Daily News Nuggets | Today’s top stories for gold and silver investors

September 23rd, 2025

Metals Update: Gold Nears $3,800, Silver Nears $45

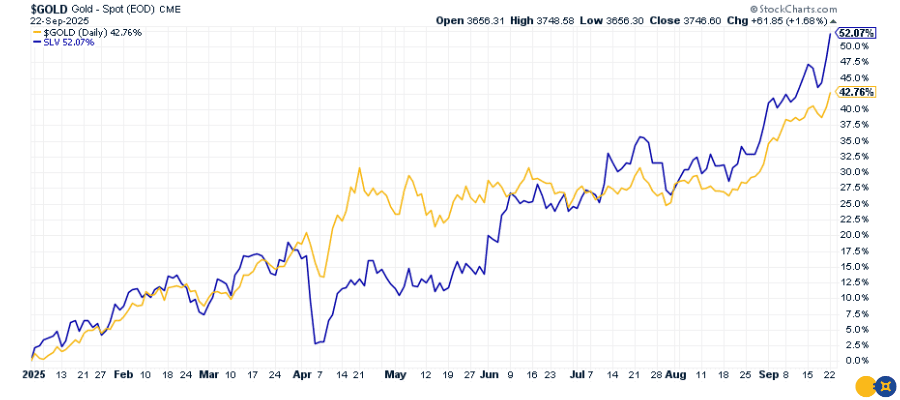

Gold has powered as high as $3,791.10 an ounce on Tuesday — the third trading day in a row it hit the all-time high milestone — up over 42% in 2025. Meanwhile, silver leads with a 52% gain, now at $44.39.

After last year’s remarkable rally, few believed metals could repeat such strength. Yet 2025 has already eclipsed it. Investors are piling into gold and silver as the dollar weakens, inflation lingers, and economic growth falters. What was once considered an “outlier year” now looks like the start of a new era — one where gold and silver are reclaiming their role as real sound money.

US Dollar Down 10% Since Trump Took Office

From above 110 in January to 97.3 today, the U.S. Dollar Index has shed 11–12% — the sharpest drop in more than 50 years, bringing an end to the long-running dollar bull market. Analysts at Morgan Stanley see more pain ahead, warning of another 10% slide by 2026.

But here’s the danger: most investors aren’t paying attention. With stocks hitting fresh highs, the dollar’s weakness is easy to overlook. Yet equities rising in nominal terms doesn’t erase the reality that the currency itself is shrinking in value. That illusion can lull markets into complacency.

A weaker dollar makes gold and silver more attractive globally, strengthening demand and reinforcing their role as the ultimate store of value when currencies falter.

OECD Projects Three More Fed Rate Cuts as Growth Slows

The Organization for Economic Co-operation and Development (OECD) — a 38-nation economic think tank that includes major economies like the U.S., Germany, and Japan — expects the Fed to cut rates three more times, bringing them down to 3.25%-3.50% by spring 2026. With U.S. growth slowing to 1.8% this year and inflation stuck above target at 2.7%, the OECD sees room for monetary easing despite sticky prices.

What this means for metals: Lower rates reduce the opportunity cost of holding non-yielding assets like gold and silver. When you can earn less on bonds and savings accounts, precious metals become more attractive. Combined with a weaker dollar, this creates a powerful tailwind for continued gains in gold and silver prices.

China Pushes for Gold Hub Status

The People’s Bank of China is leveraging the Shanghai Gold Exchange to encourage central banks from allied nations to buy bullion and store it within China. By positioning itself as a gold hub, Beijing is aiming to reduce reliance on Western exchanges and deepen financial ties with its partners.

While the move won’t upend the dollar overnight, it signals growing appetite for alternatives to dollar reserves. If more central banks diversify into gold under China’s watch, demand for physical bullion could rise — a supportive tailwind for prices that benefits U.S. gold investors, even as it reflects waning trust in the dollar-led system.

Australian Gold Miners Rally as Bullion Breaks Records

Shares of Australian gold miners jumped yesterday as bullion prices smashed new records, helping lift the ASX-200. For miners, years of high costs and tight regulations are finally giving way to booming margins.

Still, mining stocks come with strings attached. While bullion has gained 42% this year, certain miners can multiply that — but only if everything goes right. Equipment failures, rising energy costs, environmental obligations, or poor management can quickly turn a promising deposit into a money-losing venture. For investors chasing leverage to gold, miners offer the possibility of outsized rewards — and equally steep risks. Physical gold and silver, by contrast, remain the most direct and reliable way to own the metals themselves.