down.

How Leverage Amplifies Metal Moves

Futures markets allow traders to control large positions with relatively small amounts of capital. Instead of paying the full contract value, they post a percentage — known as the margin requirement — as collateral.

This creates leverage.

For example, if silver is trading at $100 per ounce, a 5,000-ounce futures contract is worth $500,000. With a 15% margin requirement, a trader only needs $75,000 to control that position.

Leverage magnifies gains. But it also magnifies losses. In strong bull markets, leverage fuels momentum. More traders pile in. Positions grow larger. Risk builds quietly in the background.

Then volatility rises — and exchanges respond.

What Happens When Margin Hikes Hit

When exchanges implement margin hikes, traders must immediately post additional capital to maintain their positions.

Some can. Many cannot.

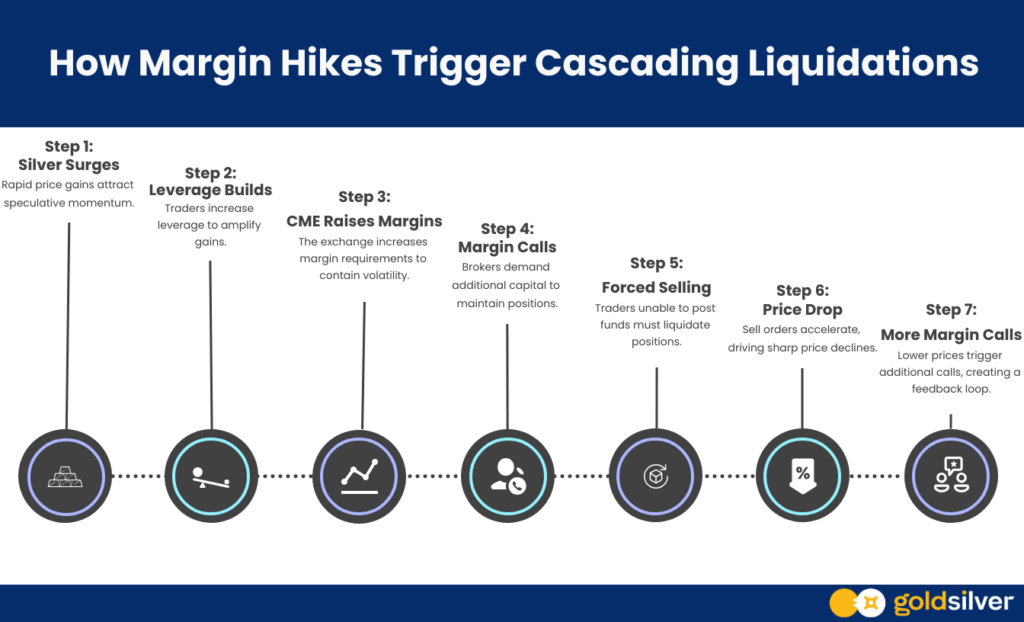

Here’s how forced selling unfolds:

This feedback loop creates cascading liquidations.

It’s important to note that these moves often have little to do with fundamentals. The metal didn’t suddenly lose industrial demand. Central banks didn’t stop buying. Inflation didn’t disappear overnight.

The driver is structural. Paper markets, by design, are sensitive to leverage. And when margin hikes arrive during peak speculation, volatility can explode.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Why Margin Hikes Are More Common in Bull Markets

Exchanges typically raise margins during periods of extreme price movement. Their goal is to reduce systemic risk — not to influence price direction.

But timing matters.

When silver or gold has already surged, leverage tends to be highest. A margin increase at that moment forces weaker hands out of the market. The result is often a sharp, fast correction.

We’re seeing this dynamic play out again. The CME recently raised margin requirements on COMEX gold and silver contracts following heightened volatility and aggressive price moves. That decision didn’t change supply and demand fundamentals overnight — but it did increase the capital traders must post to maintain positions.

And when margin hikes hit at times of peak speculative enthusiasm, they can accelerate reversals.

We’ve seen this repeatedly throughout metals history. Silver’s dramatic runs — in 1980, 2011, and most recently in January 2026 — were all followed by aggressive margin hikes that intensified corrections. After silver surged above $120 earlier this year, a series of CME margin increases forced leveraged traders to unwind positions, triggering cascading liquidations that drove prices sharply lower.

Nothing fundamental about silver’s long-term supply-demand outlook changed overnight. What changed was the capital required to hold speculative positions.

Paper Markets vs. Physical Ownership

Here’s the key distinction many investors overlook:

- Margin hikes affect leveraged futures positions.

- They do not directly affect physical gold or silver owners.

If you hold allocated metal outright, there are no margin calls. No forced liquidations. No requirement to post additional capital because an exchange changed its rules.

That doesn’t mean spot prices won’t fluctuate — they will. But the structural risk of being forced out of your position disappears.

In that sense, volatility is largely a feature of paper markets. Physical ownership insulates you from the mechanical pressures that margin hikes create.

Why This Matters in Today’s Market

We’re in an environment defined by elevated debt levels, geopolitical friction, persistent inflation pressures, and fragile confidence in central banks. Metals have responded with powerful rallies.

As prices climb, leverage typically follows. That means the probability of future margin hikes increases if volatility remains elevated. And when they occur, price swings can become even more pronounced — not because fundamentals suddenly changed, but because leverage is being forcibly unwound.

For long-term investors, this isn’t necessarily a reason to fear volatility. It’s a reason to understand it.

Short-term corrections driven by forced liquidations often reset markets without altering the broader macro backdrop. In some cases, they create rare entry points for investors with liquidity and conviction.

If anything, these episodes expose how fragile leveraged speculation can be — and why owning real assets outside the financial system carries a fundamentally different risk profile.

Understanding Leverage Risk in Precious Metals

Margin hikes don’t create bull or bear markets. But they can dramatically intensify price movements in both directions.

In leveraged paper markets, volatility is amplified by structure. When it comes to physical ownership, volatility is simply price movement — not forced liquidation risk.

Understanding that difference may be one of the most important steps you take as a metals investor.

Because in a world built on leverage, certainty isn’t found in paper contracts.

It’s found in what you can actually own.

People Also Ask

What happens when CME raises margin requirements?

When CME raises margin requirements, traders must post more capital to maintain their futures positions. If they can’t, they’re forced to sell — which can accelerate price declines. These forced liquidations are structural, not fundamental, and often increase short-term volatility in gold and silver.

Why do margin hikes cause silver price crashes?

Margin hikes increase the capital required to hold leveraged positions. When highly leveraged traders receive margin calls, many are forced to liquidate, triggering cascading selloffs. The January 2026 silver correction is a recent example of how margin increases can intensify volatility.

How do margin calls work in gold and silver futures?

A margin call occurs when a trader’s account equity falls below required levels. The broker demands additional funds to maintain the position. If the trader can’t add capital quickly, the position is automatically liquidated, often amplifying price swings.

Do margin hikes affect physical gold and silver owners?

No. Margin hikes apply to leveraged futures contracts — not to physical metal held outright. Physical owners may experience price fluctuations, but they are not subject to margin calls or forced liquidation risk.

Why is silver more volatile than gold during margin hikes?

Silver typically has a smaller market size and higher speculative participation than gold. When leverage builds in silver futures, margin hikes can trigger sharper, faster liquidations — making price moves more extreme.

You May Also Like:

- What Are Margin Requirements? Why CME’s Hike Triggered a Silver Crash

- Silver Price Components: Premium, Spot, and Dealer Markup Explained

- Silver Price Forecasts Revisited: Why Wall Street Got It Wrong

- Gold’s Purchasing Power: What One Ounce Buys Over Time

- Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]

- Best Investment Of 2026: Silver’s Setup Is Hard To Ignore