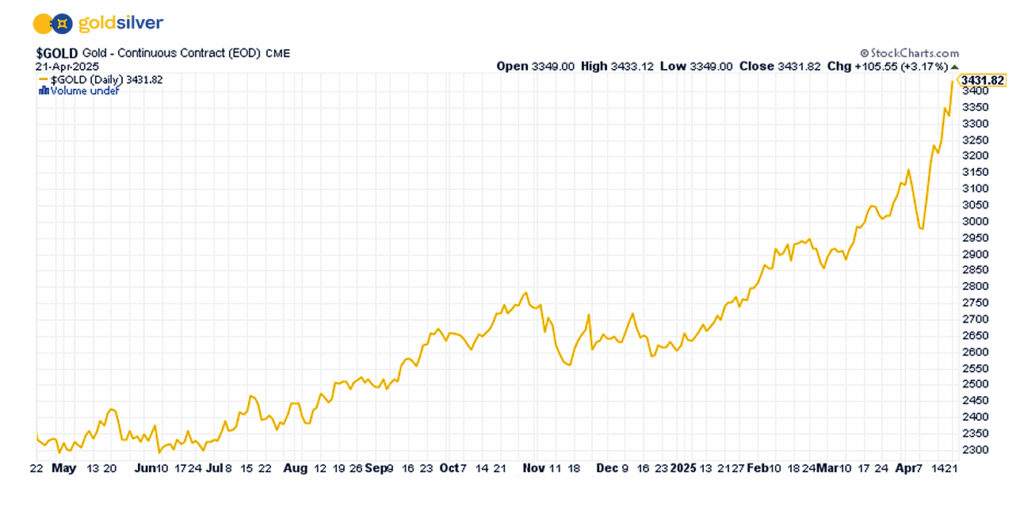

Gold passes $3,400 per ounce, shattering another historic milestone — a move that has left even seasoned market watchers astonished at the speed and intensity of the current bull market. In just the past few days, gold has leapt from breaking the $3,300 barrier to topping $3,400, a feat that underscores how rapidly momentum is building in the precious metals space.

The Velocity of Gold’s Rally: Unprecedented Acceleration

The pace of gold’s ascent in 2025 is nothing short of extraordinary. Year-to-date, gold has gained over 30%, and we’re not even halfway through the year. Gold is vastly outpacing its historical average annual return of 8.3%.

The metal has climbed more than $800 since the start of this year alone, a rate of appreciation that dwarfs previous bull runs. For context, it took gold 12 years to move from $1,000 to $2,000 per ounce, but it has added that same amount in approximately 4.5 months through the start of 2025.

This rapid escalation is not just a function of speculative fervor; it reflects deep-seated anxieties about the global economic outlook, persistent inflation, and the intensifying U.S.-China trade war. The Trump administration’s aggressive new tariffs and the resulting uncertainty have turbocharged safe-haven demand, while a weakening U.S. dollar has further fueled the rally.

For more on how inflation impacts precious metals, visit GoldSilver’s inflation impact articles, and stay updated with the latest Gold price forecasts article.

What’s Driving the Relentless Surge?

Several powerful forces are converging to create a “perfect storm” for gold:

- Safe-Haven Demand: Investors are flocking to gold as a refuge from economic and geopolitical turmoil, particularly with escalating trade tensions and fears of stagflation.

- Central Bank Buying: Central banks continue to accumulate gold at a record pace, fundamentally altering the supply-demand balance and providing structural support for higher prices.

- Dollar Weakness: The declining U.S. dollar, partly driven by trade policy and de-dollarization trends, is making gold more attractive globally.

- Technical Breakouts: Gold has convincingly broken through multiple resistance levels, drawing in a new wave of momentum-driven investors.

How This Bull Market Compares

Gold has seen several dramatic bull markets over the past five decades. Here’s how the current rally stacks up against the most notable surges in history:

- 1971–1973: After the U.S. abandoned the gold standard, gold prices soared over 200% in just 22 months as investors rushed to hedge against currency devaluation.

- 1978–1980: Amid rampant inflation and the oil crisis, gold skyrocketed a staggering 329% in only 13 months — marking the fastest and most explosive bull run ever recorded.

- 2008–2011: In the wake of the Great Recession, gold climbed nearly 160% over 34 months, fueled by massive monetary stimulus from central banks and widespread economic uncertainty. (For a deeper dive into gold’s fascinating monetary history, explore Mike Maloney’s Hidden Secrets of Money Series.)

By comparison, the current gold bull market, which began in March 2020 during the initial shock of the COVID-19 pandemic (approximately $1,712), has lasted more than four years and delivered nearly 100% price increase — making it the longest uninterrupted run since the 1970s, though not the most explosive in percentage terms.

As the accompanying five-year chart shows, the pace is clearly ramping up — and the momentum may just be getting started.

So far in 2025 alone, gold has surged about 30%, propelled by persistent inflation, global economic uncertainty, and the renewed tariff war initiated by the Trump administration.

Is This the Start of a Supercycle or a Temporary Spike?

With such explosive momentum and no clear end in sight to the underlying drivers — trade wars, inflation, central bank accumulation — many analysts believe we are witnessing the early stages of a structural bull market that could last for years.

Some even see the potential for gold to approach $4,500 or higher if global uncertainties continue and more countries shift away from the US dollar.

How to Prepare for the Next Move in Gold

- Don’t Chase, But Don’t Ignore: While the pace of gains may invite caution, the fundamental drivers remain intact. Corrections are possible, but the long-term case for gold is robust.

- Diversify Exposure: Consider a mix of physical gold and physical silver to balance security and liquidity.

- Stay Informed: Monitor macroeconomic developments, central bank policy, and geopolitical risks—they are likely to dictate gold’s next moves.

For guidance on purchaing precious metals, visit our Learn to Invest Page. GoldSilver offers state-of-the-art vault storage solutions designed to safeguard your wealth against theft and damage while maintaining full liquidity. Learn more about our secure storage solutions here.

And if you’d like crucial insights about monetary history, economic cycles, and wealth preservation strategies, check out Mike Maloney’s acclaimed “Hidden Secrets of Money” video series.

Final Thoughts: The Bull Market Is Heating Up — Fast

The gold market’s historic sprint past $3,400 is more than just a headline; it’s a signal that the bull market is entering a new, more intense phase. With year-to-date gains already among the strongest in modern history and the fundamental backdrop only growing more supportive, gold’s rally is showing no signs of cooling off.

For investors, the message is clear: the gold bull market is not just alive, but accelerating—and the next milestones may come even faster than anyone expects.

Protect your wealth by exploring physical gold options today. Visit Start Buying Gold to begin your journey and access Free gold investing resources to learn more.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.

- ⏰ Timely alerts on major price moves and important events

- 📢 Market updates from Mike Maloney & Alan Hibbard

- 💡 Strategies to profit from this rare opportunity

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Past performance is not indicative of future results. Always conduct thorough research or consult with a financial advisor before making investment decisions.