Daily News Nuggets | Today’s top stories for gold and silver investors

December 19th, 2025

Gold and Silver on Track for Record-Breaking Year

Gold is on track to close 2025 with a 60%+ surge and more than 50 all-time highs — making it the strongest year since 1979. Silver has been even more explosive, doubling in price to record highs above $66 per ounce.

What’s fueling the rally? Record central bank buying — exceeding 1,000 tonnes for the third straight year. Investors have piled back into ETFs after three years of outflows. Trade tensions under Trump, sticky inflation, and a weakening dollar have turbocharged safe-haven demand. Silver’s industrial uses in solar panels and electronics added fuel, with supply constraints amplifying gains.

For investors watching inflation and geopolitical risk, precious metals are delivering a masterclass in crisis hedging.

Wall Street is taking notice — and raising price targets.

JP Morgan Sees Gold Breaking $5,000 by Late 2026

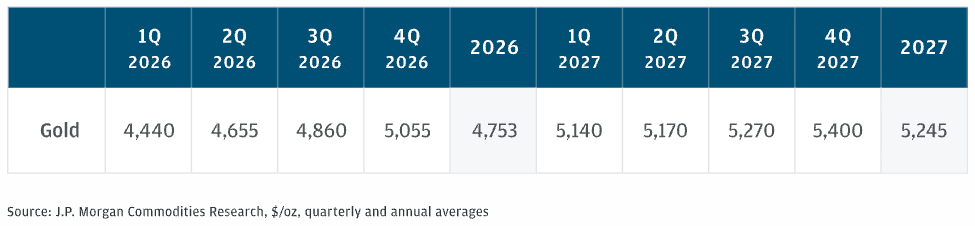

JP Morgan just put out a bold call: gold could hit $5,055 by the end of 2026 and climb toward $5,400 by late 2027. That’s another 25% upside from today’s levels.

JP Morgan’s Gold Price Forecasts

The drivers? Central banks aren’t slowing down. They’re expected to buy around 900 tonnes this year alone — part of a bigger trend of countries diversifying away from U.S. dollar reserves. Meanwhile, investor appetite is heating up. ETF inflows already hit 310 tonnes year-to-date, and analysts say there’s plenty of room left to run.

“We remain deeply convinced of a continued structural bull case for gold,” says Natasha Kaneva, JP Morgan’s head of Global Commodities Strategy.

For investors navigating tariff chaos, geopolitical tensions, and stubborn inflation, gold just got one of the strongest endorsements on Wall Street.

World Gold Council Maps Three Paths for 2026

After gold’s blistering 2025, the World Gold Council sees three distinct scenarios ahead.

The baseline: rangebound trading if current conditions hold. The moderate case: 5-15% gains in a slowdown. The bullish case: a 15-30% surge if global risks escalate.

The WGC warns that softer growth, accommodative policy, and persistent geopolitical risks are more likely to support gold than undermine it. But there’s a bearish scenario too. If Trump’s reflation policies succeed in driving stronger growth, gold could correct 5-20% as higher yields and a stronger dollar weigh on the metal.

Central bank demand and recycling flows remain wildcards that could swing prices either way. The message? 2026 will likely bring volatility — and gold’s role as a portfolio hedge remains front and center. Listen to the full analysis on the Unearthed Podcast.

One key variable that could swing gold either way: inflation.

Trump Team Touts Lower Inflation — Economists Urge Caution

The White House celebrated November’s inflation reading of 2.7% — well below the 3.1% forecast. Press secretary Karoline Leavitt promised “lower prices and bigger paychecks” ahead.

But December’s data told a different story. Inflation ticked back up to 2.9%, extending a recent uptick that’s kept the Fed cautious about further rate cuts.

Economists warn that prices are still rising — just at a slower pace. They remain above the Fed’s 2% target. Core inflation (stripping out volatile food and energy) came in slightly lower than expected, offering some relief.

The mixed signals matter. They could delay rate cuts investors have been counting on. Higher-for-longer rates typically pressure risk assets while supporting the dollar.

But how reliable is the data the White House is celebrating?

Economists Question “Too Good to Be True” Inflation Data

November’s inflation report looked like a gift. Headline CPI came in at 2.7% and core at 2.6% — both well below forecasts. Markets rallied. But many economists aren’t buying it.

Here’s why. The government shutdown wiped out October’s data. That forced the Bureau of Labor Statistics to make “methodological assumptions” that weren’t clearly explained.

“The BLS might have carried forward prices in some categories, effectively assuming 0% inflation,” said Michael Gapen, chief U.S. economist at Morgan Stanley. Housing costs looked especially odd, with rent gains that don’t align with real-world trends.

Stephanie Roth of Wolfe Research warned the Fed will “put less weight on this reading” due to “technical quirks.” Wells Fargo expects “a bounce back in prices in the December CPI report” — which could remind investors why the Fed has been so cautious about cutting rates.