Thousands of people are buying gold from Costco right now — but when it’s time to sell, Costco won’t buy it back. That leaves many new investors stuck with metals they can’t easily liquidate.

That’s exactly why GoldSilver created a comprehensive, industry-leading sellback program. When you’re ready to convert part of your holdings into cash, you can do it quickly, transparently, and entirely online — including directly from our storage vaults. No shipping, no hassle. Just a simple, streamlined process designed for real investors.

Why People Sell Gold & Silver — and Why It Pays to Be Strategic

Whether you’re rebalancing your portfolio, exiting a position, or simply converting metal into cash, gold and silver remain among the most liquid assets on earth. But unlike selling a stock, selling physical metal requires a bit of preparation to ensure you’re not giving up profit through large spreads, hidden fees, or unverified buyers.

The good news: with today’s online tools — and especially with GoldSilver’s built-in sellback system — you can access competitive pricing and a frictionless selling experience whenever you need it.

Know What You Own: Coins, Bars, and Purity

Before contacting a buyer, identify the type and condition of the metal you’re selling:

- Gold coins (e.g., American Eagles, Maple Leafs, Krugerrands)

- Silver coins (e.g., Eagles, Philharmonics)

- Gold bars (1 oz, 10 oz, kilo bars, etc.)

- Silver bars (10 oz, 100 oz, 1,000 oz)

- Rounds or generic bullion

- Numismatic or collectible coins

- Jewelry or scrap gold

Each category has a different market, different premiums, and different buyer demand. For example, selling gold coins safely often yields stronger bids than selling jewelry because bullion products trade closer to spot prices.

If you’re unsure, most reputable dealers — including GoldSilver — can help identify your items.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Understand How Pricing Works (and What Affects Your Payout)

Every buyer determines prices using the same foundation:

- Buy-back spreads that vary by dealer

- Market demand and supply conditions

To sell gold and silver for the best price, compare dealer buyback rates — not just their marketing claims. Transparent dealers clearly publish spreads and update pricing in real time.

Factors that influence your final payout:

- Condition of the item

- Rarity or collectibility

- Quantity being sold

- Payment method requested

- Market volatility (fast-moving markets can tighten spreads)

Choose Where to Sell: Online vs. Local Dealers

Both options have advantages, but one typically yields higher returns.

Selling Gold & Silver Online (Often the Best Value)

Reputable online dealers generally offer:

- Higher buyback prices

- Lower operating costs (meaning tighter spreads)

- Insured shipping

- Fast processing and electronic payment options

- Transparent, published pricing

This is often the best place to sell gold coins, silver bars, and investment-grade bullion.

Selling Gold for Cash Near You (Local Shops & Pawn Brokers)

Local buyers are convenient, but you may encounter:

- Larger spreads

- Pressure-based sales tactics

- Limited expertise on collectible coins

- Cash-only transactions

They may be a good same-day option, if you need cash immediately, but rarely the highest-value option.

How to Sell back from GoldSilver Storage

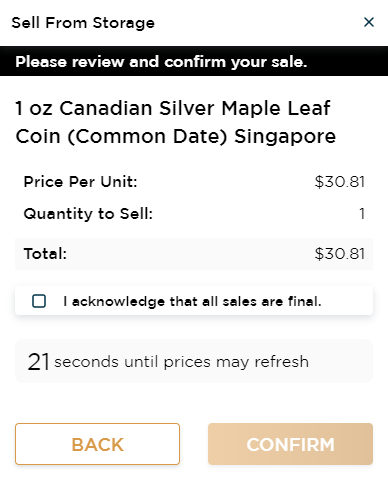

If you store your metals with GoldSilver, selling is even easier. There’s no packaging, no shipping, and no waiting for items to be inspected — your metals are already authenticated and ready to trade. Here’s exactly how the process works:

Note: Withdrawing funds comes after the sale is complete. ACH withdrawals typically take 2 business days from the trade date. For wire transfers, go to ACCOUNT → BANK ACCOUNTS → WIRE WITHDRAW once your sale has settled.

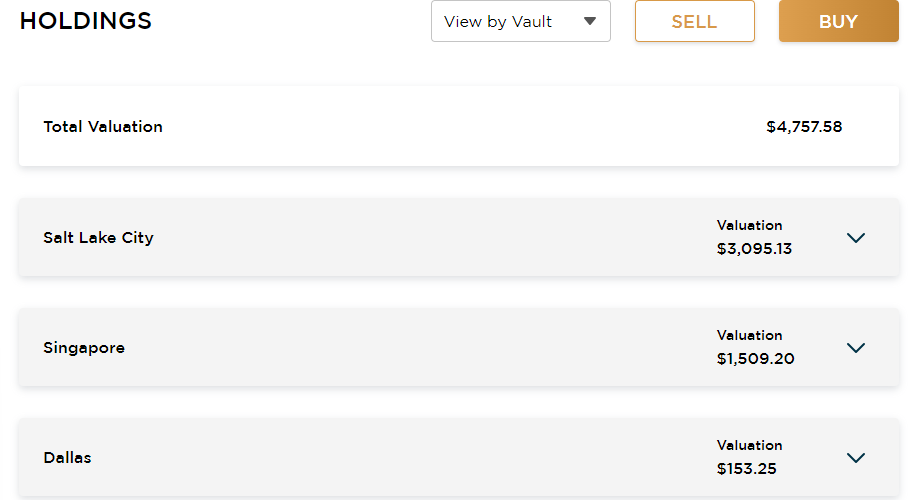

- Login to your GoldSilver account online and scroll down until you see HOLDINGS

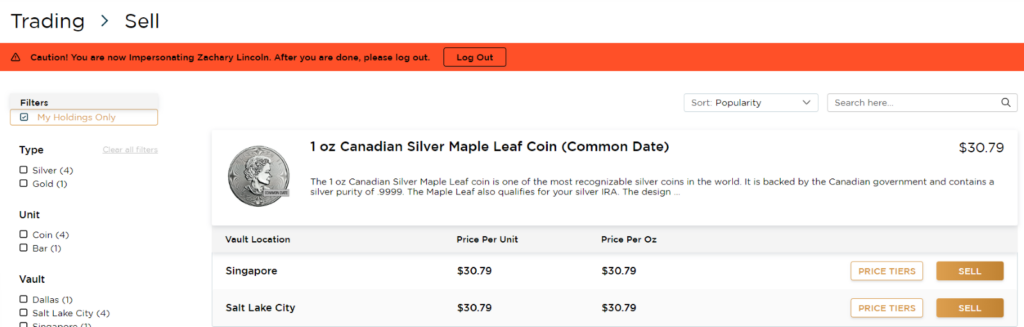

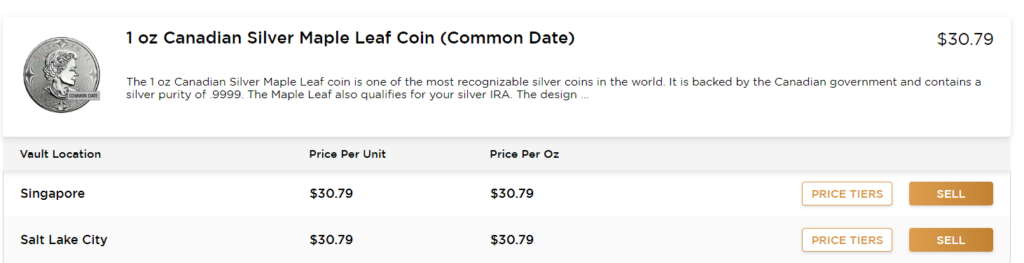

- Select SELL

- Choose which assets you would like to sell.

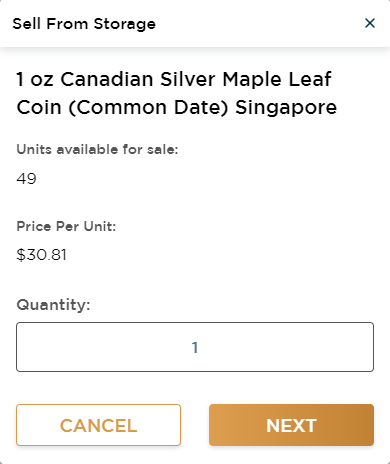

- Enter the quantity, e.g. 1

- Acknowledge all sales are final and select CONFIRM

REMINDER – To withdraw funds, this is a second step after you sell. When selling it takes 2 full business days from the trade date in order to withdraw funds. To receive payment via WIRE, please go to ACCOUNT>BANK ACCOUNTS>WIRE WITHDRAW.

Selling from storage is the fastest and most secure way to liquidate your metals — and it’s one of the biggest advantages of storing with GoldSilver. But whether you sell through storage or ship metals to a buyer, it’s important to know how to protect yourself and recognize warning signs along the way.

Red Flags to Avoid When Selling Precious Metals

Selling gold and silver safely means watching for:

- Hidden fees or unclear spreads

- Buyers who refuse to publish pricing

- Strong-arm offers (“this deal is only good for five minutes!”)

- Requests to ship uninsured

- No physical corporate address

- No history or public reviews

Better rule: if a buyer makes you uneasy, walk away.

Tips to Get the Best Price

Here’s how to maximize your return:

- Sell recognizable bullion products when possible.

- Check multiple dealer buyback rates before committing.

- Track spot price trends — small timing differences can matter.

- Sell in larger quantities (some buyers pay more per ounce).

- Keep original packaging or certificates for premium products.

- Work with established, reputable dealers.

Getting competitive bids is your best leverage for securing top dollar.

Where to Go From Here

Selling precious metals doesn’t have to be complicated — and with the right partner, you can convert your holdings into cash quickly, safely, and at highly competitive rates.

Whether you’re selling from storage, shipping metals to us, or just comparing your options, GoldSilver’s team is here to help you make the most informed decision.

Next steps you can take now:

➡ Compare buyback rates and start a sell order: Sell to Us

➡ Learn the smartest strategies for selling your metals: Best Ways to Sell Gold

➡ Understand what your metals may be worth today: How Much Gold Is Worth

When you’re ready, we’re here to make selling your gold and silver simple — and to ensure you get fair, transparent pricing every time.

People Also Ask

What’s the best way to sell my gold or silver for the highest price?

The best way to get top dollar is to sell to a reputable online bullion dealer that publishes transparent buyback rates and offers competitive spreads. GoldSilver provides real-time pricing and an easy sellback process so you always know exactly what you’re getting paid.

Can I sell my gold or silver directly from storage?

Yes — if your metals are stored with GoldSilver, you can sell them instantly through your online account with no shipping or inspection delays. This is often the fastest and most secure way to liquidate your holdings.

Does Costco buy back gold?

No. Costco sells gold bars, but they do not buy them back, leaving customers to find alternate buyers. That’s why GoldSilver’s industry-leading sellback program is designed to give investors an easy, transparent way to convert metals into cash anytime.

How do I know what my gold or silver is worth before selling?

Your metal’s value is based on the current spot price, product type, and buyback spread. You can check real-time pricing and estimated payouts on GoldSilver.com to make sure you’re getting a competitive offer.

What types of gold and silver can I sell?

You can sell coins, bars, and rounds, as well as certain collectible pieces and IRA-approved bullion. GoldSilver buys a wide range of precious metals and posts daily buyback rates so you always know whether your product qualifies.