Brandon Sauerwein, Editor

Gallup Poll: Americans’ Favorite Long-Term Investment Just Shifted

Which of the following do you think is the best long-term investment — [bonds, real estate, savings accounts or CDs, stocks or mutual funds, gold, (or) cryptocurrency]?

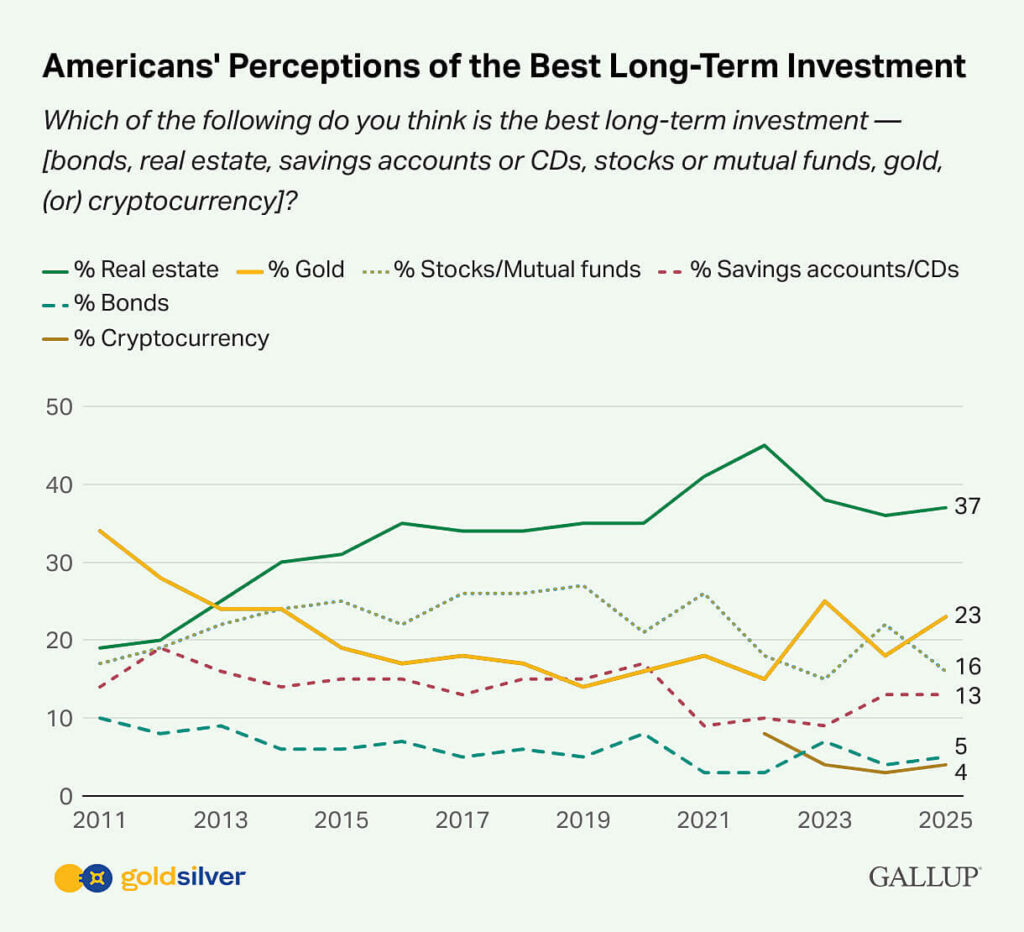

Real estate still tops the list of long-term investments for Americans, according to a brand-new Gallup poll.

But here’s the real headline: for the first time in over a decade, gold has overtaken stocks.

In an era of political chaos and market volatility, more and more Americans are turning to something real — physical gold — as their long-term safe haven. And what we’re seeing may be just the early innings of a much bigger trend.

Behind the headlines, a major reallocation of capital is underway. JP Morgan analysts now forecast gold could reach $6,000 per ounce by 2029 — if even just 0.5% of U.S. assets held by foreign investors shift into the metal.

But the impact could be even more dramatic at home.

As of the end of 2024, total U.S. retirement assets stood at $44.1 trillion. A modest shift — just 0.5% — into precious metals would represent over $220 billion in new demand.

That’s why many see this gold rally as the beginning, not the peak.

But here’s the twist: while gold captures headlines, silver may hold the bigger upside. With the gold-to-silver ratio signaling historic opportunity, smart money is watching closely — and moving fast.

Mike Maloney: Why Silver Could 10x in Value

It might sound far-fetched — until you see the data.

Mike Maloney and Alan Hibbard break down the data behind the $300 silver scenario. Is $300 silver really possible? Mike and Alan say the math checks out.

You’ll discover:

- Why Wall Street still misunderstands gold and silver

- What the gold-to-silver ratio is signaling right now

- How past government moves could repeat themselves

- The smarter way to build long-term security in a shifting world

If you own any silver — or are thinking about it — this is a must-watch.

Is Now the Time to Swap Gold for Silver?

Gold is climbing. Silver is lagging. Mike Maloney says that’s no accident—and it might be your chance to act.

In this eye-opening episode, Mike and Alan Hibbard show how you can buy gold for as little as $35 and why converting between metals at the right time could be a game-changer for your portfolio.

They answer real viewer questions, break down economic trends, and explain why average investors can still make extraordinary moves — if they know where to look.

What Else is in the News?

🇺🇸🇨🇳 U.S.–China Agree to 90-Day Tariff Truce

The U.S. and China have struck a temporary trade deal, slashing tariffs for 90 days while negotiations continue. U.S. tariffs on Chinese goods will drop from 145% to 30%, while China’s tariffs on U.S. products fall to 10%. Treasury Secretary Scott Bessent called the agreement — finalized during talks in Switzerland — a “major step forward.” The deal also includes joint efforts to tackle the fentanyl crisis.

🥇 Gold Pulls Back from Record Highs on Trade Optimism

Gold prices dipped slightly following the trade breakthrough between the U.S. and China, along with softer U.S. inflation data. While gold retreated from its recent record above $3,500 per ounce, it remains up roughly 20% year-to-date. Improved geopolitical sentiment has pushed some investors back toward riskier assets, at least for now.

📉 Inflation Eases to 2.3%, Lowest Since 2021

U.S. inflation cooled in April, with both headline and core CPI rising just 0.2% — under expectations. The annual inflation rate dropped to 2.3%, its lowest level in more than three years. Grocery prices declined, and egg prices saw their biggest monthly drop since 1984. While housing remains the biggest driver of inflation, markets welcomed the news: stocks climbed and Treasury yields slipped.

🏛️ Fed’s Jefferson Warns: Tariffs Could Disrupt Inflation Progress

Federal Reserve Vice Chair Philip Jefferson acknowledged recent progress on inflation but cautioned that new tariffs could reverse that trend. While April’s CPI data came in softer than expected, Jefferson noted that sustained import taxes may temporarily push inflation higher — and possibly slow the economy. He emphasized the need for a steady hand on interest rates, calling current levels “well positioned” to respond to emerging risks.

💬 What GoldSilver Investors are Saying

⭐ ⭐ ⭐ ⭐ ⭐ Best Company & Customer Service in the Industry

“GoldSilver.com has been my go-to bullion company for over a decade. Every purchase or sale with them is always effortless, fast, and professional. Last week, I had an urgent order, and Travis from the customer service team went above and beyond to expedite my transaction and meet my impossibly tight deadline. I couldn’t be happier with this company, and all the free educational resources they provide are life-changing. I’m looking forward to many more years with GoldSilver.com as my preferred metals dealer.”

— A. Mackness

Experience the GoldSilver difference:

- Receive expert guidance from dedicated precious metals specialists

- Access comprehensive educational resources to master your investment strategy

- Trust in our industry-leading customer service team that puts you first

Ready to get started?