American Silver Eagle Coins

Silver Eagles are arguably the most recognized silver coins in the world. They represent a strong investment opportunity for those who want to own a hard asset that is real money. The upside potential of silver makes these US minted coins one of the most popular vehicles for precious metals investors. American Silver Eagles are only minted in a 1 oz denomination, but the design has evolved slightly over time. GoldSilver has investment silver coins in a range of purchasing options, from single common date Eagles to 500-ounce cases of silver American Eagles, to match your budget and investment goals. Start here if you’re in the market for investment bullion that you can pass down from one generation to the next.The Modern Silver Eagle

American Silver Eagles, otherwise known as silver dollars, are the official silver bullion of the United States. The modern American Silver Eagle was first minted by the US Mint in 1986, and has been immensely popular from the start. It is prized for the beauty of its design and its intrinsic value. Since the first minting, over 400 million silver Eagles have been produced. All of them contain one troy ounce of pure .999 fine silver. They are far and away the most popular silver coins in the world. Silver Eagles— sometimes referred to as ASEs— should be a core element of any investor’s precious metals portfolio.

Silver Dollars— A Historic Lineage

The silver dollar is America’s most iconic coin. Its roots go all the way back to the founding of the Republic, with the first strike in Philadelphia in 1794. It was a true corner piece of US currency for over a century, constantly in use in everyday transactions. It always carried the same face value: $1.

The early dollars—Flowing Hair and Draped Bust design—were minted from 1794 to 1803. They are highly prized by collectors today. Production ceased in 1803 and did not resume until 1836 with the introduction of the Seated Liberty dollar. That was succeeded by the Morgan Dollar in 1878 and the Peace Dollar in 1921. Both were 90 percent silver.

The minting of silver dollars by the US government ceased between 1935 and the Eagle’s introduction in 1986, except for a limited edition of Eisenhower dollars between 1971 and 1976. Eisenhower dollars contain 40 percent silver and were aimed primarily at collectors.

Enter the Eagle

When it came time to issue silver Eagles, the government went with a classic design to represent our heritage: American Eagle on the reverse, with 13 stars for the original 13 states. Walking Liberty, Adolph Weinman’s well-recognized and beloved creation, is on the obverse. Walking Liberty was already familiar to coin lovers from its use on the half-dollar from 1916 to 1947.

While Eagles remain legal tender, they do not circulate as currency and pass directly from the Mint to bullion buyers. Though they will vary slightly in quality of strike from coin to coin, by definition all are graded at least Brilliant Uncirculated (BU). Therefore they are an investment coin rather than a collectible.

Eagles as an Investment

It doesn’t matter the size or purpose of your portfolio, silver Eagle coins are always a top-notch choice for investment purposes. American Eagles are a judicious investment for many reasons:

- Guaranteed by the U.S. Government — Each time you purchase a silver American Eagle coin from GoldSilver, you can be sure you’re getting a legal tender coin of reliable quality and purity.

- Can Serve as a Hedge Against Economic Crises — Interestingly, silver has been used as currency more often in history than gold. It has served a role of not just currency but money, especially when paper currencies lose value.

- Universally Recognizable and Redeemable for Currency – A Silver Eagle is easily recognized around the world, and can be quickly liquidated no matter the circumstances or where you are.

- Inflation Hedge – The purchasing power of an ounce of silver tends to remain steady in times of rising inflation, when paper currencies are declining. Thus, you can bet that it will be a relatively staple or valuable investment.

- Potential for Appreciation in Value – Silver has the potential to increase in value, not only due to inflation, but also because it is a metal with wide and growing industrial purposes.

- Uncorrelated with Other Asset Classes – The price of silver has a low correlation to stocks, bonds, land or other assets, providing investment diversification. If these markets decline, that doesn’t mean your silver will, too.

- IRA-Eligible – You may place silver American Eagles in a properly-structured IRA or 401(K) and reap some tax benefits.

- Easily Storable – Bullion investment is easily storable, and GoldSilver offers private vault storage for all purchases at very competitive rates if you’d like to have us safely store yours for additional peace of mind.

- Inheritable – Silver coins, including silver Eagles, are easily passed on to heirs and will help ensure that more of your wealth stays in the family.

Buying American Silver Eagles Online

GoldSilver’s online portal allows prompt buying (and selling) of your American Silver Eagles. It has never been more convenient to add this valuable asset to your portfolio. We offer a variety of purchase options, from single coins all the way up to “monster boxes” of 500.

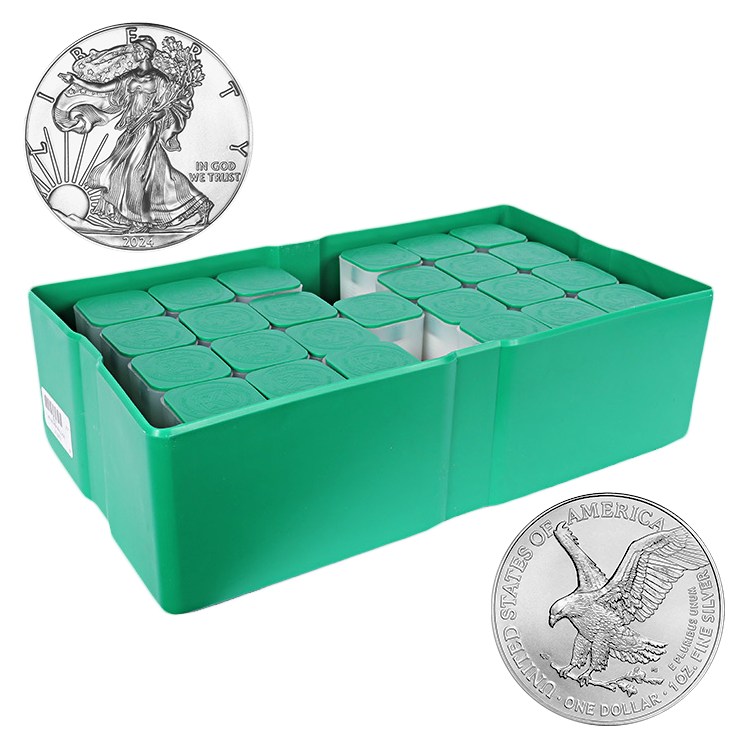

Silver Eagle Mint Case/Monster Box

The US Mint allows investors to save on premiums by buying silver Eagles in bulk. Mint cases, often referred to as monster boxes, contain 500 1-oz silver Eagle coins. Buying monster boxes ensures investors get the lowest premium on each coin. They also facilitate convenient storage and portability. That said, monster boxes are heavy, take up a fair amount of space, and their high value makes them risky for home storage. Consider storing these in GoldSilver’s private vaults, located around the world and managed by Brinks.

Brilliant Uncirculated (BU) Silver Eagles

All current year coins sold at GoldSilver are uncirculated and delivered in pristine condition directly from the Mint. Common dated Eagles and other gold and silver coins may show signs of circulation. Generally, BU (Brilliant Uncirculated) Silver Eagles will carry a slightly higher premium than common year Eagles, which is why some investors opt for random year coins.

Guaranteed Lowest Prices on Silver Eagles

The price of silver constantly fluctuates in the markets. This can make pricing somewhat challenging for many dealers. But we’ve created a strategy that updates the prices of our products in real time in accordance with the relevant spot price at the time of purchase. We also have a price match guarantee to match the advertised price of any of our products on the sites of our top competitors.

To learn more about how you can always get the best price from GoldSilver, read about our price match guarantee.

Simple Online Selling

GoldSilver will buy back most bullion products, whether you bought them from us or elsewhere, with competitive prices and an easy-to-use online sales portal—by mail or from storage. If you decide to sell some of your silver coins, you have a ready buyer on standby.

Read more about our sell-back policy, request a quote for your Silver Eagles, or find out why our sell-back policy and storage program are a match made in heaven.

The GoldSilver Difference

At GoldSilver, we pride ourselves on offering investors world-class education, an investor-friendly product catalog, and a uniquely secure and flexible storage program.

Our educational video series has generated tens of millions of views on YouTube. Our founder, Mike Maloney, is the best-selling author of Guide to Investing in Gold & Silver, the most popular book ever on precious metals investing.

Our catalog is focused on physical precious metals products with the most competitive premiums. We believe these products allow investors to gain maximum exposure to gold and silver while increasing potential profits by saving on costs.

And our unique storage program offers allocated and segregated storage options at your choice of global vaults, with easy and rapid liquidity.

On top of all this, we are committed to providing our clientele with a broad assortment of purchase options, with discounts when you pay through check or wire so you can make even more money. We also offer discounts on bullion for those who pay with Bitcoin.

Together, we believe these features offer an unmatched experience for precious metals investors.

But don’t take our word for it. See what our investors are saying about us: read our testimonials.

- Front.png)