Brandon Sauerwein, Editor

While tariff uncertainty has markets in a tailspin, precious metals are doing what they do best — providing a safe haven during times of instability.

Gold just shattered the $3,300/oz barrier for the first time in history (+2.5% today), with silver following strong at $33/oz (+2.1%). All this while the S&P 500 and Nasdaq continue their painful double-digit retreat year to date.

Could escalating trade tensions propel metals into their biggest bull market in decades? What other key factors are fueling this historic rally? And most importantly — what strategic moves should YOU be making with your portfolio right now?

Alan recently revealed something surprising in an important interview: silver’s unique market position could potentially make it the smarter play at this specific moment — but there are critical factors every investor needs to understand first…

Silver’s Hidden Potential: Why Silver May Outperform Gold in 2025

We’ve all felt that sinking feeling lately — checking our retirement accounts only to see years of careful saving eroded in a matter of weeks.

But what if this market turmoil actually presents an opportunity most investors are overlooking?

In his latest interview, investment expert Alan Hibbard makes a compelling case for the often-overlooked precious metal that could outpace gold.

While recommending gold as essential protection, Alan explains why silver’s unique market position could translate to superior gains for investors willing to tolerate its volatility.

“Historically, silver outperforms gold during these bull runs, so it does ultimately rise a lot more in price — however, you pay the price of volatility.”

For investors willing to weather the volatility, silver could offer much higher upside in the coming market cycle. It all depends on your personal risk tolerance.

Secure Bulk Pricing on Every Single Gold & Silver Purchase

What Else is in the News?

🪙 Metals Market Update

Gold continues its stellar performance, now trading above $3,300/oz—up an impressive 26% since January. Meanwhile, silver has quietly gained around 15% during the same period. This metals surge comes as major stock indexes struggle, with the S&P 500 down 8% and the Nasdaq tumbling 11% year-to-date.

🤺 US Challenges China’s Mineral Dominance with New Investigation

President Trump has ordered an investigation into potential tariffs on critical mineral imports, citing national security concerns. The probe will examine supply chains for essential materials including cobalt, nickel, rare earths, and uranium. This action comes as the US remains heavily dependent on foreign sources—particularly China—for processed minerals vital to the economy. China recently underscored America’s vulnerability in this sector by restricting rare earth exports in retaliation to earlier US tariffs.

📉 Fed’s Waller Signals Potential Rate Cuts

Speaking to the CFA Society in St. Louis, Federal Reserve Governor Chris Waller suggested substantial interest rate cuts may be necessary if President Trump’s tariffs remain in place long-term. Waller, considered a potential successor to Jerome Powell as Fed Chair in 2026, indicated the Fed might “look through” tariff-induced inflation up to 5% as temporary, rather than responding with rate hikes. He acknowledged this “transitory inflation” approach would likely face criticism from Wall Street, especially given the Fed’s misjudgment during the 2021-22 post-COVID inflation surge.

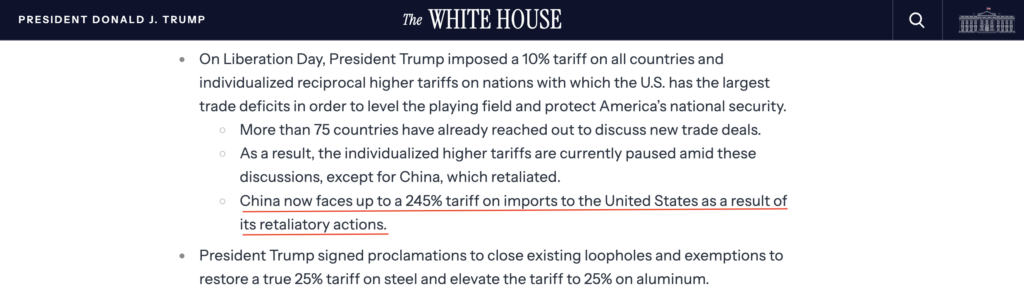

📈 Trump Administration Ramps Up China Tariffs to 254%

President Trump clarified that Chinese-made smartphones and other electronics will not be exempt from tariffs, earlier this week. But the fued is far from over. According to a new White House press release, China now faces up to a 245% tariff on United States imports as a result of its retaliatory actions.

💰 Goldman Sachs: Still Room to Run in Gold Rally

Despite gold’s recent gains, Goldman Sachs believes there’s still significant upside potential. The investment bank recently predicted gold could reach $4,000/oz by 2026 if a recession materializes — representing approximately 25% growth from current levels.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Jenelle in customer support – outstanding lady!

“Jenelle helped me to update my details at Gold and Silver as well as explaining a number of things that I didn’t fully understand including creating a Roth IRA. She very patiently took me through everything I needed for over half an hour -she was so helpful, very pleasant and if I could rate her over 5 stars, I would-she is an absolute gem and ask you to please share this with Mike directly-she is a tribute to your Company-thank you…” — G. Elias

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?