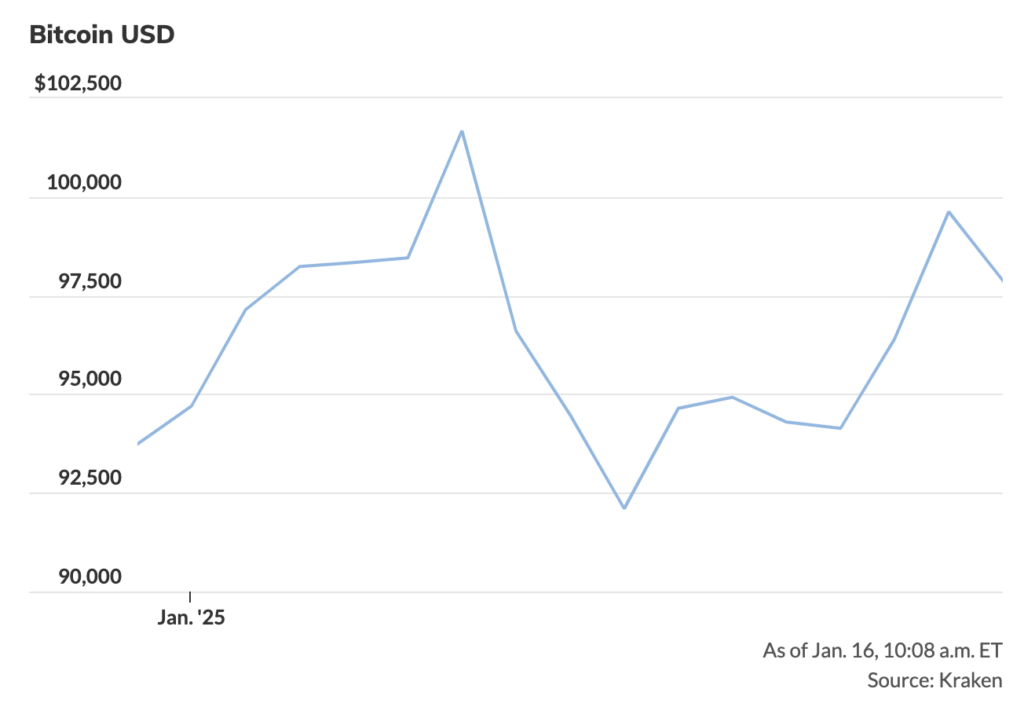

As both gold and bitcoin reach record highs in 2024, with bitcoin surpassing $100,000 and gold reaching nearly $2,800 per ounce.

Today a growing number of investment experts suggest including both assets in portfolios for enhanced diversification.

Gold, with its 5,000-year history, offers proven stability and acts as a hedge against dollar depreciation and geopolitical risks. Bitcoin, despite its higher volatility and shorter 15-year history, presents potential for exponential growth while moving more in sync with technology stocks.

Investment professionals suggest a conservative approach, with BlackRock recommending up to 2% bitcoin allocation in traditional portfolios, while gold might comprise up to 10%, reflecting the different risk profiles and market behaviors of these complementary assets.