Written by: The MacroButler

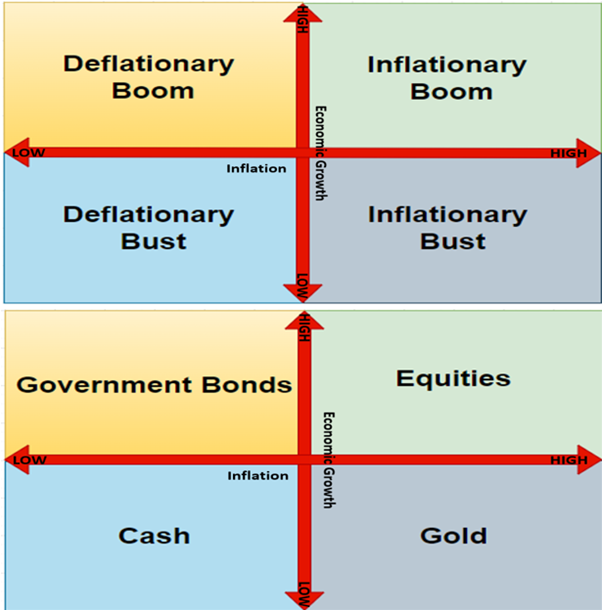

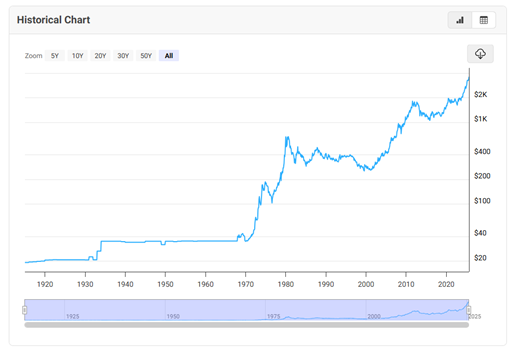

Harry Browne’s Permanent Portfolio is basically a four-course financial meal: stocks for the inflationary sugar rush, bonds for the deflationary nap, gold for the inflationary hangover, and cash for when everything else goes sideways. The genius lies in its balance—no matter what the economy cooks up, at least one dish is always edible. Layer in Schumpeter’s business cycle, and you’ve got a cheat sheet for knowing which plate to pile higher. The trick, of course, is figuring out which course the economy is currently serving—easier said than done.

If Harry Browne’s Permanent Portfolio is the financial slow cooker: toss in stocks, bonds, cash, and gold, then let it simmer through booms, busts, bubbles, and panics, the mix is designed to survive any economic mood swing—without you needing antacids or day-trading stress. Think of it as portfolio geometry: a neat four-square grid where at least one corner always behaves, keeping your wealth from staging a coup.

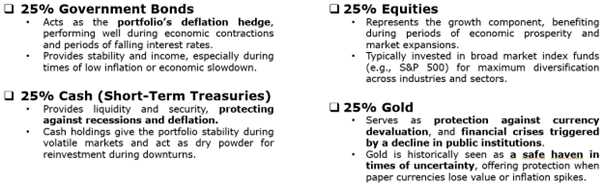

Financial assets boil down to two tribes: contracts (IOUs like bonds) and properties (ownership claims like stocks). Some play the long game (government bonds, equities), others are short-term sprinters (cash, gold). Put them on a grid—contracts vs. properties, long vs. short—and voilà: the “forever portfolio” splits neatly into four quadrants, like a well-behaved pizza where every slice handles a different economic mood swing.

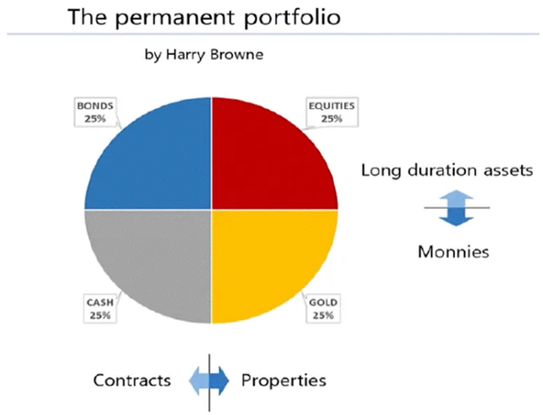

In Browne’s Permanent Portfolio, gold plays the role of timeless trouble-shooter. It’s been money, jewellery, and a shiny obsession for millennia—but in modern finance it’s the ultimate “break glass in case of emergency” asset. Unlike fiat, it can’t be printed on a whim, which makes it scarce, durable, and annoyingly hard to kill. Central banks stash it in vaults, investors cling to it in crises, and whenever inflation, currency shenanigans, or geopolitical chaos hit, gold dusts off its cape and steps in as the safe-haven hero.

Gold has been humanity’s go-to money and wealth preserver for millennia—rare, durable, and universally trusted. From Lydia’s first coins to Rome’s solidus to the gold-backed dollars of recent history, it’s outlasted empires and paper promises alike. Unlike fiat that governments can inflate at will, gold keeps its buying power—whether it’s a toga in ancient Rome or a tailored suit today. Through wars, crashes, and revolutions, it stays the same: the ultimate anchor of trust when everything else wobbles.

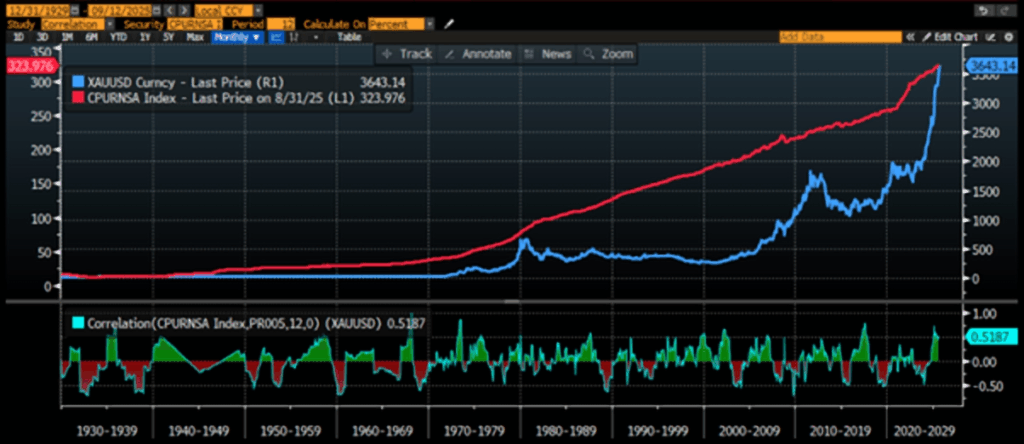

Gold’s place in a portfolio is endlessly debated. While it’s often billed as an inflation hedge, the data says otherwise: over nearly a century, the 12-month correlation between gold prices and U.S. CPI has rarely topped 0.5. In other words, gold is no reliable short-term shield against rising prices. Its value lies less in tracking inflation tick-for-tick, and more in serving as a long-term store of trust when paper money wobbles.

Gold Price in USD (blue line); US CPI Urban Consumers Index (red line) & Correlation since 1929.

Alright, myth-busters, put down your Wall Street popcorn—time to see if gold really dances to the tune of inflation expectations. The “gold = inflation hedge” gospel preached by countless investors? Yeah… not so fast. Even when we ditch the short-term consumer noise and peek at the University of Michigan’s 5–10-year inflation expectations, gold’s correlation with long-term expectations is only slightly better than its laughable link with the U.S. “CP-Lie.” In short: gold might twirl around inflation a bit, but it’s certainly not leading the conga line.

Gold Price in USD (blue line); University of Michigan Expected Change in Prices During the Next 5-10 Years (red line) & Correlation since 1979.

So, if gold isn’t dancing to the inflation beat, what is moving the shiny metal? Enter another Wall Street myth: the idea that the dollar calls the shots. Sure, gold is priced in USD, so when the dollar flexes its muscles against other fiat currencies, gold tends to sulk. Case in point: the 1980s and 1990s—strong dollar, even with inflation lurking, and gold basically shrugged. Look at the numbers: since 1967, gold and the USD Index (DXY) have mostly been frenemies, negatively correlated with a typical correlation below -0.5. Translation: when the dollar struts, gold often sits it out.

Gold Price in USD (blue line); US Dollar Index (red line) & Correlation since 1967.

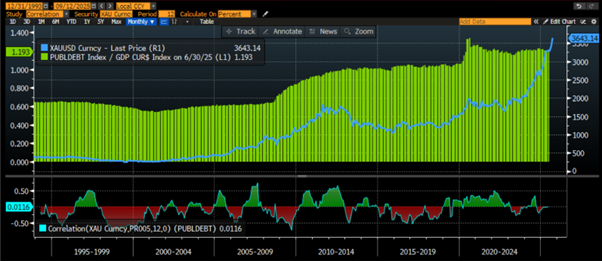

Gold is the original “don’t-need-a-boss” asset. No counterparty, no middleman, just pure antifragile rebellion against monetary chaos and authoritarian governments. Unsurprisingly, debt-heavy governments hate it—Roosevelt confiscated it, the Soviets banned it, Venezuela hawked it abroad—because nothing cramps a ruler’s style like a shiny metal they can’t inflate away. And yet, gold persists. Meanwhile, if you look at its correlation with U.S. debt-to-GDP, investors occasionally glance at it as a hedge… but mostly, they just admire it from afar.

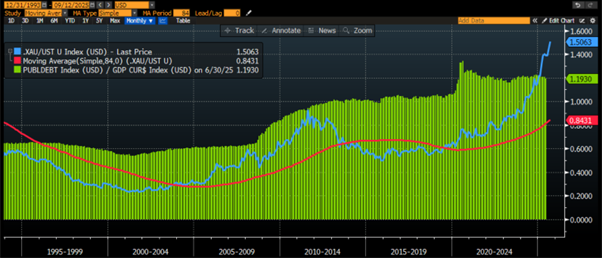

Gold Price in USD (blue line); US Total Debt to GDP (green histogram) & Correlation since 1993.

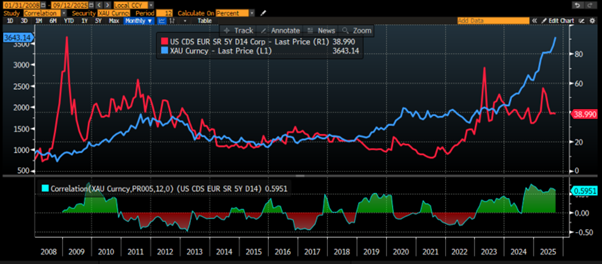

Well, who could’ve guessed? The one asset that’s managed to outlive empires, currencies, and a thousand government IOUs—gold—just so happens to be the only thing investors can actually trust. Shocking, right. And lo and behold, for the past 17 years, its price in USD has danced pretty closely with the US CDS rate, that little metric that supposedly tells us the “true” risk of Uncle Sam defaulting. But sure, keep pretending government paper is risk-free.

Gold Price in USD (blue line); US Credit Default Swap (red line) & Correlation since 2008.

Naturally, the U.S. will nobly wait its turn to be the last Western government to default—such manners! And as for the charts showing gold moving in lockstep with French, British, and Japanese bond yields? Just happy accidents, like spilled wine on a white shirt. After all, who still would trust debt-bloated governments to keep everything perfectly under control?

Upper Panel: Gold Price in EUR (blue line); 30-Year French Government Bond Yield (red line); Middle Panel: Gold Price in GBP (green line); UK 30-Year UK Government Bond Yield (purple line); Lower Panel: Gold Price in JPY (Magenta line); 30-Year Japan Government Bond Yield (orange line).

To be clear, caution is essential: it’s all too easy to mistake coincidence for causation—or to cling to a pattern that suddenly collapses. Remember when everyone swore real yields dictated gold prices? Then came 2023, and—surprise! —the theory fell flat.

Gold Price in USD (blue line); US 10-Year Real Yield (axis inverted; red line) & correlation since 1997.

Lately, gold’s been the belle of the investment ball—outshining most other assets that mere mortals and institutions can actually buy. Its recent price rise? A cocktail of macro chaos, structural quirks, and geopolitical drama—basically everything that makes investors clutch shiny rocks like they’re life preservers.

Nominal (not ‘CP-Lie’ adjusted) performance of $100 invested in physical gold (blue line); S&P 500 index (red line); Bloomberg US Treasury Index (green line); Bloomberg US Treasury Bill: 1-3 Months Index (purple line) since 31/12/2019.

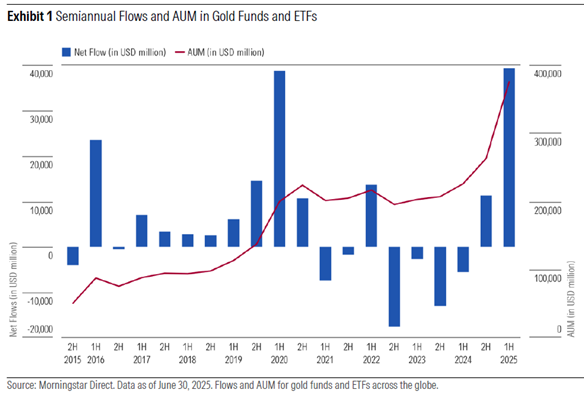

Persistent chaos, weaponization of USD assets make gold look like the ultimate “don’t let your wealth melt” asset. Throw in trade spats, and regional conflicts, and voilà—gold became the crowd’s favourite safe haven. Some investors bought it for diversification; others just hopped on the momentum bandwagon—because nothing says “smart portfolio move” like chasing shiny rocks. Central banks, retail, and institutions piled in, pushing gold ETFs past USD 375 billion by mid-2025—up sixfold from a decade ago. Inflows in the first half of 2025 alone hit USD 40 billion, matching the panic-buying frenzy of early COVID, proving that when fear strikes, gold still steals the show.

Savvy investors know gold isn’t just shiny—it’s antifragile. The economy swings through business cycles—usually seven years on average—shifting between inflationary booms, busts, and deflationary phases. The Browne Permanent Portfolio, equally weighted in cash, bonds, stocks, and gold, aims to deliver steady real returns across these cycles—peace permitting. But in today’s turbulent world, where full-scale war hasn’t yet hit but storms rage nonetheless, investors need more than a data-driven compass—they need an asset that actually benefits from chaos.

An antifragile asset is an investment that doesn’t just survive market chaos—it thrives on it. Coined by Nassim Nicholas Taleb, the concept describes assets that grow stronger amid volatility, shocks, or crises, unlike merely resilient investments that just endure stress. Antifragile assets typically feature a convex response to pressure, optionality to benefit from unexpected opportunities, asymmetric payoffs where potential gains far outweigh losses, and low fixed obligations to reduce fragility. In short, they give investors a rare edge in uncertain times, making them a powerful addition to any portfolio—gold being the only tangible example.

While most people obsess over government-fed “economic data” (aka the propaganda numbers), savvy investors know the real story comes from the market itself. Forget the CPI—anyone who can read a chart knows that tracking gold versus government bonds tells you far more about currency debasement and inflation than a bureaucrat’s spreadsheet ever could. When debt-to-GDP starts sprinting upward, the gold-to-bond ratio usually follows, often breaking above its 7-year moving average like a rebel with a cause. Gold has grabbed investor attention recently, thanks to trade wars and geopolitical drama, and while it can diversify portfolios and boost risk-adjusted returns, it’s no miracle asset—short-term swings can be wild, and chasing momentum is a fast track to disappointment.

Gold to US Bond ratio in USD (blue line); 7-Year Moving Average of the Gold to US Bond ratio (red line); US Total Debt to GDP (green histogram) since 1993.

On the geopolitical front, the first week of September made one thing clear: the Global South keeps assembling its own economic and financial dream team. At the 25th SCO Summit in Tianjin (Aug 31–Sept 1, 2025), China flexed its leadership, hosting the largest gathering in SCO history with Putin and Modi—India’s first return in seven years. The summit rolled out a 10-year development plan, backed multilateralism, and greenlit an SCO Development Bank along with cooperation platforms in energy, AI, and green tech—quietly nudging against U.S. dominance. Xi’s “Global Governance Initiative” pitched a model based on sovereign equality and greater Southern representation, while a casual photo of Xi, Modi, and Putin perfectly symbolized the rising multipolar world order.

The launch of the SCO Development Bank at Tianjin is a bold stride toward reducing dependence on Western finance and the U.S. dollar. By pooling member resources and financing projects in local currencies, it strengthens regional resilience and nudges cross-border trade toward yuan, rubles, and rupees. Much like the BRICS New Development Bank, it signals a slow but steady shift of global capital away from Western hubs toward the Global South and Eurasia. History repeats: just as Bretton Woods cemented U.S. dominance after WWII, the SCO’s move hints at a new financial inflection point—one where unipolarity gives way to a multipolar world order.

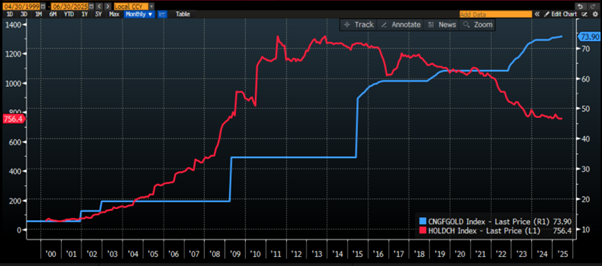

Putin, Xi, and Modi are quietly rewriting the playbook: de-dollarizing trade across the Global South, building non-SWIFT settlement systems to dodge Washington’s financial sledgehammer, and diversifying central bank reserves away from U.S. Treasuries. The numbers tell the story—over the past decade, China’s gold reserves have steadily climbed, while its U.S. Treasury holdings have quietly retreated in the opposite direction. Gold is back in style.

China Monthly Gold Reserves (blue line); China US Treasury Holdings (red line).

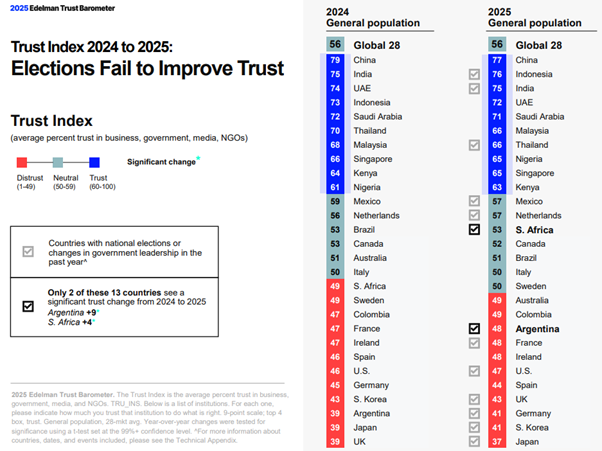

Amid the flaws of the USD-centric financial system, gold offers freedom—from credit risk, government meddling, and geopolitical tantrums like freezing foreign assets. As trust in public institutions falters and geopolitical tensions rise, both institutional and retail investors are gravitating toward assets with no counterparty risk. Enter gold: the ultimate antifragile asset, quietly thriving while paper promises wobble.

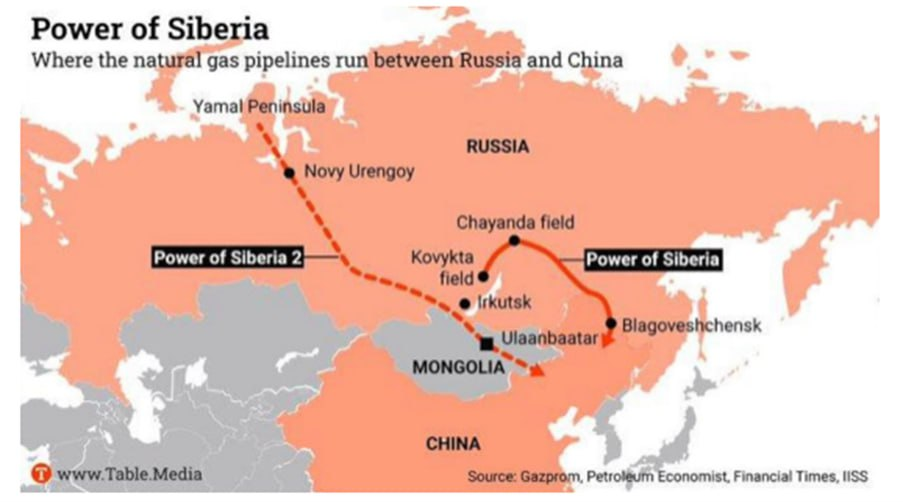

While Western media keeps freting over carbon credits and virtue points, the “mercantilist” Global South was busy in Tianjin plotting new overland pipelines to move oil and gas from Russia to China. Gazprom and CNPC quietly signed another gas deal—just more proof that Russia and China are steadily weaving their economic web, while the West debates green optics and another round of economic sanctions against the Russian Bear.

While the U.S. clings to its naval supremacy, the Global South is busy building roads—and pipelines. Gazprom and CNPC are pushing the world’s largest, most capital-intensive gas pipeline from Russia’s Arctic across Siberia to China. With Beijing already Russia’s top buyer of oil, gas, and coal, this isn’t a “new deal”—it’s topping off an already full tank. Europe? You’re cheering green zealots and warmongers while sleepwalking toward economic ruin. Meanwhile, China cements energy independence and global clout, quietly winning the infrastructure arms race of the century.

At the end of the day, anyone who studies markets knows GOLD IS FOR WAR. Harsh? History proves it: when pillaging becomes acceptable, moral and religious excuses follow. Modern myths don’t help: low interest rates magically create wealth (tell that to Americans priced out of property), government stimulus drives growth (real growth comes when returns on invested capital beat the cost of capital, nothing else), and discouraging saving doesn’t boost the economy as everyone who has not been brainwashed by the communist keynesian religions know.

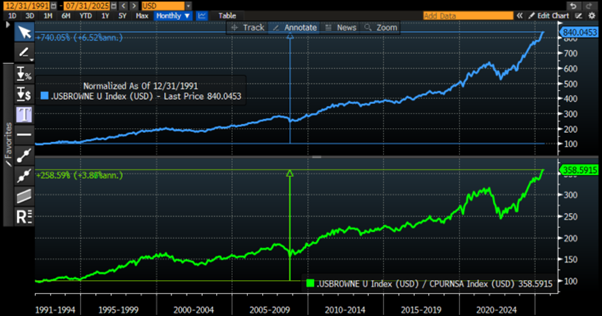

Yet many still praise U.S. economic management over China’s, judging by stock markets alone—ignore the Browne Portfolio returns in their respective domestic currencies: 3.89% annually when adjusted for domestic CPI in China versus 3.85% for the U.S., also adjusted for domestic CPI. The difference: in China, all components are in the green, fostering fairness and political stability.

US Browne Portfolio in USD (blue line); US Browne Portfolio in USD adjsuted to US CPI (green line).

China Browne Portfolio in CNY (blue line); China Browne Portfolio in CNY adjsuted to US CPI (green line).

Asset allocation skeptics ask: why bother if the Permanent Portfolio delivers 3–4% real returns with minimal drawdowns? Simple: it works in peace. In wartime, cash and bonds crumble—France saw debt securities lose 97% of real value between 1914 and 1950. Gold, on the other hand, keeps its shine.

In a nutshell, even in financial disasters sparked by war, the Permanent Portfolio never hits zero—thank the 25% gold allocation for that. Meanwhile, the idea that government bonds and cash are “risk-free” is adorable… if you’ve never lived where governments can’t balance a budget. Take Ukraine: it narrowly avoided defaulting on $20 billion in loans in July, after suspending interest payments for two years due to the war—a default that would have ranked among the ten largest in recent history. History teaches that war cycles erode confidence in public institutions and wreak havoc on asset allocations. As the 2020s roll on, wars rise, trust falls, and mismanaged Western governments keep piling debt for the benefit of the 1%, leaving the rest scrambling. In this climate, gold isn’t optional—it’s mandatory.

Gold and war have always danced together. Spain’s New World silver financed conquest but sparked domestic inflation, weakening it for future conflicts while England and the Netherlands profited by supplying goods. During the French and Napoleonic Wars, Britain abandoned the gold standard in 1797 but leveraged its financial credibility to borrow heavily, while France’s bimetallic approach limited borrowing and forced reliance on taxation—tilting the advantage to Britain. By World War One, Imperial Russia’s vast gold reserves were drained in the chaos, with Bolsheviks seizing private and Imperial gold to sustain their revolution. Meanwhile, the Allies’ gold—especially from Britain and South Africa—financed war efforts and blocked Germany’s access. Germany preserved smaller reserves, lending gold to allies like the Ottoman Empire. These patterns repeated in World War Two, as Nazi Germany plundered gold from occupied territories to fund its war machine. World War Three will not be much different and those who are still believing in bonds and cash to preserve their wealth will be the first collateral victims of the warmongering agenda of the ‘North Atlantic Terror Organization’ alias NATO and other Malthusian western globalist organization like the European Union or the club of the elite men of Davos.

For investors, wartime conditions are a whole new ballgame. In such chaos, gold shines brightest, gaining against beta as volatility spikes. When stock market risk metrics climb, the gold-to-S&P 500 ratio usually rises, letting gold outperform equities. This trend is even more relevant today, as U.S. assets face weaponization by governments and the cozy China-Russia-India alliance fuels gold demand across the Global South.

Relative Performance of S&P 500 index to Gold Ratio (blue line); CBOE Volatility Index 200 day moving average (VIX Index) (axis inverted; red line).

For those who actually understand monetary illusions, it’s obvious: when the S&P 500-to-Gold ratio dips below its 7-year moving average, history whispers “Ursus Magnus” — aka, a major bear market. But of course, YOLO investors glued to CNBC and other mass-media fairy tales are blissfully oblivious. Since Donald Copperfield waltzed into the Oval Office on January 20, 2025, that very ratio has been flirting below its 7-year moving average—a canary in the coal mine that apparently nobody wants to notice.

Relative Performance of S&P 500 index to Gold Ratio (blue line); 7-Year Moving Average of S&P 500 index to Gold Ratio (red line); S&P 500 index 12-month return (yellow histogram).

The markets are basically telling investors that taking risks no longer pays—and that’s what really matters. That’s all investors need to know. As for why—well, that’s irrelevant. In fact, the day we finally understand why risk doesn’t pay will probably be the perfect day to start buying.

Here’s the trick: stocks and gold take turns wearing the crown. Since 1970, S&P 500 dividends have always drifted back to about one gram of gold, no matter how much Wall Street pats itself on the back. Translation: most of that “growth” is just monetary smoke and mirrors. So, buy stocks when they’re dirt cheap versus gold (S&P 500 dividend to 1 gram ratio under 0.56) and sell when they’re pricey (ratio over 1.3). Right now, the ratio is already flashing danger, and if it dips below 0.5630, that’s the cue to flip gold into stocks.

Until then, the best trade is… doing absolutely nothing. Keep the powder dry, because when the correction in equity comes, it’ll be fast, ugly, and terrifying. And honestly, that’s when smart investors make money—shaking in their boots while everyone else is running for the exits. Everyone should be excited to be terrified again.

S&P500 Dividend Per Share in dollars (blue) and in gold grams (red).

Indeed when the dividend of the S&P 500 expressed in gram of gold trade below 0.56 grams the 12 month return in the S&P 500 tends to have peaked and has only troughed once a reversal has been started to materialize in the valuation of S&P 500 dividend in gold terms. In a nutshell, for those who expect that equity return will remain in double digit as they have been over the past 2 years they must believe that the pace of S&P 500 dividend growth will be much higher than the pace of price appreciation of 1 gram of gold. As stagflation looms on the horizon, these hopes could appeared to be elusive.

S&P500 Dividend Per Share gold grams (red); 12-month return of S&P 500 index (yellow histogram).

To the goldbugs who cling to their own fairy tales, let me save you the headache: believing only gold survives while fiat currencies are doomed is pure nonsense. History shows that for thousands of years, money wasn’t metal at all—it was just book entries in ancient Egyptian banks, backed by grain, not gold. Coins appeared centuries later, often imitating the most trusted foreign currency, like Athenian Owls or Roman aurei. Their value wasn’t in the metal; it was in trust—people trusted Athens, Rome, or India more than the metal in the coin. Even the Celts copied Macedonian coins, and the Maria Theresia Thaler lived on for decades after her death because it was trusted internationally. In short, money has always been about trust, convention, and recognition—not just shiny metal. So, before you curse “fiat,” remember: humans have been doing this for millennia, and it works remarkably well when you understand the history.

Luckily, you’ll never convince a fool that he’s a fool. There will always be plenty of these champions who refuse to listen—because apparently, losing their shirts, pants, house, car, spouse, and maybe even the dog is the only way to learn. We learn from mistakes, not wins. The good news? That leaves a perfectly sized herd for the rest of us to trade against.

Looking at history with open eyes, it’s clear Washington’s warmongers have been running endless wars—from Vietnam to the War on Terror—none of which they’ve actually won. McNamara admitted Vietnam was a civil war, not a battle against Russians. Iraq? No WMDs, no accountability, $8 trillion down the drain. Today, EU leaders seem poised to pick fights with Russia—not for security, but to distract from economic failures and a flawed euro that could never replace the dollar. Centralized governance was meant to prevent wars, yet history—from Charlemagne to Napoleon, even Kohl sneaking Germany into the euro—shows it often fails, sparking unrest instead. Now, with ungovernable institutions and ballooning debt, war looks like the EU’s only way to save face, while NATO and lobbyists keep milking the forever-war machine.

The inevitable World War III is poised to shift the economic and financial center of gravity eastward, with China—and most likely Hong Kong—emerging as the new hub of global capitalism. This would mark the eclipse of the globalist Keynesian agenda and the rise of a multipolar world driven by mercantilist ambitions.

In the meantime, as the global economy is heading into an inevitable inflationary bust, the path to real prosperity remains paved with tangible assets, not fragile IOUs not genius digital tokens, Physical gold and silver—free from counterparties, free from surveillance—stand as the ultimate antifragile shields. Beyond precious metals, broader commodities guard against a fracturing global supply chain.

Cash must be wielded with precision: favor short-dated USD investment-grade bonds and T-bills to maintain income and swift agility.

In equities, hunt for lean, low-debt, high-cash-flow champions—businesses ready to thrive amid reshoring, trade wars, and surging defense budgets. Because the real enemy isn’t next door; it’s the warmongers pulling the strings.

The Goldilocks era is dead. The age of Gold In Lots—is the new survival playbook.

At the end of the day, as Charles De Gaulle once said, “Betting against Gold is the same as betting on government. He who bets on governments and government money bets against 6,000 years of recorded human history”

KEY TAKEWAYS.

As investors finally wake up to why gold matters—and why it matters right now—the key takeaways are:

- Harry Browne’s Permanent Portfolio is a four-quadrant financial “pizza” of stocks, bonds, gold, and cash, designed to survive any economic mood swing—no antacids or day-trading required.

- Gold is finance’s timeless superhero—scarce, durable, and ready to preserve wealth when inflation, currency chaos, or crises strike.

- Gold isn’t a short-term inflation shield—it’s a long-term store of trust that holds value when paper money wobbles.

- Gold: the ultimate “I don’t take orders” asset—antifragile, counterparty-free, and eternally annoying to debt-heavy governments, which explains confiscations from Roosevelt to the Soviets.

- Gold isn’t just a shiny relic—it’s an antifragile asset that thrives on chaos, giving investors a rare edge through every twist of the economic cycle.

- When the S&P 500-to-Gold ratio breaks below its 7-year moving average, history screams bear market ahead—so while CNBC’s YOLO crowd cheers, the smart money is quietly waiting to buy in fear.

- Putin, Xi, and Modi are fuelling a global gold comeback, as investors seek the antifragile security of metal over wobbling paper promises and a USD-centric system in crisis.

- As the US economy shifts into an inflationary bust, investors will once again need to focus on the Return OF Capital rather than the Return ON Capital, as stagflation spreads.

- Physical gold and silver remain THE ONLY reliable hedges against reckless and untrustworthy governments and bankers.

- Gold and silver are eternal hedge against “collective stupidity” and government hegemony, both of which are abundant worldwide.

- With continued decline in trust in public institutions, particularly in the Western world, investors are expected to move even more into assets with no counterparty risk which are non-confiscable, like physical Gold and Silver.

- Long dated US Treasuries and Bonds are an ‘un-investable return-less’ asset class which have also lost their rationale for being part of a diversified portfolio.

- Unequivocally, the risky part of the portfolio has moved to fixed income and therefore rather than chasing long-dated government bonds, fixed income investors should focus on USD investment-grade US corporate bonds with a duration not longer than 12 months to manage their cash.

- In this context, investors should also be prepared for much higher volatility as well as dull inflation-adjusted returns in the foreseeable future.

HOW TO TRADE IT?

As of September 12th , 2025, the US remains in an inflationary boom, but with the S&P 500 to Gold ratio now below its year below its 7-year moving average for more than 7 months, an inflationary bust will materialize much sooner than Wall Street pundits and their parrots are eager to tell their clients. In this context, investors should stay calm, disciplined, and use market data tools to anticipate changes in the business cycle, rather than fall into the forward confusion and illusion spread by Wall Street.

As war casts its shadow, the wise understand that true strength arises from knowing both oneself and the currents around them. Those who grasp the nature of the enemy yet remain ignorant of their own path win only fleeting victories; those who know neither are swept away by every storm, whether in the flow of wealth or the chaos of battle.

In times of war and financial chaos, the wise know first what not to do: do not trust fragile banks, sovereign bonds, or government promises, for they crumble when tested. Instead, seek the enduring path—hold physical gold and silver in secure, independent hands, diversify across safe jurisdictions, and preserve your freedom and options. Reduce reliance on cash and paper claims, favor tangible assets that thrive in turmoil, and prepare for shifts in power and policy beyond your control. Focus not on fleeting gains but on the quiet art of staying rich, protecting family, and valuing what is freely given by life itself—while remembering the ancient truth: gold is for war.

As the western imperialistic dominance stumbles through its boom-bust death cycle and European unelected lamed ducks autharitarian leaders prepare their next ‘false flag’, investors have to follow the gold as history’s verdict is unchanged: tangible assets endure while paper promises burn. The future will not be won by those who innovate fastest, but by those who hold what cannot be printed, censored, or erased. Gold has outlasted empires; it will outlast this one.

In a nutshell, the playbook is simple: don’t get confiscated, don’t get frozen, and don’t get poor trying to get rich. In times like these, liberty and liquidity live in personal vaults—not in banks. And always remember: In Gold We Trust—Because Gold Is For War.

As William Rees-Mogg wisely noted: ‘Governments lie; bankers lie; even auditors sometimes lie. Gold tells the truth.’

Want the full deep dive? You can read The MacroButler’s original article on his Substack