Brandon Sauerwein, Editor

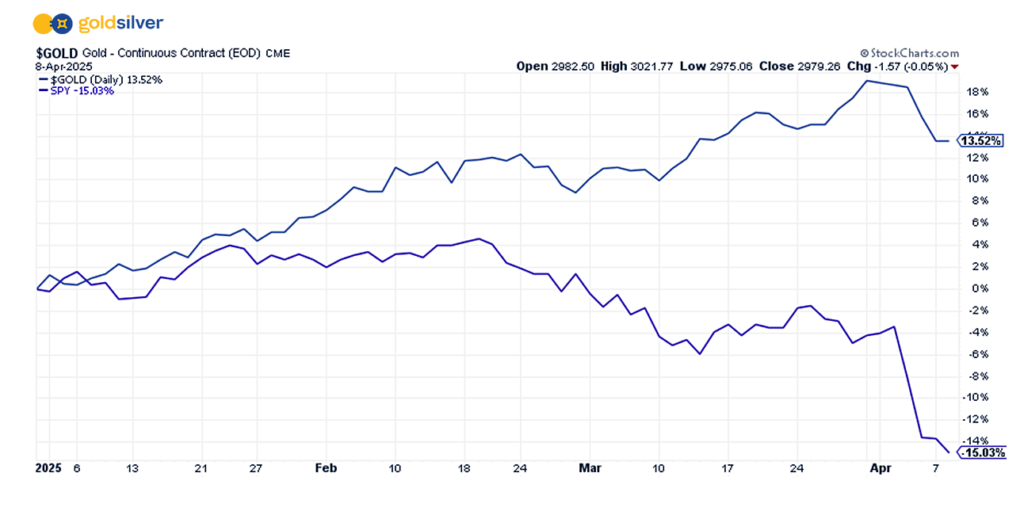

While the stock market whipsaws back and forth, metals continue to be a stabilizing force in financial portfolios. When it comes to gold vs S&P 500, the contrast is striking: year-to-date, gold has climbed +13.5% while the S&P 500 has tumbled -15%.

Many in the precious metal space are debating gold vs S&P 500 or buzzing about gold’s new record highs, but here’s something that might surprise you…

If you rewind to January 1980, gold peaked at $850 per ounce. Adjusting for inflation, that’s equivalent to roughly $3,486 in today’s dollars.

So, despite all the champagne popping over recent price action, gold actually hasn’t yet reclaimed its true historical peak in real purchasing power. We’re witnessing history in the making, but the most fascinating chapter might still be ahead.

This “hidden discount” raises an intriguing question: What happens when gold finally breaks above its inflation-adjusted 1980 high? If historical patterns offer any clues, the momentum could be extraordinary…

Mike Shares New Silver Forecast at Rare Live Event

Mike Maloney just made a rare public appearance at the Secrets of Syndication Conference, and his forecast for gold and silver might be the most important one he’s made in years.

In this rare live presentation, Mike shares:

- Evidence of over $500 billion in fraud within the U.S. Treasury

- Why someone just took delivery of nearly half a billion dollars in physical silver

- His bold prediction for silver prices to surge into triple digits ($150-$500 per ounce)

- Critical warning signs of an imminent recession that could devastate stock portfolios

- Why gold inflows to the U.S. are raising serious questions about Fort Knox reserves

Mike rarely makes public appearances anymore, making this presentation particularly valuable. Watch his most current thinking before these market-moving insights become common knowledge.

Secure Bulk Pricing on Every Single Gold & Silver Purchase

What Else is in the News?

⏰ 24 HOUR PRICE UPDATE | As of 9:00 AM, Wednesday, April 9th:

- Gold is up roughly +2.6%

- And silver is up +1.9%

📊 Safe Haven Debate: Gold Stable, Bitcoin Down

The long-running correlation between gold and Bitcoin has broken in 2025, with the precious metal up roughly +14% while Bitcoin has fallen -18% during the same span. Since 2020, China, India, and Russia are collectively purchasing over 1,000 metric tons of gold annually, helping drive gold’s rise. Meanwhile, Bitcoin’s price action matches more speculative assets than safe haven.

⚔️ China Pledges to “Fight to the End” In Trade War

President Trump’s reciprocal tariff plan has officially gone into effect, with U.S. Customs and Border Protection beginning to collect country-specific tariffs from 86 U.S. trade partners starting at 12:01 a.m. ET. The plan includes a substantial 104% tariff on Chinese goods, intensifying trade tensions between the world’s two largest economies. China has pledged to “fight to the end” by imposing strong countermeasures.

This trade war comes at a precarious time for US fiscal health. With a deteriorating fiscal position, ballooning interest expenses, and economic weakness, the credit outlook for US government debt appears increasingly vulnerable.

🏛️ US Treasuries: Safe Haven Status at Risk?

The longstanding position of US Treasuries as the world’s premier safe-haven investment could be at risk. Trump’s tariff policies may be accelerating global diversification away from US assets, with Deutsche Bank warning of a potential “confidence crisis” in the dollar and UBS suggesting the euro could strengthen as an alternative reserve currency.

Today, foreign investors own approximately one-third of the US Treasury market. Any significant reduction in international demand would create substantial funding challenges precisely when fiscal demands are escalating. — potentially threatening the dollar’s reserve currency status.

🔄 Trump Uncertainty Isn’t Going Away

One of the key repercussions of the trade war is heightened economic uncertainty. Tariffs swing wildly — 10% one day, 104% the next — creating an unpredictable environment for businesses and investors alike.

Even if tariffs were suddenly eliminated, trust with our trading partners has already been damaged. The global economy is entering an era of instability that shows no signs of abating soon.

In this climate of uncertainty, protecting your hard-earned wealth with time-tested safe havens isn’t just prudent — it’s essential.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Always Great

“Always great. Thank you GoldSilver for helping me preserve wealth, and thank you Travis for assiduous persistence in helping us with helping my daughter log in to my account invite.” — J. Grimes

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?

![Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]](https://goldsilver.com/wp-content/uploads/2026/01/gold-silver-performance-2025-300x200.jpg)