Brandon Sauerwein, Editor

What do 89% of hedge fund managers, Warren Buffett, and the Atlanta Fed all have in common right now?

They’re positioning for an economic storm. Fund managers overwhelmingly report overvalued markets, Buffett holds record cash levels, and the Atlanta Fed now projects a 2.8% GDP contraction in Q1 2025.

As Mike explains in his latest analysis, once this recession begins, the economic dominoes will fall rapidly. The question isn’t if it’s coming, but how you’ll weather it…

“They Can‘t Prevent the Crash That is Going to Happen” Mike Maloney

In this critical update, Mike reveals:

- Why the Atlanta Fed’s 2.8% GDP contraction forecast signals the beginning, not the end

- How Warren Buffett’s record cash position mirrors previous pre-crash behaviors

- The domino effect that will cascade through markets once the recession officially begins

- Why conventional financial advice will fail in the coming environment

As Mike shows, these aren’t isolated events — they’re the first visible cracks in a dam that’s about to break.

Are you prepared for what comes next?

Gold Stands Alone

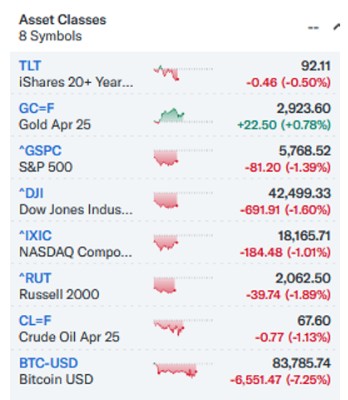

They say a picture is worth a thousand words. Today’s market performance tells a compelling story:

Chart courtesy of Yahoo Finance at noon 2/4/2025.

What you see is not just a dreadful day in the markets. It is a clear illustration of what happens when policy shifts create uncertainty across the investment landscape. As new tariffs take effect today, we are seeing market-wide turbulence with every major U.S. asset class in negative territory.

Except one: Gold.

While stocks tumble, bonds struggle, oil retreats and bitcoin continue to reveal itself as a speculation that attracts all sorts of bad behaviors, gold continues to prove why it has endured as a compelling financial asset. Today’s price action reinforces what we have long maintained: geopolitical tensions, trade realignments and feckless fiscal and monetary policies are accelerating the trend toward gold as neutral, responsible, and apolitical money.

This is not about politics — it is about mathematics. When policies of any stripe introduce uncertainty, gold’s eternal properties become even more valuable. In a world of increasing complexity, gold is still refreshingly simple.

For those who have kept proper gold allocation in their portfolios, today serves as validation. For those who have not, it offers a clear signal that now is the time to reconsider adding ballast to their investment portfolio.

Stay safe.

What Else is in the News?

📊 TRADE WAR ESCALATES

President Trump has imposed sweeping 25% tariffs on Canadian and Mexican imports while raising China’s to 20%, affecting $1.5 trillion in annual trade. Canada has retaliated with phased levies on $107 billion of US goods, while China has implemented its own countermeasures. Economists warn these tensions could raise household costs and slow economic growth during an already vulnerable period.

📉 RAY DALIO WARNS OF US DEBT “HEART ATTACK”

Billionaire Ray Dalio predicts a major US debt crisis within three years without immediate deficit reduction. The Bridgewater founder points to the dangerous combination of a $1.8 trillion annual deficit, continued tax breaks, and retreating Treasury buyers as creating an unsustainable fiscal situation. He urges cutting the deficit to 3% of GDP to prevent what he describes as an approaching economic “heart attack.”

🏦 CENTRAL BANKS ACCELERATE GOLD BUYING

Central banks added 18 tons of gold to official reserves in January 2025, with Uzbekistan, China, and Kazakhstan leading purchases. Poland and India each contributed 3 tons as emerging markets continue to dominate gold accumulation strategies. This persistent buying trend underscores gold’s strategic importance as a hedge against growing economic and geopolitical uncertainties.

📈 $3,100 GOLD PRICE TARGET FROM GOLDMAN

Goldman Sachs has raised its gold forecast to $3,100 per ounce by end-2025, projecting another 8% gain on top of this year’s 40% rally. The bullish outlook is driven by strong central bank demand following the 2022 freezing of Russian assets and anticipated investor interest as interest rates fall. Under continued global uncertainty, Goldman suggests prices could climb even higher to $3,300.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Always Great

“Always great. Thank you GoldSilver for helping me preserve wealth, and thank you Travis for assiduous persistence in helping us with helping my daughter log in to my account invite.” — J. Grimes

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?