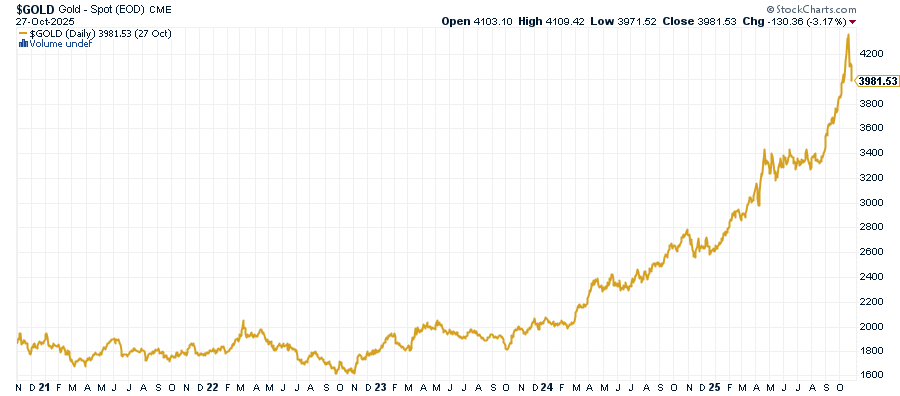

Nearly every major bank’s gold price prediction for 2025 pointed higher — but few anticipated just how explosive the rally would be. Gold surged above $4,000 per ounce in October 2025, setting historic new highs and reaffirming its role as the ultimate safe haven in an era of monetary and geopolitical uncertainty.

The numbers tell a compelling story. Over the past five years, gold has quietly delivered one of the strongest risk-adjusted performances of any major asset class:

- 2020: +24.9%

- 2021: -3.6%

- 2022: -0.31%

- 2023: +13.09%

- 2024: +27.11%

(Source: StatMuse, CME, World Gold Council)

Gold Price 5 Year Chart

With prices now consolidating just below record highs, investors are asking the right question: how much higher can gold go — and how long can this bull market last?

What the Big Banks Are Saying: 2026–2030 Outlook

The consensus among major financial institutions has shifted dramatically. What was once considered bullish is now baseline, with multiple banks publishing $5,000 gold price predictions extending into 2026 and beyond.

Here’s what the street is calling for:

HSBC sees a “bull wave” taking gold to $5,000/oz by the first half of 2026, lifting their annual average forecast to $4,600.

Bank of America raised its 2026 target to $5,000 (with a ~$4,600 average), citing policy uncertainty and surging investment demand.

J.P. Morgan (updated October 2025) now projects gold averaging ~$5,055 in Q4 2026, with a longer-term target of ~$6,000 by 2028.

The bottom line? The “forecast range” has shifted upward. Baseline forecasts now cluster around the high $3,000s for late 2025 and ~$4,000+ in early-to-mid 2026, while multiple credible banks publish $5,000 scenarios for 2026 — and at least one marquee desk lays out an extended path toward $6,000 by 2028.

What’s Driving Gold Higher?

Three major forces are supporting this bullish outlook:

1. Central Bank Demand Remains Voracious

Central banks continue to load up on gold, averaging around 710 tonnes per quarter in 2025. According to J.P. Morgan’s analysis, central banks aren’t done yet — added political uncertainty is likely to fuel a revival into 2025 and beyond.

When the world’s largest financial institutions are buying aggressively, it’s worth paying attention.

2. Inflation and Monetary Policy

The CPI combined with M2 money supply growth continues to show stable expansion — a recipe for continued gold appreciation. Historical data confirms gold’s strong relationship with inflationary periods, making it an attractive hedge against currency devaluation.

Translation? As long as money printing continues and inflation remains elevated, gold should hold its value relative to weakening fiat currencies.

3. Geopolitical Uncertainty Shows No Signs of Easing

Current global tensions continue to support gold’s safe-haven appeal. Should economic and financial conditions deteriorate further — exacerbating stagflationary pressures and geoeconomic tensions — safe haven demand could push gold 10%-15% higher from current levels.

How Much Gold Should You Own? Portfolio Allocation for the Next 5 Years

The right allocation depends on your risk tolerance and investment goals:

Conservative Approach (8-12% allocation): Focus on gold’s stability for wealth preservation. This higher allocation is particularly suitable given current economic uncertainties and the metal’s proven track record during market volatility.

Moderate Strategy (5-10% allocation): Balance gold’s defensive characteristics with other growth assets, taking advantage of the projected steady appreciation over the next five years.

Aggressive Positioning (3-8% allocation): Complement gold with silver exposure. Both metals typically benefit from similar macroeconomic conditions, while silver offers higher volatility and potentially greater returns.

In September 2025, Morgan Stanley CIO Michael Wilson made a groundbreaking call: allocate 20% to gold — replacing half the bond allocation in the traditional 60/40 portfolio. His new “60/20/20” model reflects a stark reality: bonds have lost their safe-haven status amid persistent inflation and unsustainable debt.

When one of Wall Street’s most influential voices says gold deserves twice the allocation of bonds, it signals that even mainstream finance is rethinking precious metals’ role in modern portfolios.

Physical Gold, ETFs, or Mining Stocks? Choosing Your Investment Vehicle

For a 5-year investment horizon, you have several options:

- Physical gold ownership eliminates counterparty risk and provides complete control over your assets.

- Gold IRAs offer significant tax advantages for retirement planning while maintaining exposure to physical metal.

- Gold ETFs provide liquidity and ease of trading, though they introduce counterparty risk.

- Mining stocks offer leveraged exposure to gold prices but come with company-specific risks.

The right choice depends on your storage capabilities, tax situation, and liquidity needs over the five-year period.

Risk Factors Every Gold Investor Should Monitor

Despite bullish forecasts, several headwinds could impact gold’s trajectory:

- US dollar strength: A sustained rally in the dollar typically pressures gold prices downward.

- Geopolitical conflict resolution: Widespread and sustained peace — something that appears unlikely in the current environment — could see gold give back 12%-17% of recent gains.

- Federal Reserve policy shifts: Aggressive tightening cycles could temporarily dampen gold’s appeal.

- Supply-side pressures: Elevated gold prices are likely to continue curbing consumer demand and potentially encouraging recycling, which could create supply headwinds.

What to Expect from Gold Over the Next 5 Years

The consensus among major financial institutions points to continued gold appreciation through 2030, with price targets ranging from $4,000 to over $5,000 per ounce. Current market positioning suggests gold remains well-positioned as both a defensive asset and growth opportunity over the next five years.

As Gregory Shearer, head of Base and Precious Metals Strategy at J.P. Morgan, puts it:

“We still think risks are skewed toward an earlier overshoot of our forecasts if demand continues to surprise our expectations. For investors, we think gold remains one of the most optimal hedges for the unique combination of stagflation, recession, debasement and U.S. policy risks facing markets in 2025 and 2026.”

For investors considering gold as a 5-year investment, the combination of strong institutional demand, monetary policy support, and geopolitical uncertainty creates a compelling investment thesis. However, like all investments, gold should be viewed as part of a diversified portfolio strategy rather than a standalone solution.

For the latest market analysis and investment guidance, visit our gold and silver investing news section and review current precious metal price charts to stay informed about market developments.

People Also Ask

What will gold prices be in 2025 and 2026?

Major financial institutions project gold will average in the high $3,000s through late 2025, with multiple banks forecasting $5,000 per ounce by 2026. J.P. Morgan’s latest analysis sees gold averaging around $5,055 in Q4 2026, with a long-term target of $6,000 by 2028 if macroeconomic conditions continue supporting the rally.

How much of my portfolio should be in gold?

Most financial advisors recommend 5-12% portfolio allocation to gold depending on your risk tolerance, with conservative investors favoring 8-12% for wealth preservation. In a notable shift, Morgan Stanley CIO Michael Wilson recently recommended 20% allocation to gold, replacing half the traditional bond allocation in classic portfolio models.

Is it too late to buy gold at $4,000?

Despite gold’s rally above $4,000, analysts believe there’s still significant upside potential driven by central bank demand, inflation concerns, and geopolitical uncertainty. Gregory Shearer of J.P. Morgan notes that “risks are skewed toward an earlier overshoot” of forecasts, suggesting the bull market has room to run through 2026 and beyond.

What is driving gold prices higher in 2025?

Three primary factors are propelling gold: aggressive central bank buying averaging 710 tonnes per quarter, persistent inflation eroding fiat currency value, and heightened geopolitical tensions driving safe-haven demand. Central banks’ shift away from U.S. Treasuries and toward gold has created a structural price floor that supports continued appreciation.

Should I buy physical gold or gold ETFs?

Physical gold eliminates counterparty risk and provides complete control over your assets, making it ideal for long-term wealth preservation and crisis protection. Gold ETFs offer greater liquidity and ease of trading but introduce counterparty risk during financial system stress. For serious investors, GoldSilver offers both physical precious metals and Gold IRA options to match your storage capabilities and investment timeline.

This analysis is for informational purposes only and should not be considered investment advice. Past performance does not guarantee future results. Always consult with qualified financial professionals before making investment decisions.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.