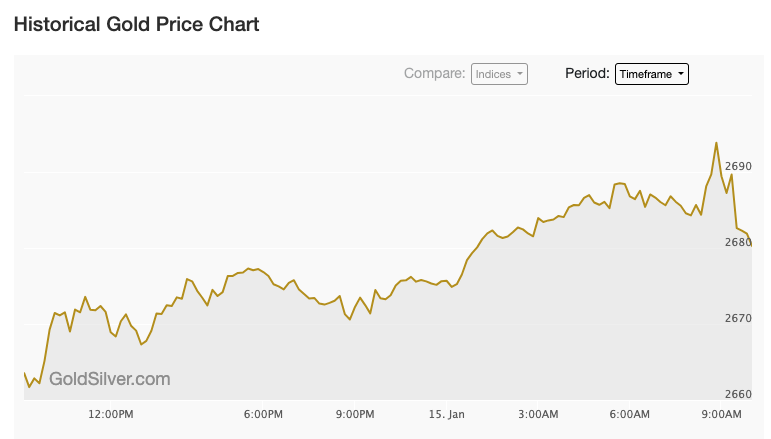

Gold prices gained momentum as both the U.S. dollar index and Treasury yields retreated, with spot prices rising 0.4% to $2,687.59 per ounce and futures climbing over 1% to $2,710.00. Markets are particularly focused on upcoming CPI data, expected to show annual inflation increasing to 2.9% from November’s 2.7%. According to Saxo Bank’s Ole Hansen, market uncertainty is heightened by both the pending inflation data and political considerations, including Trump’s proposed import tariffs that could impact inflation and complicate the Federal Reserve’s rate decisions. Despite Tuesday’s moderate PPI increase, analysts suggest rate cuts may not materialize until the second half of the year.

Videos

Silver vs Gold Performance: What Happened After the Gold Silver Ratio Went Above 90

In early 2025, the gold-silver ratio approached 90. Mike Maloney and Alan Hibbard discussed why extreme ratios often precede strong silver rallies. Since that video, silver vs gold performance has been striking—outpacing gold, stocks, and bonds by a wide margin.