Daily News Nuggets | Today’s top stories for gold and silver investors

February 19th, 2026 | Brandon Sauerwein, Editor

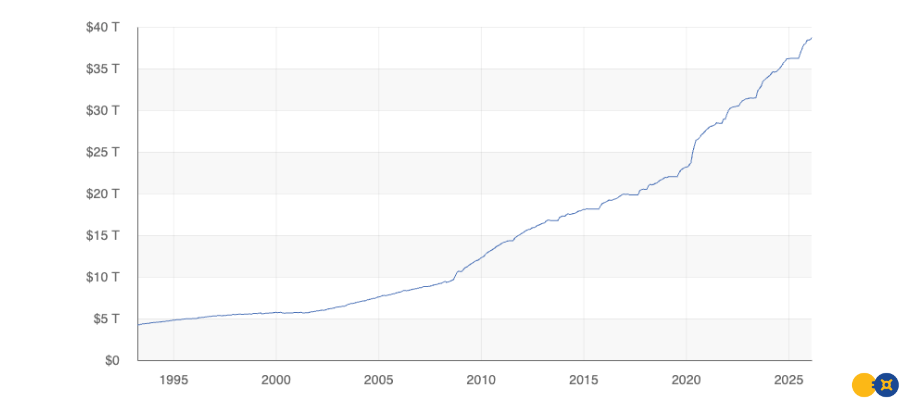

Debt Tops $38.6 Trillion as $1T Added This Fiscal Year

When it comes to national debt and gold prices, the trend is hard to ignore: both keep climbing. The Joint Economic Committee just released a stark warning: more than $1 trillion has been added to the national debt this fiscal year alone, pushing the total to $38.647 trillion.

30 Years of Borrowing — With No End in Sight

The numbers behind the headline are just as alarming. Interest payments alone have already hit $346 billion in just the first four months of the fiscal year. That’s 14% of all federal spending just on interest payments — and the year isn’t close to over.

When you include interest paid back to government trust funds, interest becomes the second-largest federal expense. It’s on track to become the largest.

Here’s what makes this a compounding problem: the government is borrowing money to pay interest on money it already borrowed. At the same time, it’s borrowing more to fund ongoing operations. Chairman David Schweikert called the trend “economically unsustainable” — and it’s hard to argue otherwise.

The real risk isn’t just abstract fiscal strain. Rising interest costs crowd out everything else — infrastructure, defense, social programs. The more Washington pays to service old debt, the less it can invest in the future.

Fed Signals Surprise Shift Toward Easing

The Federal Reserve is changing its tune. Multiple officials have signaled greater openness to rate cuts in the months ahead — a notable shift from the “higher for longer” stance that defined policy for the past two years.

No immediate action was announced. But the tone has clearly changed. Policymakers acknowledged that inflation progress — though uneven — has improved enough to start discussing a recalibration. Meanwhile, signs of labor market softening and slowing consumer demand have raised a new concern: that the Fed may be keeping rates too tight for too long.

Bond markets reacted immediately. Treasury yields fell as traders priced in higher odds of easing later this year. Equity markets rallied on the news, though questions remain about whether the pivot is premature.

That’s the tension. Inflation hasn’t fully surrendered. Cutting too soon could reignite price pressures and force the Fed into an embarrassing reversal.

The bigger picture: the Fed is no longer solely focused on beating inflation. The mandate has quietly shifted toward balancing price stability with slowing growth. That’s a more complicated — and more volatile — policy environment for both bonds and equities.

Stay Ahead with Gold & Silver News The most important market insights, Fed updates, and global trends — everything investors need to make smarter, safer decisions.

Inflation “Slower and More Uneven” — Fed Minutes Raise the Bar for Cuts

But yesterday’s FOMC minutes complicated that picture. Minutes from the Fed’s January meeting, released yesterday, revealed that most policymakers believe progress toward the 2% inflation target could be “slower and more uneven than generally expected.”

The risk of inflation running persistently above target, officials warned, “was meaningful.”

Markets felt it immediately. Treasury yields ticked higher after the release. The 10-year note rose to 4.087% as traders scaled back rate cut expectations. The policy-sensitive 2-year yield climbed to its highest level in a week.

The minutes also reintroduced something markets had hoped was behind them: two-sided risk language. Officials acknowledged that rate increases could be warranted if inflation fails to cooperate — a signal that the door to further tightening isn’t fully closed.

The broader message: the Fed isn’t on a preset path. It’s watching the data, and the data isn’t cooperating fully.

For precious metals investors, this creates an interesting setup. Sticky inflation that the Fed can’t fully tame is historically bullish for gold. The link between national debt and gold prices becomes even clearer when the Fed is trapped — unable to cut without risking inflation, unable to hold without slowing growth.

Middle East Tensions Inject Premium Into Oil Prices

Oil markets broke out sharply this week. Brent crude climbed above $71 a barrel, while WTI traded comfortably above $65, the largest single-day price jump since late 2025.

The catalyst: escalating fears of a U.S. military operation against Iran. Reports of mounting military posturing — and a lack of progress in nuclear negotiations — signaled to traders that the risk of disrupted oil flows was rising fast.

The focal point is the Strait of Hormuz. That single chokepoint handles roughly one-fifth of all global oil transit. Even the threat of disruption there can move prices, regardless of where inventories or output actually stand.

That’s the nature of geopolitical risk premiums. Markets don’t wait for confirmation — prices react first and ask questions later.

For precious metals investors, the same logic applies. Geopolitical shocks historically drive safe-haven demand, and gold tends to move in the same direction as oil when conflict risk rises. If Middle East tensions continue to escalate, gold may have further to run.

Rising Gold Prices Deliver Windfall for Major Miner

When gold prices rise, mining profits can rise even faster. Gold Fields — one of South Africa’s largest gold producers — just reported that full-year profit more than doubled, driven almost entirely by the rally in bullion.

Higher realized gold prices expanded margins sharply. That gave the company stronger free cash flow even as costs in labor, energy, and capital expenditures continued to climb. Revenues grew and the balance sheet strengthened.

This is operating leverage in action. Mining companies carry significant fixed costs. When gold prices surge, those costs don’t double — but profits often do. That’s why some miners can outperform bullion itself during a strong rally.

But that cuts both ways. When gold prices stall or correct, miners can fall even harder than bullion. The same leverage that amplifies gains also amplifies losses — making miners a higher-volatility play than holding physical gold directly.