Daily News Nuggets | Today’s top stories for gold and silver investors

February 10th, 2026 | Brandon Sauerwein, Editor

Safe Haven Demand Powers Precious Metals Rally

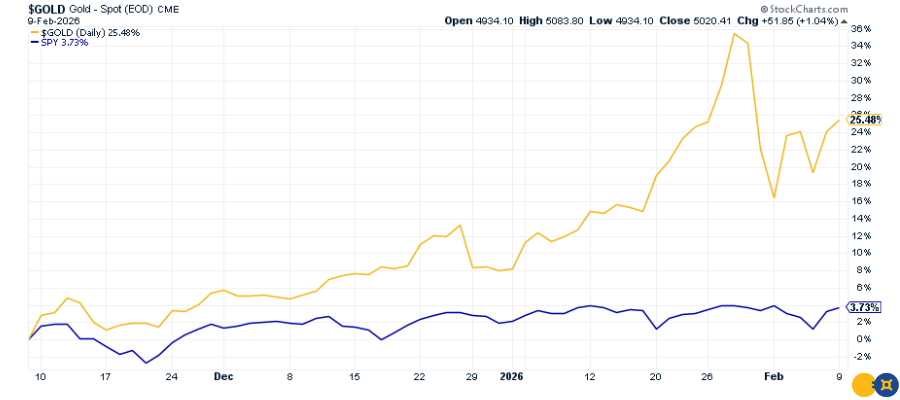

Gold has climbed back above $5,000 an ounce, extending an extraordinary rally that has pushed prices to record levels. The move follows a highly volatile stretch that included the metal’s largest weekly sell-off in decades, quickly followed by a sharp rebound as investors bought the dip.

Gold vs SPY Past Three Months

The resilience reflects growing safe-haven demand amid geopolitical tensions and rising economic uncertainty. A softer U.S. dollar has also helped, making gold more attractive to global buyers. Central bank activity remains a key support. China extended its gold-buying streak to a 15th consecutive month, signaling a broader push to diversify reserves away from dollar-heavy assets.

Markets are now focused on this week’s U.S. data, including inflation readings and January’s jobs report, which could reshape expectations for Fed rate cuts. For investors, the signal is clear: gold’s ability to hold elevated levels suggests markets are quietly pricing in policy risk, slower growth, and the possibility that financial conditions remain tighter for longer.

Stay Ahead with Gold & Silver News The most important market insights, Fed updates, and global trends — everything investors need to make smarter, safer decisions.

Silver Bounces Back: 7% Rally Sparks Bullish Calls

After a turbulent week, silver jumped about 7% on Monday, snapping a volatile stretch and reviving interest in precious metals after last week’s sharp swings. The move tracked strength in gold, as analysts said both metals could be setting up for another push toward, or beyond, recent highs.

The rally reflects a familiar mix of pressures. Investors are reacting to macro uncertainty, a weaker U.S. dollar, and ongoing concerns about inflation and slowing growth. Together, those forces tend to favor hard assets over risk-heavy trades.

Volatility remains elevated, and some models still point to potential pullbacks. Even so, many strategists now see silver’s rebound as part of a broader reset, not a short-lived bounce. Bullish forecasts are gaining traction as investors reassess silver’s dual role as an industrial input and a defensive asset in uncertain markets.

That renewed interest isn’t just showing up on trading desks — it’s also reshaping physical demand.

The Affordable Hedge: Buyers Pivot to Silver

In Pakistan, rising gold prices are pushing many buyers toward silver as a lower-cost way to participate in the precious-metals rally. With gold trading above $5,000 an ounce, entry costs have become prohibitive for many households, even as demand for hard assets remains strong.

Silver, which sells at a fraction of gold’s price, is gaining traction for both investment and jewellery. Local jewellers report increased interest in silver bars, while traditional gold purchases are becoming less common. For many buyers, silver offers a practical alternative when gold feels out of reach.

Gold still holds deep cultural importance, but affordability is reshaping behavior. Silver’s lower price point and recent strength are attracting new buyers, especially in a high-inflation environment. The shift reflects a broader global trend: rising costs are forcing consumers to seek value without abandoning financial protection.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Hidden Tax: How Tariffs Are Raising Consumer Costs

New research shows that broad U.S. import tariffs are quietly hitting household budgets. Analysts estimate the average American household paid about $1,000 in tariff-related costs in 2025, with that figure expected to rise toward $1,300 this year if current policies remain unchanged.

Tariffs on products ranging from electronics to automobiles function much like a consumer tax. While importers pay the levies at the border, most of the cost is passed along. A study from the Kiel Institute finds that Americans absorb roughly 96% of the total tariff burden, challenging claims that foreign exporters foot the bill.

The impact goes beyond trade. Higher import costs feed into everyday prices, adding friction to the inflation outlook. That pressure weighs on household spending at a time when consumers are already grappling with elevated living costs and tighter financial conditions.

China Quietly Pulls Back from U.S. Treasuries

China is reportedly accelerating a gradual move away from U.S. Treasuries, urging state-linked banks to reduce exposure to dollar-denominated debt. The guidance comes amid rising market volatility and heightened geopolitical risk.

Regulators have asked banks to limit new Treasury purchases and trim oversized positions. The effort is part of a broader push to diversify foreign-exchange reserves and reduce concentration risk. China’s Treasury holdings have declined for months and now sit well below prior peaks, signaling long-term caution toward heavy reliance on U.S. assets.

So far, global bond markets have remained calm. Yields and prices are still relatively stable, suggesting investors see the shift as manageable. That calm may prove misleading. Sustained foreign selling could lift U.S. yields and pressure the dollar, conditions that often support gold and other non-dollar assets.