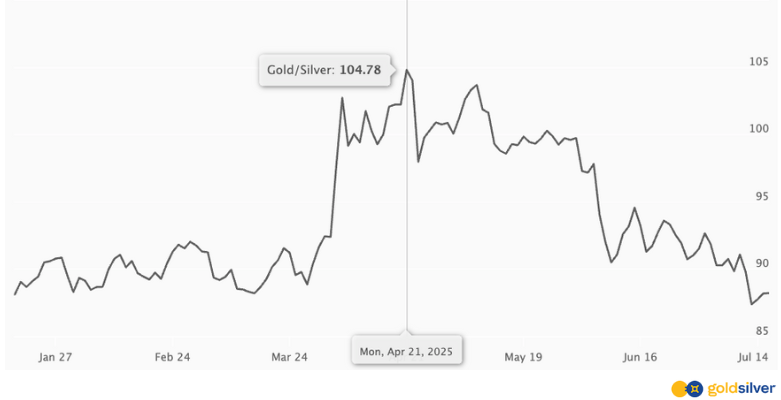

Back in April, we highlighted a rare and historically significant event: the gold to silver ratio soared past 100:1. That meant it took over 100 ounces of silver to buy a single ounce of gold — a level seen only a handful of times in modern history. Now, just three months later, the gold to silver ratio today is retreating toward more typical levels, and silver investors who acted on the signal have been rewarded.

The Gold to Silver Ratio in April vs Today

As of mid-July, the ratio has dropped to below 90 after peaking around 104 in April. That shift may sound small, but it reflects a meaningful move in the precious metals market — especially for silver.

On April 21, when the gold to silver ratio was near its recent high, silver traded around $32.68 per ounce. Today, silver sits close to $38 — a 16.3% gain in just three months. For investors who recognized the gold to silver ratio’s historical implications and added silver to their portfolios, the strategy has already paid off.

Silver Price Up 16.3% Since Ratio Peaked

On April 21, when the gold to silver ratio was near its recent high, silver traded around $32.68 per ounce. Today, silver sits close to $38 — a 16.3% gain in just three months. For investors who recognized the gold to silver ratio’s historical implications and added silver to their portfolios, the strategy has already paid off.

This move reinforces a key point we discussed in April: when the ratio hits extreme levels, it often signals that a reversion to the mean may be on the horizon — and that silver could be due to outperform.

Why the Gold to Silver Ratio Remains a Key Market Signal

To recap, the gold to silver ratio is simply the price of gold divided by the price of silver. Historically, this ratio has averaged around 60:1 in modern times and closer to 15:1 in eras when both metals circulated as money.

Whenever the ratio climbs above 80:1, many seasoned investors view it as a sign that silver is undervalued relative to gold. At over 100:1, the message is hard to ignore.

The recent pullback from 104 to the low 90s doesn’t mean the opportunity is gone — it may just be getting started.

Silver Catching Up: What’s Driving It?

Several factors are contributing to silver’s recent strength:

- Industrial demand is rebounding. From solar panels to electric vehicles, silver’s industrial uses are growing — and recent economic data suggest manufacturing activity is picking back up in key sectors.

- Monetary demand is firming. As central banks continue to accumulate gold, many retail investors are looking to silver as the more affordable alternative hedge.

- Technical breakouts. Silver has cleared some key resistance levels, opening the door to further upside.

The Silver Investment Opportunity Gold Investors Are Missing

Discover why silver may be the smarter investment opportunity now, offering greater growth potential than gold.

Read MoreIs It Too Late to Buy Silver?

Not necessarily. The gold to silver ratio today is still elevated compared to historical norms — and that could mean more room for silver to run. As of July 16, 2025, gold is trading around $3,348, while silver sits at about $37.96, giving us a ratio of roughly 88:1.

If the ratio were to move back to a more typical modern average of 60:1, and gold held steady at $3,348, silver would need to rise to about $55.80 to close that gap. That’s nearly a 47% increase from today’s price — a compelling upside scenario for silver bulls.

And if we returned to a more aggressive ratio like 50:1, silver could reach nearly $67, representing even greater potential gains.

While no outcome is guaranteed, the gold to silver ratio today suggests silver is still undervalued — and historically, these gaps have often closed through silver outperforming gold.

Interpreting the Gold to Silver Ratio Today

For those who already bought silver in April — congratulations, you caught a powerful move. For others watching from the sidelines, this could still be a compelling time to explore silver exposure.

Here are a few strategic takeaways:

- Extremes don’t last forever. When the gold to silver ratio hits triple digits, it historically doesn’t stay there long.

- Silver tends to move fast. It’s often a more volatile metal than gold — which means it can rise sharply in a short period.

- Opportunities still remain. While the easy gains from $32 to $38 may be behind us, further upside is possible if the trend toward normalization continues.

A Market in Motion

The precious metals market is dynamic and often counterintuitive. But the gold to silver ratio remains one of the most telling signals investors can watch. In April, that signal flashed bright — and now, we’re seeing what happens when history starts to rhyme.

Stay tuned. This story isn’t over.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.

- ⏰ Timely alerts on major price moves and important events

- 📢 Market updates from Mike Maloney & Alan Hibbard

- 💡 Strategies to profit from this rare opportunity