Daily News Nuggets | Today’s top stories for gold and silver investors

October 23rd, 2025

Inflation Still Running Hot, But Fed Expected to Cut Anyway

Friday’s CPI report is likely to show inflation remains uncomfortably elevated, with core prices forecast to rise 0.3% in September and hold at 3.1% year-over-year — well above the Federal Reserve’s 2% target. That marks another month of stubborn price pressures that haven’t responded to higher rates as quickly as policymakers hoped.

Yet markets are pricing in a rate cut next week with near certainty. JPMorgan’s trading desk estimates a 65% chance stocks rally after the data regardless of the print. The rationale: investors believe slowing growth now trumps inflation concerns in the Fed’s decision-making.

That’s a risky bet. Cutting rates while inflation runs hot has historically fueled currency weakness and kept real yields compressed — conditions where gold has consistently outperformed as both an inflation hedge and portfolio insurance against policy mistakes.

Americans Aren’t Buying the “Inflation Is Fixed” Narrative

The White House may be ready to declare victory, but American consumers aren’t convinced. Everyday costs — groceries, insurance, housing — remain painfully high despite official assurances that inflation is under control. August’s CPI reading of 2.9% reversed months of cooling, a reminder that tariffs and supply-chain pressures are still working through the system.

When the gap between political messaging and lived experience widens, investor behavior shifts. People gravitate toward tangible stores of value — real estate, commodities, and precious metals — that can’t be devalued by central bank policy or political promises. That sentiment tends to outlast the headlines, keeping demand for inflation hedges resilient even as policymakers move on to the next crisis.

And those concerns may be more justified than headline GDP numbers suggest.

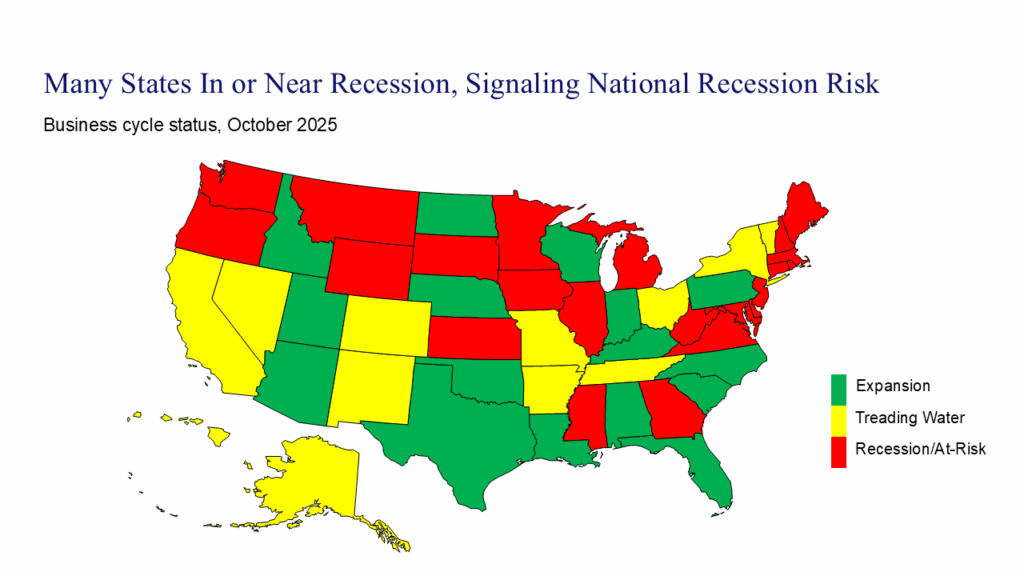

Nearly a Third of U.S. Economy Now at Recession Risk

The national GDP numbers look healthy, but zoom in and the picture fractures. Moody’s Analytics reports that 22 states and Washington, D.C. are currently in or near recession. That’s a jarring disconnect from the robust growth figures policymakers keep citing.

Chief economist Mark Zandi’s breakdown shows the damage isn’t confined to rural states. Texas continues expanding, but economic heavyweights like California and New York are barely treading water. More concerning: Michigan, an industrial bellwether, has deteriorated from stable to distressed in recent months, joining 21 other states showing serious strain.

Here’s why that matters: when a third of the economy is cracking while the S&P 500 sits near record highs, markets are likely underpricing downside risk. History shows this kind of fragmentation often precedes broader weakness—the kind that shows up in employment data and corporate earnings before Wall Street adjusts. That’s precisely when defensive assets like gold tend to validate their role as portfolio insurance.

And the risks don’t stop at state lines.

U.S. National Debt Crosses $38 Trillion

The U.S. national debt just breached $38 trillion — up $2 trillion since January alone. The latest trillion was added in roughly eight weeks, the fastest pace outside pandemic-era emergency spending. But unlike 2020, there’s no crisis to justify it. Just persistent deficits and an interest bill that now exceeds $1.2 trillion annually, consuming an ever-larger slice of federal revenue.

Wall Street is increasingly worried about the endgame. Sustained deficits of this magnitude can erode confidence in the dollar, especially if foreign creditors — already holding record Treasury positions — grow reluctant to finance America’s spending habit. When fiat currency credibility weakens, hard assets historically fill the void. Gold thrives in that environment precisely because it’s no one’s liability and can’t be printed away.

Combine persistent inflation, regional economic cracks, and runaway fiscal policy, and you have the kind of macro backdrop where precious metals aren’t just a hedge — they’re increasingly a core allocation.

J.P. Morgan Predicts Gold Above $5,000 by Late 2026

J.P. Morgan’s commodities desk just released one of the most bullish gold forecasts on record, projecting prices will average $5,055 per ounce by the end of 2026 — roughly 20% above current levels. The bank cites three converging forces: slowing global growth, a weakening dollar, and aggressive central bank accumulation, particularly from China and emerging markets racing to reduce dollar dependency.

Analysts are drawing parallels to the early 2000s, when similar conditions sparked a decade-long rally that saw gold surge from under $300 to over $1,900. The common thread: negative real interest rates, currency concerns, and geopolitical instability creating sustained demand for monetary alternatives.

If inflation stays elevated while the Fed pivots to rate cuts — compressing real yields further — gold isn’t just a tactical trade. It’s increasingly positioning itself as a structural portfolio holding for an era of fiscal excess and monetary uncertainty.