Where We Are in the Cycle

If you’re wondering whether gold’s recent all-time highs mean you’ve missed the rally, history offers a reassuring answer: gold bull markets tend to last far longer than most investors expect. And by historical standards, this cycle may still be in its early innings.

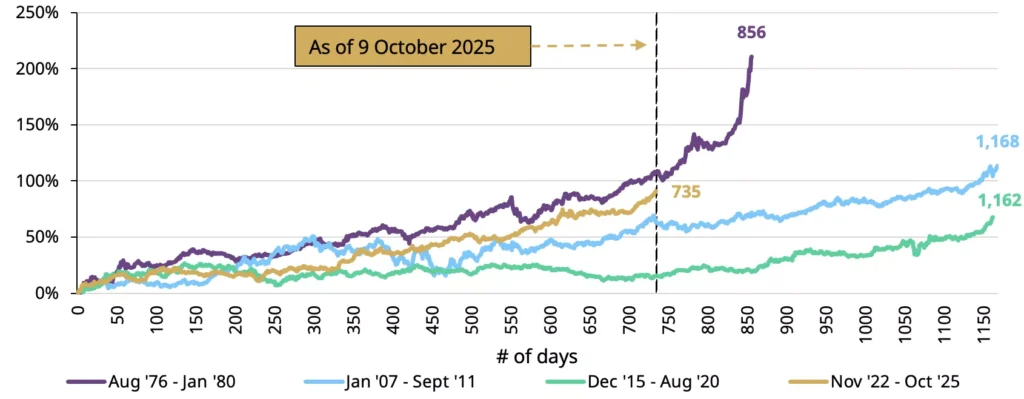

One of the best ways to understand where gold stands today is to compare this rally with previous gold bull markets — not just in price, but in duration. The patterns don’t repeat exactly, but they do rhyme. And what they suggest is that this move may have more room to run.

How Today’s Rally Compares to Past Bull Markets

Source: Bloomberg, World Gold Council | *Data as of 10/09/2025. Based on the LBMA Gold Price PM.

As of October 9, 2025, gold’s current rally is roughly 735 days old. That might sound substantial — until you compare it to history. Major gold bull markets have averaged about 1,062 days in duration. Nearly three years.

And here’s the critical insight: in past cycles, gold often hit record highs early in the rally — then kept climbing for years afterward.

The chart above shows three major gold bull markets alongside today’s rally, indexed to their starting points. What becomes immediately clear is that duration matters as much as magnitude — and by that measure, this cycle still has runway.

The 1970s: When Gold Rose 2,300% Over Four Years

The 1970s gold bull market remains the most dramatic example of gold’s potential during periods of monetary instability.

Gold began that decade at $35 per ounce — a fixed price that had been maintained since 1934. When President Nixon severed the dollar’s tie to gold in 1971, the floodgates opened. By January 1980, gold had surged past $850, a staggering 2,300% gain in less than a decade.

But here’s what many investors forget: gold broke above its previous all-time high relatively early in that cycle. It then spent years consolidating and climbing higher before its final parabolic surge.

The drivers were clear: double-digit inflation, expanding budget deficits, geopolitical shocks (oil embargoes, Cold War tensions), and a crisis of confidence in fiat currencies. Sound familiar? Today’s macro environment shares more parallels with the 1970s than most investors realize.

The 2001-2011 Rally: A Decade-Long Climb

The next major gold bull market began in 2001, following two decades of bear market conditions. This rally was different in character — steadier, longer, and driven by a new set of concerns.

Gold bottomed near $250 in 1999 and began climbing as the dot-com bubble burst. By 2006, it had reached new nominal highs around $725. Many investors at that point assumed the rally was overextended.

They were wrong. Over the next five years, gold tripled from those “all-time highs,” eventually peaking near $1,900 in September 2011.

What drove that decade-long climb? The financial crisis of 2008, unprecedented monetary expansion through quantitative easing, sovereign debt concerns in Europe, and persistent fear that central banks were debasing their currencies. Once again, the rally didn’t end because prices felt high — it ended when those fundamental drivers began to ease after 2011.

What Actually Ends a Gold Bull Market

Gold rallies don’t end just because prices feel high. They end when the underlying drivers reverse — and right now, those forces are accelerating, not easing.

The fundamentals supporting gold today include:

- Mounting sovereign debt across developed economies

- Persistent inflation pressuring purchasing power

- Currency debasement through expansionary monetary policy

- Rising geopolitical instability driving safe-haven demand

Until those trends shift, the macro backdrop remains bullish for gold. And none of them show signs of reversing soon.

Why This Cycle May Still Be Early-Stage

By duration alone, today’s rally looks younger than previous gold bull markets. If this cycle follows historical patterns, the risk of being under-allocated to gold may outweigh the risk of holding a core position.

The takeaway isn’t to chase price or time every dip. It’s to recognize that gold bull markets have historically rewarded patience over market timing. The trend length has favored staying invested rather than trading around headlines or short-term volatility.

History suggests we may be watching the middle chapters of this story — not the final act.

People Also Ask

How long do gold bull markets typically last?

Major gold bull markets have historically averaged around 1,062 days — nearly three years in duration. The 1970s rally lasted over four years, while the 2001-2011 bull market ran for a full decade. By comparison, the current cycle (as of October 2025) is roughly 735 days old, suggesting it may still have room to run.

Can gold continue rising after hitting all-time highs?

Absolutely. In past gold bull markets, reaching all-time highs was often an early-stage signal, not a peak. During the 1970s rally, gold more than doubled after breaking records, and in the 2001-2011 cycle, it tripled following its first new highs in 2006. Historical patterns show that duration matters more than price levels alone.

What causes a gold bull market to end?

Gold bull markets typically end when their underlying drivers reverse — not simply because prices feel elevated. The key factors include fiscal stress, currency debasement, inflation, and geopolitical instability. When government debt stabilizes, inflation subsides, and geopolitical tensions ease, gold rallies tend to plateau. Those conditions aren’t present today.

Is it too late to buy gold in 2025?

History suggests it may not be. If this cycle follows previous patterns, the rally could still be in its middle stages rather than approaching a peak. The risk of being under-allocated to gold may outweigh the risk of waiting for a pullback that never comes. GoldSilver offers educational resources to help investors build a strategic position rather than trying to time the market.

How does the current gold rally compare to the 1970s bull market?

The 1970s gold bull market lasted over four years and saw prices surge more than 2,000% from start to finish. Importantly, gold continued climbing for years after breaking all-time highs. Today’s rally shares similar fundamental drivers — fiscal deficits, currency concerns, and geopolitical risk — but is shorter in duration so far, suggesting it may still have significant upside potential.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.

![Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]](https://goldsilver.com/wp-content/uploads/2026/01/gold-silver-performance-2025-300x200.jpg)