Silver Price Chart

Stay up to date with real-time silver spot prices, available in troy ounces (oz), kilos and grams.

Home / Price Charts / Silver Price Charts

Silver Live Price

Gold Price

Gold/Silver Ratio

Explore ourSilver Products

Calculated Return on Silver Investment

Select Your Metal

Investment Amount

Time

Invested Amount

$ 0

Gain/Loss

$ 0

$ 0

$ 0

$ 0

Total Return

0

$ 0

$ 0

$ 0

Frequently Asked Questions

Why is silver often more volatile than gold?

Silver’s price tends to be more volatile than gold due to its dual nature as both an industrial metal and a precious metal. About half of silver demand comes from industrial applications, making it more sensitive to economic cycles. During economic expansions, industrial demand can drive silver prices higher, while during downturns, prices may fall more sharply than gold.

What are the main industrial uses of silver, and how do they impact its price?

Silver has numerous industrial applications, including in electronics, solar panels, and medical devices. These uses account for a significant portion of silver demand.

As technological advancements increase the need for silver in various industries, this can drive up prices. Conversely, economic slowdowns that reduce industrial production can negatively impact silver prices.

How does silver perform as an inflation hedge compared to gold?

While both silver and gold are considered hedges against inflation, silver’s performance can differ from gold’s performance. Silver tends to be more volatile and may offer higher potential returns during inflationary periods, but it also carries more risk.

Some investors view silver as a leveraged play on gold, potentially offering greater percentage gains (and losses) during times of economic uncertainty or inflation.

What Is the Silver Spot Price?

”Spot” is the underlying price for one ounce of silver in most financial and commercial markets. In most parts of the world the silver price per ounce is quoted in US dollars.

The silver spot price is based on trading activity predominantly in ‘futures’ markets, where major producers, refiners, financial companies, and speculators set the prices for future deliveries of metal. It constantly fluctuates during market hours, depending on the activity of buyers and sellers. While trading of physical metal occurs on most exchanges, those trades are primarily used to hedge positions and as such are a derivative of futures, and thus have minimal impact on setting the price.

Silver trades around the world and around the clock. It trades from 6pm eastern to 5:15pm eastern, Sunday through Friday. In the US, the price is set at the COMEX exchange.

The London market also provides a silver “fix” price once per day (on business/trading days). The fix price is used to price contracts by institutions, producers, and other large market participants. Retail customers like you and I do not usually buy and sell based on the fix price, but on the spot price.

What Factors Impact the Silver Price?

Ordinary buying, selling, and speculating typically make for daily fluctuations you see to the spot price of silver.

Other factors, both direct and indirect, impact the price, too. The primary sources of demand are industrial use (56%), jewelry and silverware (33%), and investment (11%), all of which can influence the silver price positively or negatively.

Since silver is a form of money (though it does not circulate as currency), indirect factors can also impact its price, such as the performance of the US dollar, commodities, interest rates, inflation, and stock markets.

It is also important to note that the silver market is tiny in comparison to most other markets. The price can thus be more easily impacted by small amounts of buying and selling.

What Is the Current Silver Price?

The top of this page displays the silver price, where you can watch its daily movements. You can also check historical prices, and our interactive chart shows how it’s performing in relation to other assets.

What Is the Silver Price In My Currency?

Since silver is globally priced in US dollars, the spot price is the same in all markets. Traders and investors in non-US countries convert the US price to their local currency to reflect its value in their unit of currency.

If a currency experiences a big move relative to the US dollar, the silver price in that currency can be significantly different than the US price. In 2014, for example, the silver price rose in many developed countries, but fell in US dollars.

What Gives Silver Value?

Silver has intrinsic value for three reasons.

First, it is a rare, naturally occurring hard asset, a tangible investment you can hold in your hand that cannot be synthesized or made in a lab. How many investments do you own that you can say that about?

Second, silver has value because it is one of the most versatile metals for industrial use. It has literally thousands of applications to a wide variety of industries, from electronics and medicine to batteries and solar panels and electric vehicles. And more uses for silver are discovered regularly.

Third and most important, silver is a monetary metal, meaning it is a form of money. In fact, silver has even been used as actual currency more often than gold. Silver can’t be diluted like paper currencies, so the more currency creation governments take on, the more valuable silver becomes. This is one of the strongest reasons for an investor to buy silver.

Why Is the Silver Spot Price Important?

The spot price of silver is the basis for all transactions in the market. Buying is based on the “ask” price, and selling is based on the “bid” price.

If you’re a buyer, you naturally want to see a low spot price. And when you someday sell, you’ll want a high spot price.

As noted above, a major distinction of the silver market is that the price can be volatile. The silver industry is tiny, so the price can see large fluctuations. It is not unusual to see the silver spot price move two or three times greater than the gold spot price.

Can I Buy Silver at the Spot Price?

No. The spot price is for “unfabricated” metal.

If you want to buy a silver product, a premium is added to the spot price, which varies depending on the type of product.

How Much Does Silver Cost?

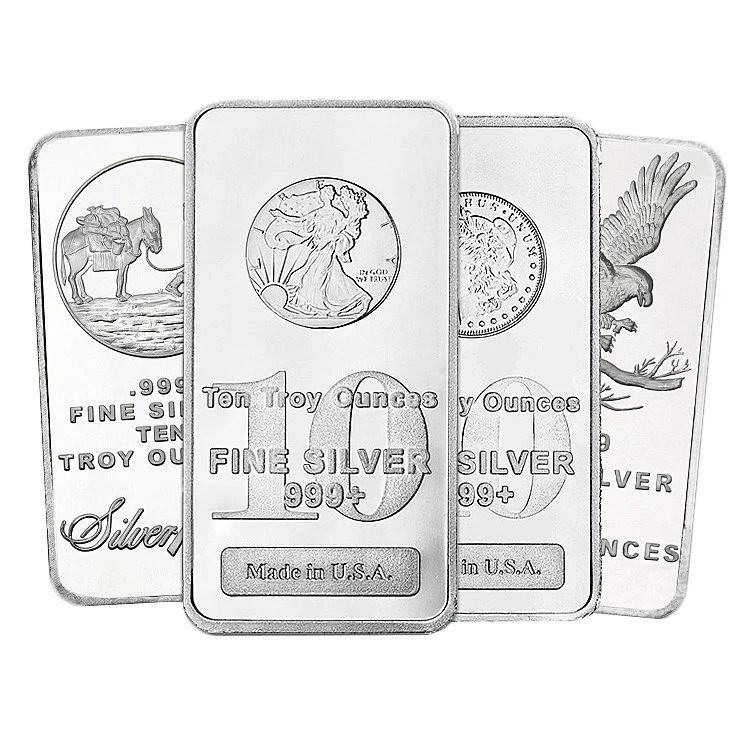

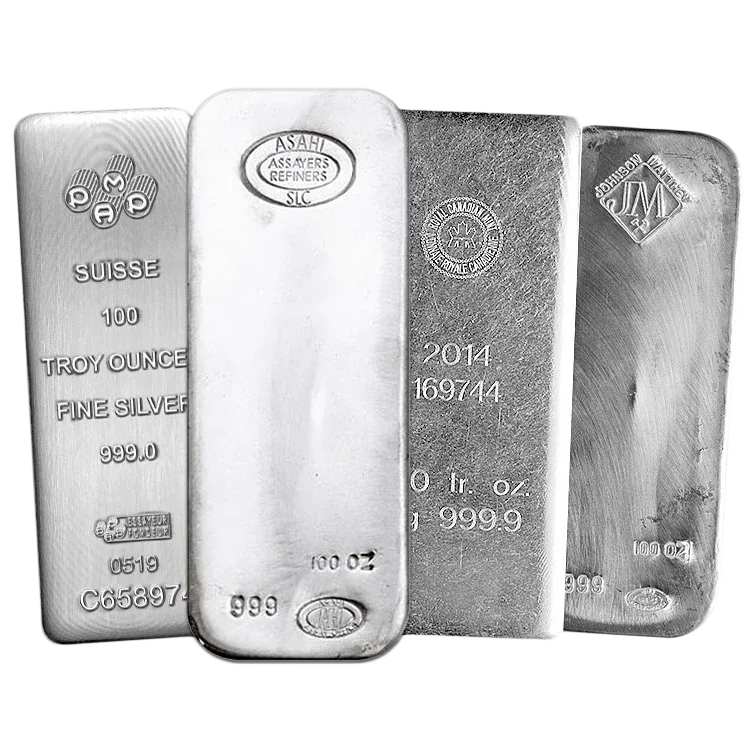

It depends on the form you buy. The lowest premium items are silver bars. Slightly higher premiums are charged for silver coins, since they entail more intricate refining. Silver jewelry is rarely of bullion purity (.999%), and as such is not considered “investment” grade.

Silver premiums are typically higher than gold premiums. This is because it costs just as much to manufacture and refine a silver coin as a gold one, and yet it sells for a much lower price.

News and Updates on Gold Market

The History of Currency Debasement: What Rome Teaches Us About Money Today

From ancient Rome to Nixon’s 1971 gold shock, the history of currency debasement follows a predictable pattern. Understanding it is one of the most valuable things a long-term investor can do.

Silver Bars vs. Silver Coins: Which Is the Better Investment?

Silver bars or coins — it’s one of the first decisions every silver investor faces. This guide breaks down premiums, liquidity, storage, and volatility so you can choose the right form of silver for your portfolio and investment goals.

Gold Price Today: Why This Week’s News May Be Bullish for Gold

Oil topped $100 a barrel for the first time since 2022. The U.S. shed 92,000 jobs in February. And the Fed meets in nine days. Gold is caught in the crossfire — but the forces driving today’s dip may be building tomorrow’s case for precious metals.