![]() Silver Rises Over 120% YTD Invest Now

Silver Rises Over 120% YTD Invest Now ![]()

Price: $0 - $1,00,000

$5000

Metal Type: 1

Product Type : 1

$15000

Metal Type: 2

Product Type : 2

Home / Silver

Showing all 15 resultsSorted by price: low to high

1 oz

2

As Low As: $90.39

39

1

Learn More Invest Now

1 oz

2

As Low As: $92.58

20

3

1 oz

2

As Low As: $93.29

11

1

1 oz

2

As Low As: $93.74

22

3

1 oz

2

As Low As: $94.75

10

3

Learn More Invest Now

1 oz

2

As Low As: $94.83

21

3

1 oz

2

As Low As: $94.85

33

3

1 oz

2

As Low As: $96.61

21

3

1 oz

2

As Low As: $99.72

37

3

10 oz

2

As Low As: $919.85

6

1

32.15 oz

2

As Low As: $3005.5

19

1

71.5 oz

2

As Low As: $6367.4

17

3

Learn More Invest Now

100 oz

2

As Low As: $9138.34

30

1

500 oz

2

As Low As: $48871.8

17

3

500 oz

2

As Low As: $52093.1

28

3

0.01 oz

1

As Low As: $53.32

40

1

Learn More Invest Now

1 oz

2

As Low As: $90.39

39

1

Learn More Invest Now

1 oz

2

As Low As: $92.58

20

3

1 oz

2

As Low As: $93.29

11

1

1 oz

2

As Low As: $93.74

22

3

1 oz

2

As Low As: $94.75

10

3

Learn More Invest Now

1 oz

2

As Low As: $94.83

21

3

1 oz

2

As Low As: $94.85

33

3

1 oz

2

As Low As: $96.61

21

3

1 oz

2

As Low As: $99.72

37

3

0.1 oz

1

As Low As: $599.02

27

3

0.1 oz

1

As Low As: $605.07

28

3

10 oz

2

As Low As: $919.85

6

1

0.25 oz

1

As Low As: $1038.03

25

3

Learn More Invest Now

0.25 oz

1

As Low As: $1409.82

23

3

0.5 oz

1

As Low As: $2797.41

24

3

0.5 oz

1

As Low As: $2825.32

23

3

Learn More Invest Now

32.15 oz

2

As Low As: $3005.5

19

1

1 oz

1

As Low As: $5298.25

24

3

1 oz

1

As Low As: $5311.54

6

3

Learn More Invest Now

1 oz

1

As Low As: $5316.43

8

3

1 oz

1

As Low As: $5316.83

9

3

1 oz

1

As Low As: $5324.51

31

1

1 oz

1

As Low As: $5372.99

34

3

1 oz

1

As Low As: $5460.45

32

3

1 oz

1

As Low As: $5479.96

38

3

71.5 oz

2

As Low As: $6367.4

17

3

Learn More Invest Now

100 oz

2

As Low As: $9138.34

30

1

500 oz

2

As Low As: $48871.8

17

3

500 oz

2

As Low As: $52093.1

28

3

10 oz

1

As Low As: $53211.3

29

1

32.15 oz

1

As Low As: $169783.14

18

1

Learn More Invest NowBuying silver bullion online is convenient, easy, and can be done 24/7. Purchasing online allows you to browse our entire selection of silver products, compare prices and premiums, and order when you want. We offer free, discreet, and secure shipping on orders over $500. We pride ourselves on offering investors the ability to shop safely, securely, and privately from anywhere in the world. Since 2005, GoldSilver has been one of the most trusted online silver bullion dealers in the world.

Our curated selection of silver coins, silver bars, and silver rounds offer investors low premiums and great opportunity for economic growth. Our team of precious metals experts boasts some of the most recognized names in the industry, including our founder, Mike Maloney, and senior precious metals analyst Jeff Clark. We believe owning silver is imperative to a well rounded portfolio, and our mission is to get precious metals into the hands of as many people as possible.

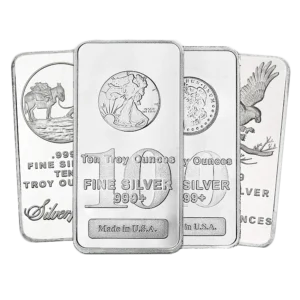

Some of the most popular silver coins we offer are:

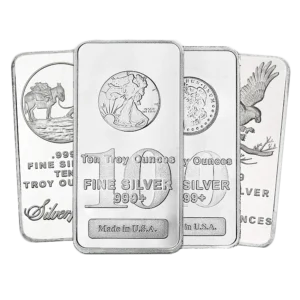

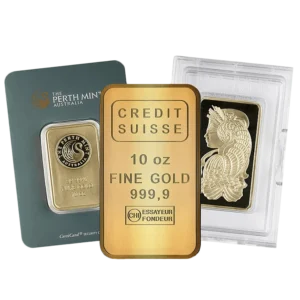

And our best-selling silver bars include:

For millennia, silver in the form of coins, bars, and rounds has been used as currency all around the world. Silver is tangible, finite, portable, and divisible, making it an ideal form of money that can hold its’ value over time. It has strong industrial uses and often outperforms gold in bull markets. For these reasons and many more, we believe silver may be the best investment opportunity of our times.

Still not convinced? Read our Top 10 Reasons to Own Silver.

Unlike many other online bullion dealers who market and sell thousands of silver items, GoldSilver carefully curates a catalog of bullion products that we believe represent the best opportunities for discerning investors.

We offer silver coins and bars from the following government (sovereign) mints:

As well as silver bars, coins, and rounds from the following private mints:

Many U.S. investors choose to purchase precious metals in Individual Retirement Accounts (IRA), because of their tax-free or tax-deferred status. Using a simple “self-directed” IRA, you can invest in true physical gold and silver and still enjoy these tax benefits.

Don’t already have a metals-ready IRA? You can open one just 5 minutes and choose tax-deferred or tax-exempt investing accounts. Read more

There is no safer way to store your silver than professional vault storage. Home storage risks your safety as well as your investments. Find peace of mind with 24/7 security at the world’s most secure, commercial, non-bank vaults. We’ve partnered with Brinks to offer secure storage vaults nearby and around the world, including:

Silver investments in storage can be sold with a few clicks, and funds available to trade again quickly.

Interested in vault storage? Learn more about our allocated and segregated secure vault storage programs.

The price of silver fluctuates constantly in the markets. This can make pricing somewhat challenging for many dealers. But we’ve created a strategy that updates the prices of our products in real time in accordance with the spot price of silver at the time of purchase. We also have a price match guarantee to match the advertised price of any of our products on the sites of our top competitors.

To learn more about how you can always get the best price on silver bullion from GoldSilver, read about our price match guarantee.

GoldSilver will buy back most bullion products, whether you bought them from us or elsewhere, with competitive prices and an easy-to-use online sales portal — by mail or from storage. If you decide to sell some of your precious metals holdings, you have a ready buyer on standby.

Read more about our sell-back policy, request a quote for your precious metals, or find out why our sell-back policy and storage program are a match made in heaven.

At GoldSilver, we pride ourselves on offering investors a world-class education, an investor-friendly product catalog, and a uniquely secure and flexible storage program.

Our educational videos have generated tens of millions of views on YouTube. Our founder, Mike Maloney, is the best-selling author of Guide to Investing in Gold & Silver, the most popular book ever on precious metals investing.

Our catalog is focused on physical precious metals products with the most competitive premiums, as we believe those products allow investors to get maximum exposure to gold & silver and increase potential profits by saving on costs.

And our unique storage program offers allocated and segregated storage options, at your choice of global vaults, with rapid liquidity.

Together, we believe these features offer an unmatched experience for precious metals investors.

But, don’t take our word for it. See what our investors are saying about us: read our testimonials.

Samantha is wonderful. I was nervous about spending a chunk of money. I asked her to `hold my hand’ and walk me through making my purchase.

She laughed and guided me through, step by step. She was so helpful in explaining everything...

Travis was amazing! I was having difficulty with a wire transfer of my life’s savings, and I was very worried that I might not be able to receive it all. My husband just passed away and I’ve been worried about these funds along with grieving for 8 months. As soon as I got connected with Travis, my concerns were immediately addressed and he put me at ease. The issue was resolved within days. He even called me back with updates to keep me in the loop about what was going on with the funds. I am so grateful for a customer representative like Travis. He really cares for his clients.

Sam was also very helpful! I called and was connected to Sam within 30 seconds. She helped me with a fee that was charged to my account. She had a great attitude and took care of the fee quickly.

Outstanding quality and customer service. I first discovered Mike Maloney through his “Secrets of Money” video series. It was an excellent precious metals education. I was a financial advisor and it really helped me learn more about wealth protection. I used this knowledge to help protect my clients retirements. I purchase my precious metals through goldsilver.com. It is easy, fast and convenient. I also invested my IRA’s and utilize their excellent storage options. Bottom line, Mike and his team have earned my trust. I continue to invest in wealth protection and my own education. I give back and help others see the opportunities to invest in precious metals. Thank you.