In a free-market economy, nearly any tangible asset can find a buyer—somewhere. But as a seller, your biggest concern is simple: will you get fair value? Or will you be forced to accept far less than your investment is worth?

This is where gold liquidity becomes crucial. It refers to how easily you can sell your gold at a widely recognized fair price on the open market. And when it comes to protecting your wealth, liquidity can make all the difference.

Understanding Liquid vs. Illiquid Investments

Gold and silver bullion are among the most liquid assets you can own. There’s a universally recognized pricing mechanism—called “spot price”—that all market participants can check at any time to determine current fair value. Whether you’re buying or selling, everyone’s working from the same baseline.

Compare that to highly illiquid markets, where buyers and sellers are few and far between. Think fine art, vintage baseball cards, or rare numismatic coins. Pricing is subjective, and there can be wild disagreement about what something is actually worth.

Why Gold Liquidity Matters More Than You Think

Liquidity is often an afterthought for investors, especially in precious metals. But it shouldn’t be.

The bullion market is well-defined and transparent. Gold and silver trade more like stocks—with daily, ongoing pricing—than like collectibles that depend on finding the right buyer at the right moment.

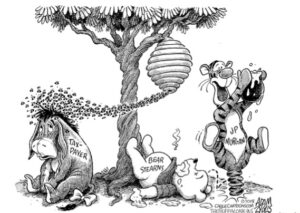

Take collectibles, for instance. These “numismatics” are worth whatever someone will pay for them based on perceived rarity and demand, which can be dramatically different from their metal content alone. Prices fluctuate wildly. Demand can evaporate overnight. And even when buyers exist, they’re a tiny fraction of the global bullion market. One person’s treasure really can be another’s trash.

Gold and silver bullion work differently. Their value is tied to the global spot price of unrefined metals—updated around the clock and accessible to anyone, anywhere.

Spot price (expressed per troy ounce) essentially puts a floor under every transaction. A dealer knows that worst case, if they can’t quickly find a buyer for a coin you’re selling, they can always sell it as scrap gold at spot minus melting costs.

This means when you sell a coin or bar, you should receive very close to the cash equivalent of spot, minus the dealer’s transaction fee.

Not All Gold Is Created Equal

Of course, not every gold coin or bar sells for exactly spot. Some fetch less, some more. Recognition matters enormously.

Legal-tender, government-minted coins like the American Eagle and Canadian Maple Leaf are globally recognized. Walk into a coin shop almost anywhere in the world, and you can sell them with relative ease.

Less popular coins — from mints in South Africa or China, for example — may be harder to move.

Sovereign-Minted Coins: The Premium Choice

Government coins carry “seigniorage” charges—fees the mint charges above the precious metal’s value. A new Silver Eagle, for instance, costs about $2 per coin at the mint. So the buy and sell prices for that coin (the “spread”) typically hover around spot plus seigniorage, or spot plus $2.

Some investors prefer sovereign coins because seigniorage tends to rise over time. If both metal prices and seigniorage increase together, you might gain a little extra on a long-term investment. Combined with superior recognition, favorable tax treatment in some jurisdictions, and better anti-counterfeiting measures, it’s why sovereign-minted bullion remains the world’s most popular choice.

Rounds and Private Bars: Lower Cost, Lower Recognition

Then there are rounds—coins from private, non-government mints—and privately minted bars. These typically contain the same precious metal weight as government-stamped products and can be a cost-effective accumulation strategy since they’re usually cheaper.

The tradeoff? They lack global recognition and won’t have as comprehensive a buyer’s market.

However, because of their lower cost and the melt-value floor that spot provides, rounds and bars often have smaller spreads and can be more profitable than sovereign bullion. This is why researching not just the purchase price, but also the ‘bid’ price you’d receive when selling, is essential. The tighter the spread, the better for your bottom line.

Avoid Commemoratives

One category to generally avoid: commemoratives or numismatic coins issued to mark specific events like the Olympics. These are often minted in “limited-edition” runs and promoted through expensive campaigns, allowing vendors to charge higher premiums for their perceived scarcity.

This makes them more collectible than investment-grade. Buyers who want them are building collections, while generic buyers seeking simply an ounce of metal won’t pay the premium. They’re harder to sell.

Common or generic rounds minted continually in standard formats are much easier to sell. If you walk into a coin shop with a round, the owner may or may not want it—or may pay less than melt value. But they’ll always welcome an Eagle or Maple Leaf.

This is why government-minted coins are the most liquid, most widely traded bullion. It’s a key reason they command a premium.

What Really Matters When Buying Gold?

If you need cash quickly, a buyer may hesitate with a less common round and offer far less than you believe it’s worth. Your market options become limited.

Still, thanks to the global liquidity of precious metals, there’s always a market for virtually any pure gold or silver coin, round, or bar.

What matters most? Don’t overpay relative to what an asset will likely sell for down the road.

Mind the spread—it’s the real measure of gold liquidity and your investment’s true efficiency.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

People Also Ask

What does liquidity mean when investing in gold?

Liquidity refers to how easily you can sell your gold at a fair, widely recognized price. Gold bullion is highly liquid because it trades based on the global spot price, which is updated continuously and accessible to all buyers and sellers. This means you can typically sell your gold quickly without having to accept a price far below its actual value.

Which gold coins are easiest to sell?

Government-minted coins like American Eagles and Canadian Maple Leafs are the easiest to sell because they’re globally recognized and accepted by dealers worldwide. These sovereign coins offer the best liquidity since any coin shop will readily buy them at prices close to spot, whereas private rounds or less common coins may be harder to sell or command lower offers.

Can I sell my gold for the spot price?

You can sell gold for very close to spot price, minus the dealer’s transaction fee or “spread.” The spot price acts as a floor for transactions because dealers know they can always melt coins for their metal content if they can’t find a buyer. Government-minted coins typically sell closest to spot, while commemoratives or rare collectibles may receive lower offers.

What’s the difference between gold bullion and numismatic coins?

Gold bullion is valued primarily for its metal content and trades based on the current spot price, making it highly liquid and easy to sell. Numismatic or collectible coins are valued for their rarity, condition, and collector demand rather than just metal content, which makes them much harder to sell and subject to wildly varying prices depending on finding the right buyer.

Should I buy gold rounds or government-minted coins?

Government-minted coins offer superior liquidity and global recognition but cost more upfront due to seigniorage fees. Private rounds and bars are cheaper to buy and often have tighter spreads (the difference between buy and sell prices), which can make them more profitable—but they’re harder to sell. For most investors, GoldSilver recommends a balanced approach prioritizing liquidity and recognized products.