Brandon Sauerwein, Editor

If you’ve ever wondered what runaway fiscal policy looks like in real time — this is it.

Back in May, the House narrowly passed President Trump’s “Big Beautiful Bill,” a sweeping tax and spending package projected to add $2.8 trillion to the federal deficit over the next decade. But the Senate just upped the ante.

On July 1, the Senate passed an amended version of the bill, which slashes federal revenues by $4.5 trillion while cutting only $1.2 trillion in spending. The result? A $3.3 trillion increase in the deficit — half a trillion dollars more than the House plan.

And when you factor in the extra borrowing costs? We’re looking at nearly $4 trillion in new debt this year alone…

Is This the Breaking Point for the U.S. Dollar?

As the national debt barrels past $37 trillion, it’s clear Washington has abandoned any pretense of fiscal discipline. With elections behind them, lawmakers from both parties have quietly shelved deficit concerns.

Trillions in new deficits are being waved through — because kicking the can down the road is easier than facing reality. Meanwhile, the markets are already reacting.

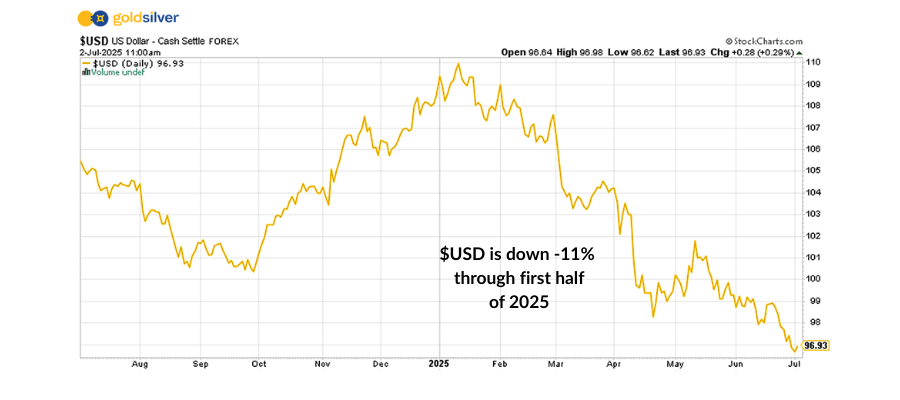

The U.S. dollar is having its worst start to the year in decades. The Dollar Index (DXY) — which tracks the greenback against a basket of major currencies — is down 11% through the first half of 2025.

US Dollar Over Past 12 Months

That’s the sharpest first-half decline for the dollar since 1973. Here’s happened to the price of gold through the rest of the decade:

- 1974: +58%

- 1975: +4.5%

- 1976: -22.5%

- 1977: +18.5%

- 1978: +31%

- 1979: +58%

- 1980: +101%

Seasoned investors can see the writing on the wall: When politicians from both parties agree that deficits don’t matter, currencies always pay the price.

For those focused on preserving long-term wealth, this isn’t the time for wishful thinking. It’s time to position yourself ahead of the inevitable consequences.

In Case You Missed It:

💵 Central Banks Are Dumping Dollars at Record Pace

The dollar’s dominance just dropped from 58% to 44% — and pro traders haven’t shorted it this heavily since 2005. Meanwhile, central banks are buying gold at record pace.

In this eye-opening episode, Mike reveals:

- Why Treasury’s “stablecoin fix” barely dents the debt

- The 2022 trigger that flipped central banks from dollars to gold

- What the 30-year countdown means for your future

📈 The Portfolio Strategy That Nearly Doubles the 60/40 Portfolio

For years, financial advisors pushed the 60% stocks / 40% bonds model as the gold standard. But what if you could’ve nearly doubled those returns?

According to new Goldman Sachs research, adding gold and silver to your portfolio would have done exactly that — going back over two decades.

In this episode, Mike and Alan break down:

- The risk-adjusted returns that got Wall Street’s attention

- Why bonds are failing as a hedge (and what works instead)

- Real portfolio strategies you can use today

Recent Articles

- Gold and Silver Price Forecast: Dollar vs Safe Haven Demand

- Bullion vs Numismatic Coins: Which Should You Choose?

- How to Choose the Best Gold IRA Storage Option for You

Market Pulse: This Week in the News

💰 Minimum Wage Hikes Take Effect in 15 States and Cities

As of July 1, over 880,000 workers will see pay bumps in places like Alaska, Oregon, and Washington D.C., adding $397 million annually to wages. Major cities including Chicago, LA, and San Francisco are also raising rates. Meanwhile, lawmakers in states like Missouri are pushing to limit voter-approved increases.

📈 Consumer Confidence Hits 4-Month High Despite Job Fears

June saw consumer sentiment rise to 60.7 — the highest since February — as inflation fears ease. Expectations for 1-year inflation dropped from 6.6% to 5%, and long-term outlooks fell to 4%. Still, more than half of consumers expect unemployment to rise, and tariff concerns linger.

🏦 Trump Blasts Fed, Demands Immediate Rate Cuts

In a fiery interview, Trump slammed Fed Chair Jerome Powell as “stupid,” demanding rates be slashed to 1–2%. With current rates at 4.25–4.5%, he warned no future Fed appointment would be made without a promise to cut. Treasury Secretary Bessent hinted a replacement could be named by October.

🌐 Trump Holds Firm on July 9 Tariff Deadline

President Trump confirmed the 90-day global tariff pause will expire July 9, with no extensions planned. Countries will soon receive notice of new tariffs — ranging from 10% to 50% — based on their trade relations with the U.S. Negotiating 90 individual deals remains an uphill battle.

🥈 The Silver Institute: Silver Faces Fifth Straight Year of Deficit

For the fifth year in a row, the world used more silver than it produced. The Silver Institute’s World Silver Survey 2025 shows a 149M oz shortfall in 2024, driven by record industrial demand. With another 117.6M oz deficit expected this year, supply pressure on physical silver is building — and smart investors are watching closely.

💬 Why Investors Choose GoldSilver

⭐ ⭐ ⭐ ⭐ ⭐ Extremely Concise

“Extremely concise, easy to read, explains REAL things vs. the ongoing narrative of Central Banks & Govt.’s. Prompts one to develop agitation for having buried one’s head in sand for decades & empowers one to spread Truth. And brings to light “how” to capitalize on this dangerous period of history. A MUST read if you use Currency/or REAL Money.” — John D.

Join thousands of smart investors who have discovered the GoldSilver difference:

- Personal guidance from precious metals experts who actually answer the phone

- Real education that cuts through the noise — no fluff, just facts

- A team that treats you like family, not a transaction number

Ready to get started?

![Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]](https://goldsilver.com/wp-content/uploads/2026/01/gold-silver-performance-2025-300x200.jpg)