Daily News Nuggets | Today’s top stories for gold and silver investors

December 3rd, 2025

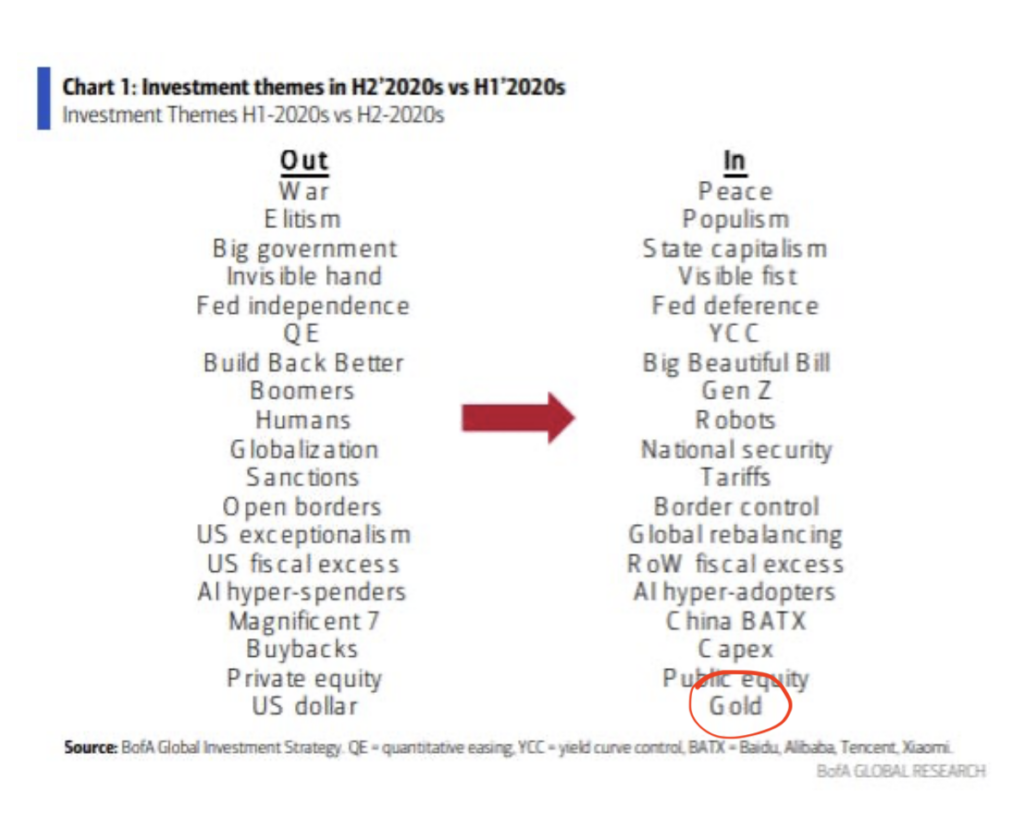

Bank of America “US Dollar Out, Gold In”

Bank of America’s investment strategy team just published one of the clearest frameworks for understanding the macro shift underway — essentially a before-and-after picture of what drove returns in the first half of this decade versus what will drive them in the second.

The big one: US dollar → gold.

The dollar dominated the early 2020s for good reason. The Fed hiked rates aggressively while other central banks lagged, making dollar-denominated assets the obvious play. But that trade is exhausted. Now we’re staring at $35+ trillion in federal debt, $2+ trillion annual deficits, and zero political appetite for fiscal discipline.

Meanwhile, central banks are accumulating gold at the fastest pace in decades. They watched the US freeze Russia’s dollar reserves in 2022 and learned a lesson: dollars held abroad are only yours until Washington decides otherwise. Gold has no counterparty risk, can’t be sanctioned, can’t be printed.

Dollar Pause Ahead of Fed Decision

The dollar is taking a breather as markets look past next week’s rate cut and start positioning for a weaker greenback in 2026.

The setup: 85% odds of a Fed cut next week, with another 90 basis points priced through 2026. Trump is expected to nominate Kevin Hassett — a known advocate for faster cuts — as Fed chair early next year. That combination has strategists turning bearish. Deutsche Bank sees room for a 2% drop through December alone. The dollar index is already down 9% this year.

What’s driving it? The weakness is showing up in the jobs data.

Private Sector Sheds Jobs for First Time in Two Years

US private employers cut 32,000 jobs in November — the biggest drop in two and a half years — against expectations for a 40,000 gain, according to ADP.

The damage was concentrated in small businesses. Firms with fewer than 50 employees shed 120,000 jobs, while larger companies added 90,000. That split suggests something structural breaking at the bottom of the labor market.

Losses were broad-based: professional services, information, manufacturing all down. Only education, health, and hospitality posted gains. Wage growth cooled to 4.4% year-over-year.

Here’s why it matters: this data lands days before the Fed’s decision. A weakening labor market gives the Fed cover to cut rates—and potentially keep cutting into 2026. Lower rates make non-yielding assets like gold and silver more attractive relative to bonds and cash. The metals are already responding.

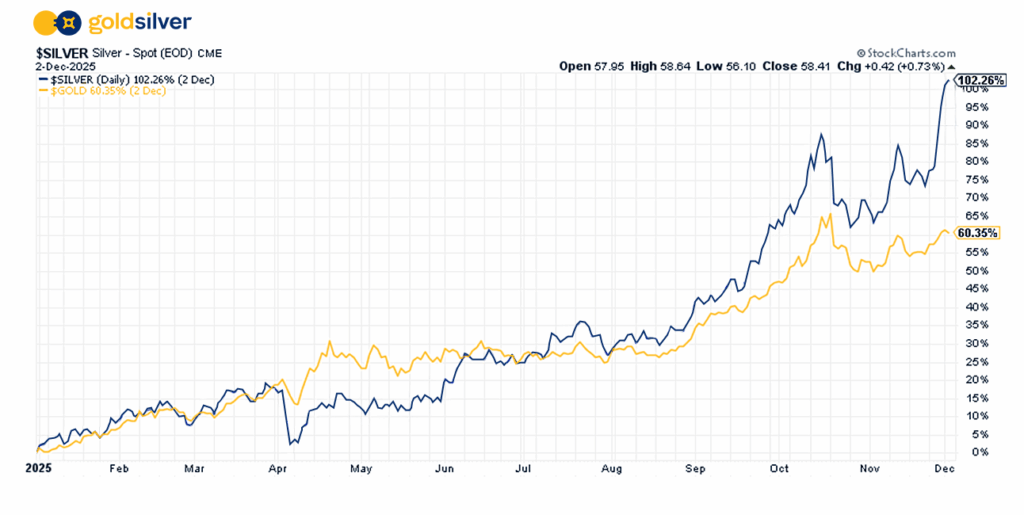

Silver Reaches 100% Gains YTD

Silver just doubled. After opening 2025 at $28.92, it’s now trading at around $58.58 — a 100% gain with a month still left in the year.

The surge reflects the same forces driving gold higher: investors hedging against inflation, currency weakness, and political uncertainty. But silver has an industrial wild card that gold doesn’t.

More than half of silver demand comes from industrial use—solar panels, electronics, medical devices, EV components. That creates a supply squeeze gold never faces. Inventories are near record lows, yet investor demand keeps climbing. If the rally continues, manufacturers could find themselves competing with investors for dwindling supply.

The price action is dramatic. The supply dynamics suggest it could get more interesting.