For many investors, comparing gold vs cash feels like a simple choice between safety and opportunity. Cash is familiar, it’s liquid, and it seems like the smart place to wait out uncertainty. But in an inflationary world — and especially in the economic landscape we’re entering — cash comes with a cost most people never see.

In fact, the “safest” asset in your portfolio may be quietly eroding your wealth every single year.

This guide breaks down why cash loses purchasing power, how inflation alters long-term returns, and why gold has historically been one of the most reliable tools for preserving real wealth.

The Illusion of Safety: Why Cash Isn’t What It Used to Be

Cash feels stable because the number in your bank account doesn’t change. But what that money can buy absolutely does.

Inflation isn’t always dramatic — sometimes it’s slow and quiet — but over time, its impact is devastating. (See current U.S. inflation data from the Bureau of Labor Statistics). Even “moderate” inflation, say 3% annually, cuts your purchasing power in half over 24 years.

To put that in perspective:

- $100,000 saved in cash today loses roughly $3,000 in real value every year

- At a 7% inflation rate (which we’ve seen in recent years), purchasing power is cut in half in just 10 years

- A retiree who keeps a large cash cushion may lose tens of thousands of dollars without ever spending a dime

The dollar doesn’t collapse all at once — it wears down through slow, persistent erosion.

Gold, on the other hand, historically moves in the opposite direction.

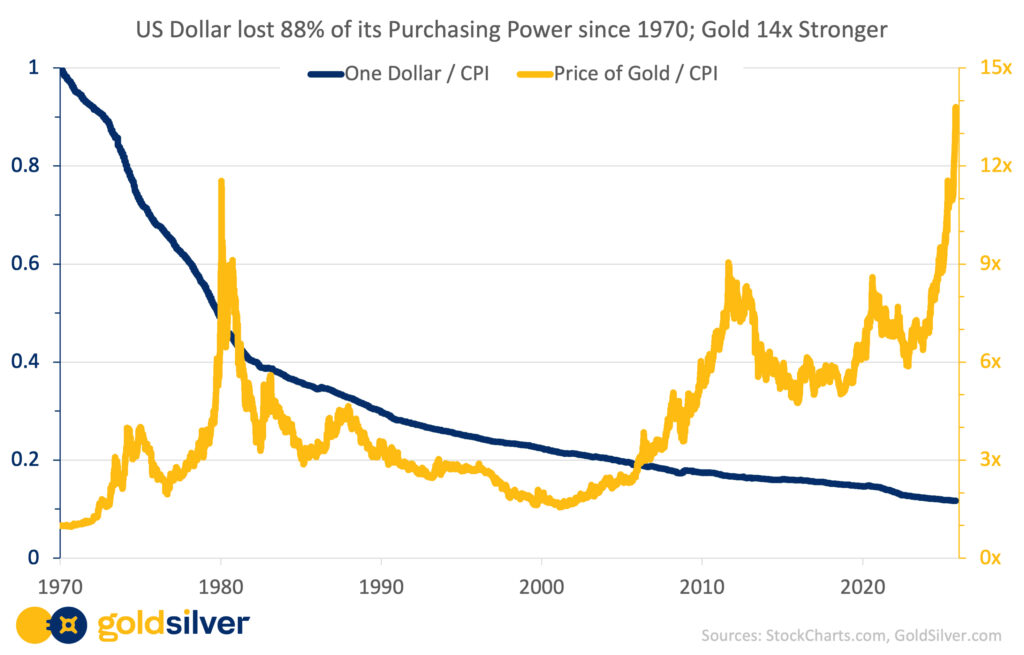

A 50-Year View: Cash Down, Gold Up

If you compare gold vs cash over any long time period, the pattern is unmistakable:

The U.S. dollar has lost nearly 90% of its purchasing power since the early 1970s.

Meanwhile…

Gold has risen more than 5,000% over the same period.

This doesn’t mean gold is “better” in every market condition — or that you should abandon cash entirely. Instead, it underscores a simple truth:

Gold preserves what inflation destroys.

Every era of rising inflation — from the 1970s to the post-2019 period — has seen gold outperform cash dramatically. Not because gold becomes more valuable, but because the dollar becomes weaker.

Why Cash Burns Value in an Inflationary Environment

Three forces work against cash holders:

1. Inflation Reduces Real Returns

Even high-yield savings or money market accounts rarely beat inflation over time.

A 5% savings account with 6% inflation is still a negative real return.

2. Currency Dilution

When governments borrow and print aggressively, like they have been for years, the supply of dollars increases — and each dollar becomes worth less.

3. Zero Hedge Against Systemic Risk

Geopolitical shocks, financial crises, and monetary instability don’t make cash more valuable — they typically make it less.

This is why long-term savers, retirees, and conservative investors are often hit hardest.

Why Gold Holds Its Value

Gold isn’t a promise from a bank or a government. It’s a tangible monetary asset with:

- Scarce supply

- Global acceptance

- No counterparty risk

- A 5,000-year track record

Gold doesn’t depend on a CEO, a quarterly earnings report, or a central bank policy decision. It simply holds value — especially when currencies don’t.

Historically, gold has shown:

- Low correlation to stocks and bonds

- Strong performance in inflationary periods

- Stability during systemic risk

- Resilience when real interest rates fall

In other words, gold tends to shine the brightest when currencies — including the U.S. dollar — lose ground.

To learn more about all of the properties of money, check out Alan Hibbard’s new Hidden Secrets of Value series, where he details all 12 of the essential properties of money.

Real-World Example: A Cart Full of Groceries

Imagine you walk into a store with $20 in 1990. You could fill a basket.

Walk in with $20 today? Maybe two or three items.

Now imagine instead that you stored the value of that $20 in gold.

You would have preserved nearly the same purchasing power for 30 years.

That’s the essence of gold’s role: it’s not about getting rich — it’s about not getting poorer.

Why More Investors Are Shifting Out of Cash Today

- High inflation.

- Rising government debt.

- Uncertain monetary policy.

- Geopolitical volatility.

- A weakening dollar trend.

This combination has pushed investors — especially those nearing retirement — to rethink how much cash they hold. Cash is necessary for flexibility, emergencies, and opportunity — but as a long-term store of value, it is historically one of the weakest options.

Gold plays the opposite role: insurance for purchasing power, designed to hold value through decades of change.

So What’s the Right Balance?

There’s no single answer for every investor. Most financial professionals position gold as part of a diversified strategy — not a replacement for cash, but a counterweight to inflation and monetary risk.

The key is recognizing that:

- Cash is for liquidity.

- Gold is for longevity.

If you want your money to remain useful 10, 20, or 30 years from now, history strongly suggests you need more than dollars working for you.

In an Inflationary World, Holding Only Cash Is the Real Risk

Over any long period of time, inflation punishes cash savers — and rewards those who hold assets that can’t be printed or diluted.

Gold has proven, for centuries, to be one of the most reliable answers to that problem.

It’s not speculation.

It’s not hype.

It’s simply math, history, and monetary reality.

If your goal is to preserve your hard-earned purchasing power — for yourself, your family, and your future — gold remains one of the few assets built to do exactly that.

People Also Ask

Is gold better than cash during inflation?

Yes. Gold has historically held its purchasing power during inflation, while cash loses value as prices rise. That’s why many investors use gold as a long-term inflation hedge. You can explore how gold performs in different environments in Hidden Secrets of Value Episode 2: Money vs Currency.

Does cash lose value over time?

Yes. Even low inflation reduces the real value of cash year after year, meaning your dollars buy less over time. This erosion is why many savers diversify into assets like gold that maintain value.

Why do investors choose gold instead of holding dollars?

Investors turn to gold because it’s a scarce, globally recognized asset that historically performs well when the dollar weakens. Gold has no counterparty risk and protects wealth during inflation or financial stress.

Is it risky to keep too much cash in savings?

Holding cash isn’t risky in terms of volatility, but it is risky in terms of purchasing power. Inflation quietly reduces what your savings can buy, especially over long periods.

Should retirees hold gold instead of cash?

Retirees often hold some cash for liquidity but use gold to preserve long-term value and protect against inflation. Gold can help offset the purchasing-power loss that fixed-income retirees face. Learn how retirees use precious metals through a Gold IRA at GoldSilver.

Get Gold & Silver Insights Direct to Your Inbox

Join thousands of smart investors who receive expert analysis, market updates, and exclusive deals every week.

Note: This article is provided for informational purposes only and should not be considered investment advice. Past performance is not indicative of future results. Always conduct thorough research or consult with qualified financial professionals before making investment decisions.