Daily News Nuggets | Today’s top stories for gold and silver investors

February 20th, 2026 | Brandon Sauerwein, Editor

Gold Above $5,000, Silver Over $80 — A New Phase for Precious Metals

The gold price in 2026 has been one of the year’s defining market stories — and Friday’s move back above $5,000 is a reminder that this rally still has legs. Meanwhile, silver cleared $80 again, pulled higher by investors seeking monetary protection and industries competing for a shrinking supply.

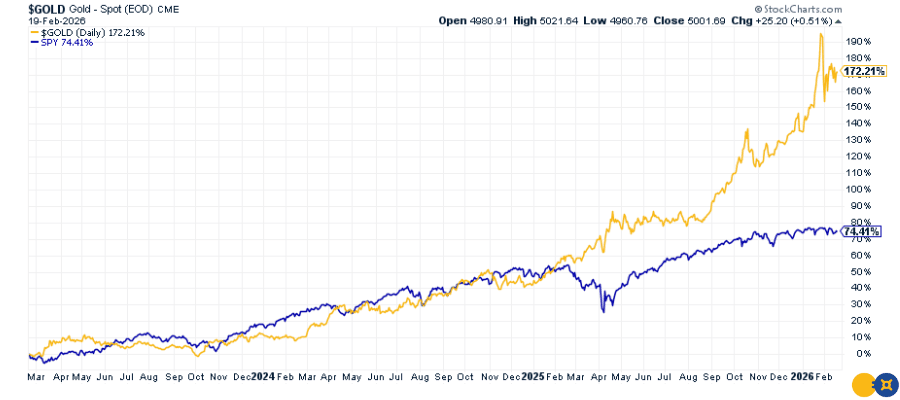

The numbers tell the story. Gold has climbed more than 70% year-over-year, one of its strongest annual advances in modern history. And over the past three years, it’s up roughly 170–175%. This isn’t momentum chasing. It’s capital repositioning at scale.

Gold vs. S&P 500: 3-Year Performance (%)

Investors are responding to a familiar set of pressures: persistent geopolitical tensions, mounting government debt, and growing uncertainty around central bank independence. When confidence in policy wavers, gold reasserts its role as a neutral reserve asset.

The takeaway is simple: when trust in institutions softens, hard assets strengthen. And right now, the pressures driving this rally show no signs of easing.

Powell Prioritizes Fed Independence in Final Months as Chair

With his chairmanship entering its final stretch, Jerome Powell is making clear: protecting the Federal Reserve’s institutional independence is his top priority. Powell sees preserving the Fed’s credibility as essential — especially as political scrutiny over rate policy intensifies.

Central bank independence is a cornerstone of stable inflation and functioning markets. When investors believe monetary policy is being shaped by political objectives, the consequences are predictable. Long-term yields rise. The dollar weakens. Volatility spreads across asset classes.

The timing couldn’t be more sensitive. Inflation pressures persist. Federal debt remains elevated. Geopolitical uncertainty is already weighing on markets. In that environment, even subtle doubts about Fed autonomy can ripple quickly through equities and bonds.

History offers a useful pattern here. Moments of monetary credibility risk have consistently coincided with stronger demand for hard assets — particularly gold. When trust in policy frameworks erodes, investors look for something that doesn’t depend on institutional credibility to hold its value.

And it’s not just monetary policy adding to the uncertainty.

Military Posturing Escalates — What It Means for Markets

The U.S. is ramping up military positioning amid escalating geopolitical tensions. President Trump has stated that American forces are prepared if diplomacy fails. Officials emphasize no final decision has been made, but the visible buildup has caught investors’ attention.

Markets don’t wait for confirmation. They price in risk as it develops. Defense stocks tend to benefit in the short term. Broader equities wobble as traders assess escalation scenarios. And historically, episodes of military tension drive demand for safe-haven assets — gold and Treasuries chief among them.

But the deeper question isn’t whether conflict materializes. It’s what prolonged uncertainty does in the meantime. Sustained geopolitical tension tends to push energy prices higher, disrupt global trade flows, and add an inflation premium that’s difficult to unwind. Those aren’t short-term concerns. They compound.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Legal Fight Over Tariffs Could Spark More Volatility

Wall Street is watching the Supreme Court closely. Justices are weighing the legality of President Trump’s emergency tariff powers after lower courts questioned whether the administration exceeded its authority under IEEPA.

The stakes are real. If the Court strikes down key tariffs, equities could wobble as traders adjust to the revenue loss and policy uncertainty that follows. But analysts are split on how severe the fallout would be. Some expect any knee-jerk equity move to be short-lived — the administration could quickly pivot to alternative legal authorities to reinstate tariffs. Others warn a ruling against could push Treasury yields higher and trigger broader risk-off trading.

Either way, the uncertainty itself is the risk. Markets don’t like unresolved questions about the legal framework governing trade policy. And drawn-out uncertainty tends to keep investors cautious.

For gold and silver, that caution creates opportunity. Volatility — whatever the source — tends to drive fresh interest in hard assets. Policy ambiguity is no exception.

Yet despite all of this, retail investors appear remarkably calm.

Risk Appetite Back, But Are Investors Getting Too Comfortable?

Global equity funds just recorded their strongest weekly inflows in several weeks. Investors rotated back into stocks on easing sector-specific concerns and renewed optimism about corporate earnings and economic resilience. Data from EPFR/LSEG shows notable net purchases across major fund categories, suggesting confidence in risk assets is rebuilding after recent turbulence.

Retail participation is also running hot. That combination — institutional inflows and elevated retail buying — is worth paying attention to. Markets can climb on optimism. They can also get ahead of themselves.

For deeper context on what record retail flows have historically signaled about sentiment and risk tolerance, watch Alan’s video: Retail Investors Just Set a Record — History Says Be Careful.

The bigger picture: investors are chasing returns in markets still navigating inflation, policy uncertainty, and unresolved geopolitical risk. That’s not irrational. But it does raise a question worth sitting with — how much of the current optimism is pricing in things going right, and how little is leaving room for things going wrong?