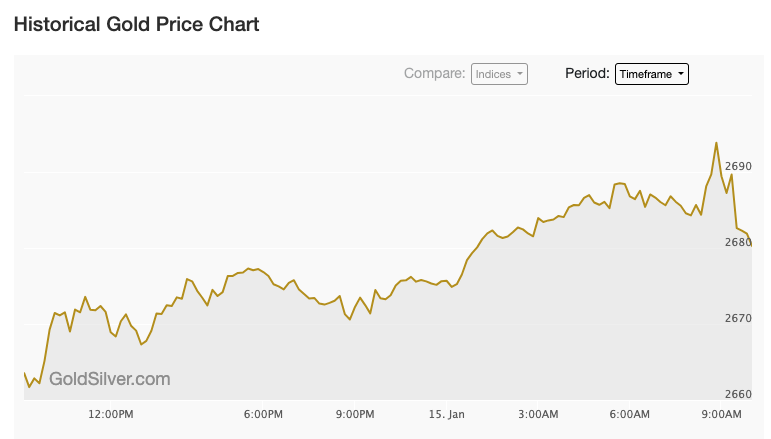

Gold prices gained momentum as both the U.S. dollar index and Treasury yields retreated, with spot prices rising 0.4% to $2,687.59 per ounce and futures climbing over 1% to $2,710.00. Markets are particularly focused on upcoming CPI data, expected to show annual inflation increasing to 2.9% from November’s 2.7%. According to Saxo Bank’s Ole Hansen, market uncertainty is heightened by both the pending inflation data and political considerations, including Trump’s proposed import tariffs that could impact inflation and complicate the Federal Reserve’s rate decisions. Despite Tuesday’s moderate PPI increase, analysts suggest rate cuts may not materialize until the second half of the year.

Articles

Gold Silver Prices: Short-Term Noise, Long-Term Signal

Gold and silver prices are full of short-term noise—daily swings driven by Fed commentary, currency moves, and speculative trading. But underneath the volatility lies a consistent long-term signal. Learn how to tell the difference, what structural forces actually drive precious metals prices over time, and how to build a strategy that stays focused on what matters most.