Brandon Sauerwein, Editor

History may not repeat itself exactly, but it often rhymes — especially in the gold market.

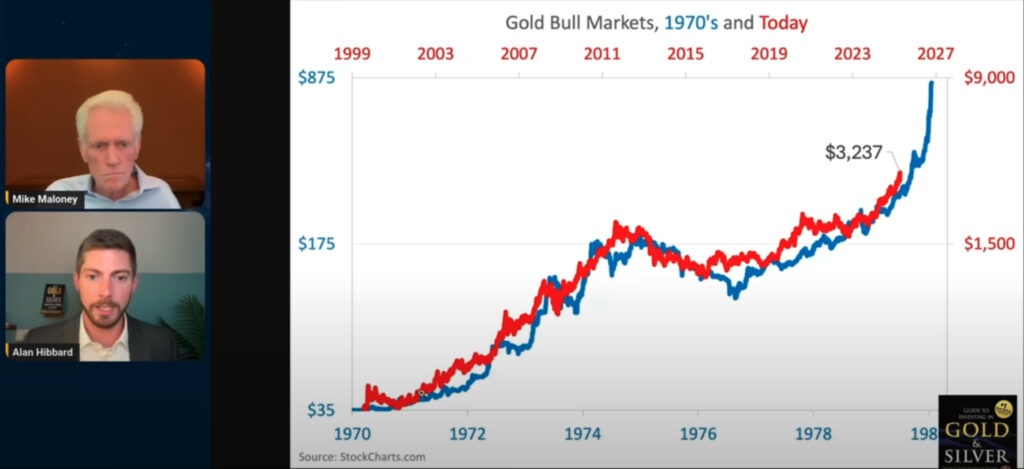

There are some uncanny similarity between today’s gold market and the legendary 1970s bull run. When adjusted for scale, the patterns align almost perfectly, hinting that we could be on the brink of a powerful surge that outpaces anything we’ve seen before.

But there’s a crucial difference this time: gold is rising while currencies are losing value.

Mike and Alan dive deep into what this means for precious metals investors — and why this moment could be historic.

Why This Gold Bull Market Could Outperform the 1970s

Alan Hibbard uncovered a striking chart overlaying today’s gold price with the iconic 1970s rally — and the pattern lines up almost perfectly. If history continues to rhyme, we may be on the brink of a historic surge that sends gold soaring to $9,000 per ounce.

What’s different this time? Instead of a crash or bubble burst, we could see a full monetary system reset that keeps gold at unprecedented highs.

The Hidden Truth About U.S. Housing Costs —

And Why Gold Is Your Best Defense

Mortgage rates are volatile. Home prices sit at historic highs. And inflation devours your savings daily. If homeownership feels impossibly expensive, you’re not alone. But here’s what they’re not telling you:

When measured in gold instead of dollars, monthly mortgage payments have actually decreased over time.

That’s right. While dollar prices explode, the real cost of housing — measured in sound money — has fallen.

Recent Articles

- Silver Market Outlook: Price Surge to $40 in 2025?

- Gold Spot Price Explained: Why It Changes Every 15 Seconds

- Ray Dalio: Put 15% in Gold or Bitcoin — Here’s Why

Market Pulse: This Week in the News

📊 Metals Price Update

- Gold prices are at $3,365/oz — up 28.2% YTD

- Silver is at $37,86/oz — up 30.9% YTD

If they keep this pace? Their annualized returns would be approximately:

- Gold: 51.6%

- Silver: 57.0%

🔥 Gold’s Hot Streak Continues

Gold just posted its longest winning streak since February, climbing over 3% in four sessions to around $3,383/oz. The catalyst? Growing fears of a U.S. economic slowdown are driving safe-haven demand, while traders bet on a September rate cut. With services stagnating and labor markets weakening, there’s now a 90% chance the Fed will ease policy — music to gold investors’ ears.

🏦 Fed Stands Pat on Rates (For Now)

At its July meeting, the Fed kept rates steady last week, despite political pressure for cuts. But here’s the interesting part: two Fed members broke ranks and voted to cut — first time we’ve seen that kind of dissent in decades. Translation? Rate cuts are likely coming soon, just not yet.

🧾 Trump’s Accusations Spark Jobs Debate

July’s jobs report was ugly — just 73,000 jobs added versus expectations. Plus, they revised May and June numbers down by 258,000 jobs. That’s not a rounding error, folks. Some are crying foul, but economists say these revisions are normal. Either way, the trend is clear: the job market is cooling fast.

💰 Citi Raises 3-Month Gold Forecast: $3,500

Citi just bumped their gold target to $3,500 (was $3,300). Their reasoning? Take your pick: new tariffs, weak jobs data, inflation fears, or a wobbly dollar. With an increased chance of September rate cuts now priced in, big banks are finally catching up to what gold bugs have known all along.

🔐 Shanghai Can’t Get Enough Gold

Here’s a number that caught our eye: 36 tons of gold just hit Shanghai warehouse records. Chinese traders are playing the arbitrage game between futures and physical, but the real story is simpler — demand is through the roof. When the world’s biggest gold buyer stockpiles at record levels, pay attention.

💬 Why Investors Choose GoldSilver

⭐ ⭐ ⭐ ⭐ ⭐ Best Company & Customer Service in the Industry

“GoldSilver.com has been my go-to bullion company for over a decade. Every purchase or sale with them is always effortless, fast, and professional. Last week, I had an urgent order, and Travis from the customer service team went above and beyond to expedite my transaction and meet my impossibly tight deadline. I couldn’t be happier with this company, and all the free educational resources they provide are life-changing. I’m looking forward to many more years with GoldSilver.com as my preferred metals dealer.”

— A. Mackness

Join thousands of smart investors who have discovered the GoldSilver difference:

- Personal guidance from precious metals experts who actually answer the phone

- Real education that cuts through the noise — no fluff, just facts

- A team that treats you like family, not a transaction number

Ready to get started?