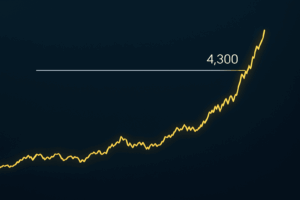

For almost a decade before the pandemic, Americans barely noticed inflation as prices rose so slowly. Now at 2.5% based on the Fed’s preferred PCE index (down from a 40-year high of 7.3% in 2022), some economists question whether returning to the 2% target is feasible or even desired by the Federal Reserve.

The economic landscape has fundamentally changed, with the Trump administration’s aggressive policies complicating the Fed’s inflation management. New tariffs and trade wars threaten to increase prices, while tax cuts and deregulation could stimulate the economy, driving up costs for scarce labor and resources. According to Steve Blitz, chief U.S. economist at TS Lombard, “All anyone has known for a generation is that inflation is 2%. That world is now behind us.”

If inflation remains above 2%, Americans would face significant economic changes: mortgage rates could stabilize around 6%, companies would have greater flexibility to raise prices rather than improve efficiency, and the government would face rapidly increasing interest payments on federal debt, potentially limiting spending on defense and entitlements.