Brandon Sauerwein, Editor

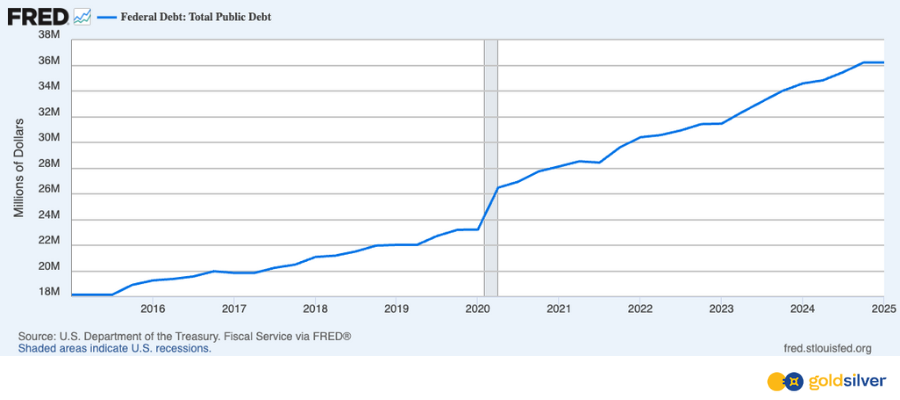

Another trillion in debt — in approximately 211 days.

The U.S. national debt has climbed from $36 trillion to over $37 trillion in roughly seven months. That’s about $4.7 billion added every single day.

The last time America had a federal budget surplus? That was back in 2001.

Since then, year after year of unchecked spending and mounting deficits caused the national debt to double over the past decade. As of 2024, our national debt has grown to 124% of GDP.

And the cost of servicing this debt? Interest payments account for 10.7% of all federal spending in 2023 — a burden continuing to grow heavier as rates stay elevated…

Where Does It End?

Trump’s proposed tax-and-spending bill, which could add trillions in deficits, will only worsen the situation. More and more Americans are waking up to the fact that this path is unsustainable.

Throughout history, nations have tried to spend their way out of trouble — funding endless wars while everyday savers foot the bill. The pattern is predictable: currencies debase, purchasing power erodes, and those who trusted paper promises lose.

That’s why now — more than ever — it’s critical to take proactive steps to safeguard what you’ve worked so hard to build. Physical precious metals remain one of the few assets with no counterparty risk, no printing press, and no political agenda.

Tangible, time-tested, and trusted — real assets for uncertain times.

In Case You Missed It:

The Death of Wall Street? Why Smart Money Is Going Local

There’s a quiet revolution unfolding — one you won’t hear much about in the headlines.

Centralized control is breaking down. And in its place, Main Street capitalism is making a comeback — fueled by those who understand real money (gold, Bitcoin) and community-first businesses.

If you’ve sensed a major shift underway, this conversation connects the dots — and shows how smart investors are already positioning themselves.

Gold and Dollar Rising Together? Here’s Why It’s Happening

Most investors believe it’s either/or: gold rises when the dollar falls, and vice versa.

But what if both could rise simultaneously?

Mike Maloney sat down with Brent Johnson at Rebel Capitalist Live to unpack exactly that — and how it fits into the Dollar Milkshake Theory that’s gaining traction fast.

If you want to understand what’s driving capital flows today — and how to position yourself smartly — don’t miss this one.

Cut Through the Mainstream Noise

The MacroButler breaks down what’s really driving gold, silver, and the global economy — so you can make smarter decisions with your money. Read his latest article Why Gold, Not Models, Will Deliver in 2025 – MacroButler

Recent Articles

- Gold and Silver Price Forecast: Dollar vs Safe Haven Demand

- How to Choose the Best Gold IRA Storage Option for You

- How Much of Your Portfolio Should Be in Precious Metals?

Market Pulse: This Week in Metals

🚀 Gold and Silver on Track for Massive 2025 Gains

Gold is up 29% so far this year, with silver close behind at 25.5%. If this pace continues through year-end, gold could notch a 58% gain in 2025, with silver hitting 51% — staggering gains that would mark one of the strongest years for precious metals in modern history.

🕊️ Iran-Israel Truce Calms Metals Markets

Gold steadied this week following reports of a truce between Israel and Iran, easing geopolitical tensions and risk appetite. Prices have hovered between $3,300–$3,400 as markets shift focus to upcoming U.S. economic data.

⏱️ Powell: No Rush to Cut Rates Despite Political Pressure

Fed Chair Jerome Powell told Congress the central bank will wait for more economic data before considering rate cuts — a stance that contrasts with President Trump’s calls for immediate easing. Powell emphasized the Fed remains “well-positioned to wait.”

📊 Fed Eyes Tariff Impact Before Policy Shift

Minneapolis Fed President Neel Kashkari echoed caution, noting recent inflation data has improved but warning that tariffs could still drive prices higher. While some Fed officials favor rate cuts this summer, the committee remains divided.

📈 BofA: Ballooning US Debt Will Drive Gold to $4,000

Bank of America forecasts gold could hit $4,000/oz within a year. While past gains were fueled by geopolitical tensions, BofA says exploding U.S. deficits will be the primary driver going forward. Central banks are increasingly dumping Treasuries in favor of gold, a trend accelerating as global debt soars.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Jenelle in Customer Support – Outstanding Lady!

“Jenelle helped me to update my details at Gold and Silver as well as explaining a number of things that I didn’t fully understand including creating a Roth IRA. She very patiently took me through everything I needed for over half an hour -she was so helpful,very pleasant and if I could rate her over 5 stars, I would-she is an absolute gem and ask you to please share this with Mike directly-she is a tribute to your Company-thank you. Gwyn Elias-a customer of yours since 2016” — Gwyn E.

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?