In the world of investing, change is the only constant. Markets rise and fall, sentiment shifts, and sometimes, in a big way, money moves. A lot of it.

One of the biggest clues that change is coming? Something called a capital rotation event. And if you’re interested in protecting (and growing) what you’ve worked so hard for, especially with gold and silver, understanding capital rotation could make a real difference.

Let’s break it down.

What is Capital Rotation, Anyway?

Think of capital rotation like a crowded party where everyone suddenly decides to leave the hot, noisy room (stocks) and head to a quieter, safer room (precious metals).

Capital rotation happens when investors collectively move their money from one asset class to another — usually because they’re seeking better returns or more safety based on what’s happening in the economy.

When it comes to precious metals, rotation often means shifting out of stocks and bonds and into gold and silver, especially during uncertain times.

Spotting these moments early can be a huge advantage.

Why Investors Rotate Into Precious Metals

There are a few major reasons investors move their money into gold and silver:

- Economic Uncertainty: When the economy feels shaky—whether from inflation, geopolitical tensions, or financial system risks—gold’s reputation as a safe haven shines. A great example? In 2020, during the peak of pandemic uncertainty, gold jumped over 25%.

- Rising Inflation: When everyday costs are going up and dollars buy less, investors often turn to gold and silver, which historically hold their value better than paper currencies.

- Falling Confidence in Stocks and Bonds: If stock valuations feel frothy, corporate earnings disappoint, or interest rates rise, investors look for alternatives. Precious metals become an attractive way to diversify.

- Currency Devaluation: When governments flood the system with money (think stimulus programs or massive debt loads), the value of currencies can erode over time. Gold and silver can act as a shield against this hidden tax.

How Rare is a Capital Rotation Event?

Here’s where things get interesting: true capital rotation events are exceedingly rare—and they often mark once-in-a-generation investment opportunities.

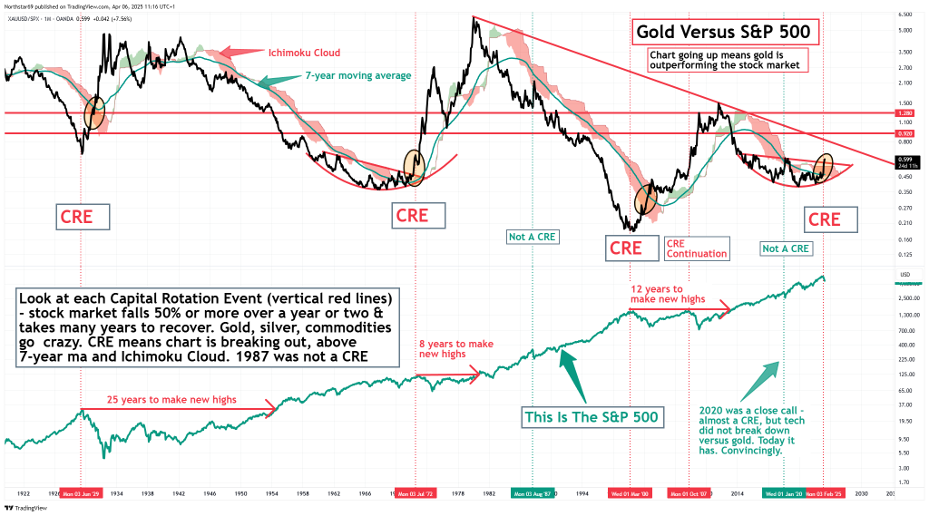

Alan Hibbard recently discussed this phenomenon with Kevin Wadsworth and Patrick Karim, co-founders of Northstar Bad Charts. Together, they highlighted that true capital rotations into precious metals have only happened a handful of times over the past century.

Here are three major examples:

- 1929: Following the stock market crash, it took the S&P 500 25 years to make new highs.

- 1972: After the peak of the Nifty Fifty bubble, it took 8 years for stocks to recover.

- 2000: After the tech bubble burst, it took the S&P 500 12 years to reach new highs.

In every case, capital rotated heavily into gold and silver as investors sought safer ground—and those who positioned early were rewarded handsomely.

Today, according to Hibbard and Northstar, we are seeing the early signs of another major capital rotation — one that could reshape the investment landscape for years to come.

During their conversation, they highlight a few key signals that capital is moving toward gold and silver.

1. The Dow-to-Gold Ratio

This simple metric measures how many ounces of gold it would take to buy the Dow Jones Industrial Average.

- When the ratio is high (above 15), stocks are pricey compared to gold.

- When it’s low (under 5), gold looks expensive—or stocks are cheap.

During major financial crises like 2008 and 2020, this ratio plunged as investors rushed toward gold for safety.

2. The Gold-to-Silver Ratio

Another useful signal compares the relative value between gold and silver.

Historically, the gold-to-silver ratio has fluctuated between about 50:1 and 70:1. A high ratio — like 80:1 or higher — often signals that silver is significantly undervalued compared to gold.

Today, we’re seeing extreme levels, with the gold-to-silver ratio hovering around 100:1 — far above historical averages.

This suggests silver could be poised for outsized gains if history repeats itself. During past periods when the ratio reached similar extremes, investors who rotated into silver ahead of the trend were rewarded handsomely — such as in 2020, when silver surged nearly 48%, outperforming gold’s 25% rise.

Final Thoughts: Be Ready, Not Reactive

Capital rotation events don’t come around often—and they certainly don’t come with flashing lights or front-page headlines.

By the time the mainstream notices, much of the big move is often already underway.

Recognizing the signs now — and acting with a smart, informed strategy — can put you in a position to not just weather the storm, but potentially thrive through it.

Whether you seek protection, growth, or a combination of both, precious metals have historically been a powerful tool for navigating change — and preserving what matters most.

Ready to learn more? Explore our latest insights on how to invest during major market rotations →

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.

- ⏰ Timely alerts on major price moves and important events

- 📢 Market updates from Mike Maloney & Alan Hibbard

- 💡 Strategies to profit from this rare opportunity

Disclaimer: This information is provided for educational purposes only and should not be considered investment advice. Past performance is not indicative of future results. Always conduct thorough research or consult with a financial advisor before making investment decisions.