What’s the Difference Between Money vs Currency?

Most people use the terms money and currency interchangeably—but they are not the same. This article explores the difference between money vs currency, why fiat currencies lose purchasing power over time, and why many investors consider gold as a long-term store of value.

Gold Price Outlook: What Could Push Gold to $6,300

After January’s sharp selloff, gold and silver are climbing again. Oil’s surge, rising geopolitical tensions, and a difficult path for the Federal Reserve are reshaping the gold price outlook — with some Wall Street forecasts now pointing toward $6,300.

Investing in Silver: A Clear, No-Hype Guide to Building Real Wealth

Silver isn’t just a cheaper alternative to gold — it’s a strategic asset with a unique role in any long-term wealth-building plan. This guide breaks down what investing in silver actually means, the difference between physical silver and paper alternatives, and the disciplined strategies that serious investors use. No speculation. No shortcuts. Just clear, practical guidance to help you make informed decisions and build real wealth over time.

Gold and Silver Prices Today: Iran, Oil, and a $1.3B Bet

Gold and silver prices eased Friday despite a week of major market signals: a $1.3B institutional bet on silver, Iran disrupting 20% of global bullion flows, oil spiking on Hormuz fears, and labor data pointing to a gradual cooldown.

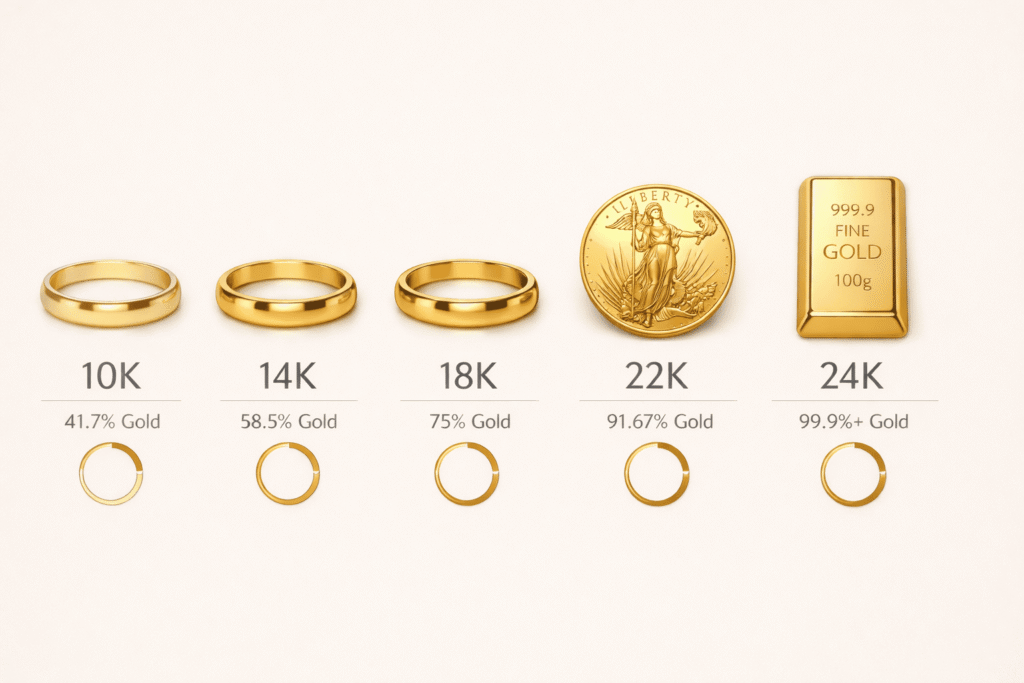

Gold Purity Explained: What Investors Need to Know

Not all gold is created equal. The karat on a jewelry piece and the fineness on a bullion coin are measuring the same thing — but they mean something very different for investors. Here’s how to read gold purity the right way before you buy.

Gold and Silver Are Climbing While the World Watches Hormuz

Iran’s conflict with the Strait of Hormuz is rattling oil markets — and quietly pushing gold and silver prices higher. Add a deepening silver supply deficit and shrinking tax refunds, and investors have plenty to watch this week.

Almost Nobody Owns Gold. What Happens If That Changes?

Gold prices are rising, yet most investors still hold very little of the metal. With average gold allocation in portfolios around 2%, even small shifts in capital could have an outsized impact on prices. Here’s what the data suggests about gold’s next move.

Hormuz, the Fed, and the Battle for Safe-Haven Status

Gold dropped 4% as the dollar claimed the safe-haven trade. With oil surging, the Strait of Hormuz under threat, and the Fed trapped between inflation and a slowdown, here’s what today’s market chaos means — and why the calculus could shift.

Gold Prices Surge on Middle East Tensions

Gold prices surge on Middle East tensions as U.S. and Israeli strikes on Iran rattle markets. Stocks fall, oil jumps, and the Fed faces renewed inflation pressure. Here’s what the conflict means for equities, policy, and precious metals.

Gold Above $5,200, Silver Above $90 — as Inflation Refuses to Fade

Gold and silver prices are climbing as inflation runs hot and tech stocks stumble. Silver jumped 4%, gold cleared $5,200, and markets are adjusting to stubborn price pressures, geopolitical risk, and a growing rotation away from high-flying growth stocks.