For years, Mike Maloney has turned down speaking engagements and group events, preferring to focus on research and creating educational content for the GoldSilver community.

But now, he’s making an exception.

Mike will spend an entire week aboard a luxury cruise ship at the Investor Summit at Sea, working directly with a small group of investors. This isn’t your typical conference where speakers disappear after their presentation. Instead, you’ll share meals with Mike, attend intimate workshops, and have those impromptu deck conversations where the real insights happen.

An All-Star Lineup

Mike won’t be alone. He’ll be joined by:

- Robert Kiyosaki (Rich Dad Poor Dad)

- Peter Schiff (Euro Pacific Capital)

- Plus many more renowned economic experts

Together, they’ll break down what’s really happening in the markets, where we’re headed, and most importantly — how to protect and grow your wealth in these uncertain times.

If you’ve ever wanted to ask Mike your burning questions about precious metals, economic cycles, or investment strategies — this is your chance.

Wait! Don't Forget Your Free Book

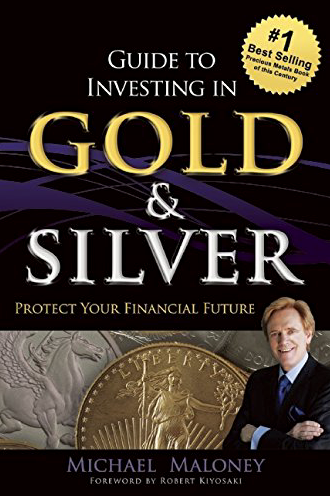

Mike Maloney's #1 all-time bestselling investment guide.