Brandon Sauerwein, Editor

Can you believe what we’re witnessing? Gold just SMASHED through the $3,000 barrier and kept running past $3,100 continuing what can only be described as a historic run.

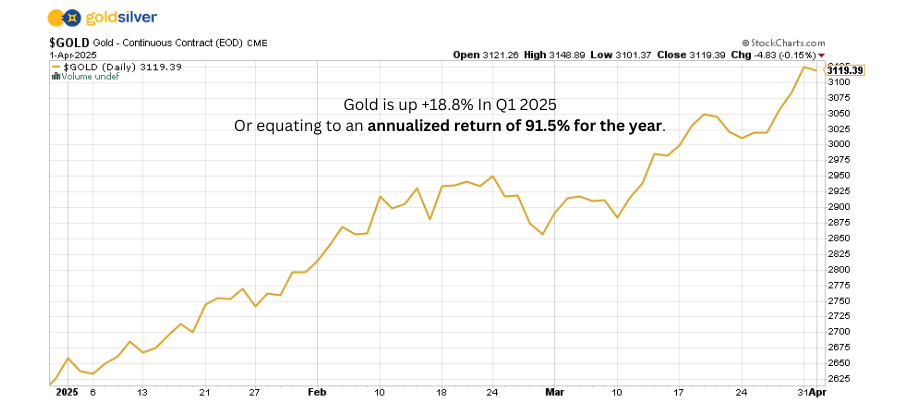

At 18.8% growth year-to-date, we’re experiencing gold’s strongest quarter since 1986 — when ‘Ferris Bueller’s Day Off’ hit theaters. Even more impressive: gold has already hit 18 record highs in 2025 alone.

And here’s a truly mind-blowing thought: If gold maintains this Q1 momentum throughout the year, we’re looking at a potential 91.5% annualized gain for the year.

Not bad for an asset many still dismiss as “just insurance,” right?

It’s clear that economic uncertainty around the stock market, tariffs, and inflation are acting as a powerful catalyst for both gold and silver…

While precious metals surge, Alan and Mike have identified a market indicator that’s flashing red, signaling the S&P 500 could see a major correction in the coming weeks.

Meanwhile the “Blood Indicator” is Signaling

Major Stress for the S&P 500

What exactly is the “Blood Indicator”?

This rare indicator flashed before the devastating Dotcom crash… again before the 2008 Financial Crisis that wiped out trillions in wealth… and once more just before the Covid-19 market collapse.

In short, it’s one of the most historically accurate warning signals preceding major market downturns — and now, according to Alan’s latest analysis, it’s signaling again. In his urgent new video, Alan shows Mike:

- Why today’s excessive household investment in equities could mean a decade or more of zero real returns

- How inflation is creating a dangerous illusion of market performance — turning what looks like “breaking even” into a significant loss

- The four potential scenarios that likely lie ahead… and the steps to protect and potentially grow your wealth in each one

The historical pattern is clear: when the ‘Blood Indicator’ appears, smart money moves to safety. Will you be among them?

Secure Bulk Pricing on Every Single Gold & Silver Purchase

What Else is in the News?

⚔️ Trump’s “Liberation Day” Tariffs Confirmed

President Trump will announce new tariffs today at 4:00pm EST, including a 25% duty on auto imports. Treasury Secretary Bessent indicated these “reciprocal tariffs” represent a ceiling that could be lowered if countries meet administration demands.

While specific details remain unclear, sources suggest the plan may include approximately 20% duties on products from nearly all countries rather than targeting specific nations or goods. America’s trading partners aren’t taking these tariff threats lying down…

🔒 Global Powers Push Back as Trade War Looms

In response to Trump’s tariff plans, China has begun restricting US investments, while Canada and Europe have warned of harsh retaliatory measures if targeted. This escalating trade tension is straining international relationships while simultaneously driving gold and silver prices higher.

Beyond trade tensions, other economic factors are also creating the perfect environment for precious metals…

⚠️ Gold’s Potential Triple Boost from U.S. Economic Headwinds

HSBC’s latest analysis reveals how three looming U.S. economic scenarios — recession, stagflation, and debt concerns — is currently creating the perfect storm for gold prices. Analysts note this uniquely “U.S.-driven” market environment may undermine traditional protective assets while strengthening gold’s position as an essential portfolio component during uncertain times.

This triple-threat of economic factors are all working in gold’s favor simultaneously, causing many major financial institutions to re-think their gold forecasts.

📈 Is $4,000 Gold “Just Around the Corner”? JPMorgan Thinks So

Major financial institutions are increasingly bullish on gold as prices hit new records. Bank of America has raised its price target to $3,500 per ounce over the next 18 months, citing increased investments from China and central banks. Macquarie Group made a similar forecast, while JPMorgan analysts are now considering the possibility of $4,000 gold in 2025.

But while many are finally giving gold the attention it deserves, silver might present the better value at the moment.

📊 Gold-Silver Ratio Signals Historic Opportunity at 90:1

With gold making headlines, savvy investors are turning their attention to silver. The gold-silver ratio has reached an extreme level of 90:1, far above its historical average. Throughout market history, whenever this ratio has exceeded 70:1, silver has typically staged a significant comeback.

If you missed out on the gold rush, now might be the perfect time to invest in silver.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Customer Service is very helpful!

“Travis was amazing! I was having difficulty with a wire transfer of my life’s savings, and I was very worried that I might not be able to receive it all. My husband just passed away and I’ve been worried about these funds along with grieving for 8 months. As soon as I got connected with Travis, my concerns were immediately addressed and he put me at ease. The issue was resolved within days. He even called me back with updates to keep me in the loop about what was going on with the funds. I am so grateful for a customer representative like Travis. He really cares for his clients.” — A. Howard

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?