Daily News Nuggets | Today’s top stories for gold and silver investors

October 21st, 2025

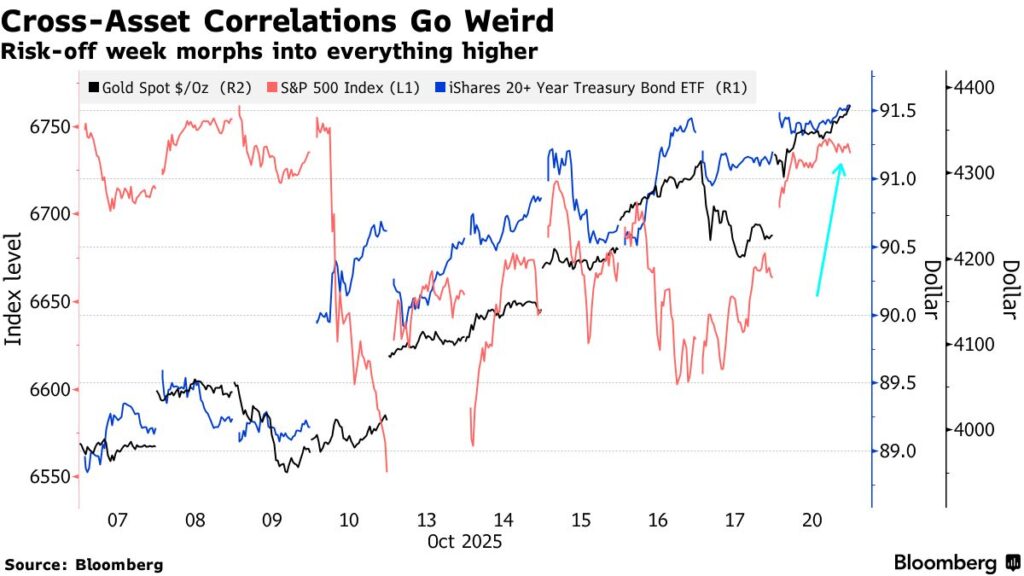

Goldman Sachs: “Everything is Weird” in the Markets

Stocks, bonds, and gold are all climbing in unison — a pattern that breaks decades of historical behavior.

Normally, these assets move in different directions. When stocks rally, bonds sell off. Gold thrives when equities struggle. But right now? The S&P 500, long-dated Treasuries, and precious metals are all making new highs together.

The S&P 500 has surged 15% this year to multiple records. Treasury bonds are rallying. Gold just hit $4,381. Meanwhile, the VIX — Wall Street’s fear gauge — remains subdued despite trade war headlines and a government shutdown.

“Everything is weird,” says Goldman trader Bobby Molavi, noting that traditional correlations are “thrown out the window.” Retail investors keep buying. AI spending shows no signs of slowing. Earnings season is holding up.

It’s the kind of market that climbs every wall of worry — until it doesn’t. When assets that typically hedge against each other all move in lockstep, something’s shifting beneath the surface. That shift became visible this week in precious metals…

Gold and Silver Pull Back, But Buyers Aren’t Retreating

Gold pulled back 2% on Tuesday morning, after touching a fresh record of $4,381 an ounce. Silver took a harder hit, dropping as much as 6% as profit-taking swept through precious metals.

The retreat isn’t surprising — technical indicators had been flashing overbought warnings for days. But here’s what matters: dip buyers emerged almost immediately. That signals investors still see value at these levels, not the start of a reversal.

The fundamentals haven’t changed. Rate cuts are coming, geopolitical tensions remain elevated, and central bank buying continues. What’s changed is the price just became more attractive for anyone who missed the initial rally.

Friday’s Inflation Report Could Signal Fed’s Next Move

Economists expect September’s CPI to show 3.1% inflation annually — enough to keep the Fed on track for a quarter-point rate cut at next week’s meeting. After keeping rates locked at restrictive levels for months, the central bank is now in cutting mode.

That matters for gold. Lower rates reduce the opportunity cost of holding non-yielding assets, which is why precious metals typically thrive when the Fed pivots. The current pullback isn’t a break in the trend — it’s consolidation before the next leg higher, assuming the data cooperates.

One wrinkle: the ongoing government shutdown could complicate the release schedule, though the Bureau of Labor Statistics typically maintains critical functions during funding lapses. Traders are hitting pause until they see the numbers. While markets watch the Fed, Washington is recalibrating its trade strategy.

Rare Earths Are the New Oil — and the West Is Scrambling

China just turned rare-earth minerals into a geopolitical weapon. Its new export restrictions, timed with Washington’s escalating tariff threats, exposed how dangerously dependent Western manufacturing has become on Beijing’s control of elements most people have never heard of.

These metals are everywhere: electric vehicle motors, wind turbines, precision weapons, smartphones. Without them, modern industry stops. China dominates roughly 70% of global production and nearly 90% of refining.

Now, the scramble to break that stranglehold is on. Companies are pivoting to domestic mining, with some stocks surging 20% on announcements alone. However, Goldman Sachs warns that even fast-tracked U.S. facilities won’t be operational until 2028. That’s three more years of vulnerability while the West tries to rebuild supply chains it spent decades outsourcing.

Markets are betting resource nationalism isn’t temporary — it’s the new normal. If they’re right, rare earths join oil, semiconductors, and steel as commodities nations can’t afford to import. That protectionist stance, however, is already showing cracks…

Trump Admin Rolls Back Tariffs that Can’t Be Made in USA

Turns out you can’t grow bananas in Michigan. The Trump administration has carved out exemptions for goods that simply can’t be produced domestically — an implicit admission of the limits of its reshoring ambitions.

The zero-tariff list covers 45 categories, from coffee and cocoa to pineapples and select electronics. Agriculture Secretary Brooke Rollins said the move applies to goods the U.S. “lacks the climate or resources to produce at scale.” In other words, this is a concession to economic geography — and reality.

It’s also a quiet shift in strategy. After retail CEOs warned in April that tariffs would cause visible price spikes within weeks, the White House began tempering its approach. Some exemptions will be permanent for trade partners with existing deals; others, like electronics, are temporary while sector-specific levies are redesigned.

The takeaway isn’t about pineapples — it’s about policy physics. The original tariff blueprint assumed America could will self-sufficiency into existence. These rollbacks are a recognition that global supply chains aren’t easily undone.

For investors, it’s another reminder that inflationary pressure won’t fade quickly—and that assets insulated from political miscalculations, like gold, still serve a purpose when economic experiments hit their limits.