Daily News Nuggets | Today’s top stories for gold and silver investors

November 12th, 2025

Trump Floats $2,000 “Tariff Dividend” Checks — But the Math Doesn’t Add Up

President Trump floated a new populist idea over the weekend — $2,000 “tariff dividend” checks for every American, supposedly funded by revenues from his new wave of import tariffs. It’s being billed as a patriotic rebate. In reality, it’s stimulus by another name.

Here’s the issue: Tariff revenues this year total about $195 billion. Sending $2,000 to every eligible American adult would cost roughly $300–$326 billion. That’s a $100+ billion shortfall, money that would have to be borrowed — directly inflating the $37 trillion national debt.

This kind of unfunded stimulus risks reigniting inflation at exactly the wrong time. Unlike COVID-era payments, the economy isn’t in crisis. Injecting hundreds of billions in consumer spending could easily spark another price surge — essentially monetary expansion through the back door.

When governments spend money they don’t have, it devalues the currency — which is precisely why gold and silver tend to shine during periods of fiscal irresponsibility. The proposal still needs Congressional approval, but even floating the idea signals that deficit spending remains the path of least resistance in Washington.

Government Shutdown Set to End After 41 Days

After the longest government shutdown in U.S. history — 41 days and counting — Congress is finally moving to reopen. The Senate passed a funding bill Monday night, and the House is expected to vote Wednesday to send it to President Trump’s desk.

The shutdown furloughed nearly 670,000 federal workers, forced millions more to work without pay, and disrupted critical programs like SNAP benefits that serve over 42 million Americans. Markets responded positively to signs the impasse would end, with gold climbing to nearly three-week highs as investors anticipated the return of economic data flows and a likely December Fed rate cut.

The bill funds the government through January 30, though it kicks some key issues down the road—including a fight over extending ACA subsidies that affect 20 million Americans.

Job Security Concerns Add to Affordability Worries

Americans aren’t just worried about affording groceries anymore — now they’re anxious about keeping their jobs too. A recent Harris Poll found 55% of employed Americans are concerned about losing their jobs, a sharp jump as major employers announce layoffs.

Amazon, Target, and Starbucks have all announced cuts recently, and October saw the most job elimination announcements in over two decades according to outplacement firm Challenger, Gray & Christmas. This anxiety is layered on top of persistent affordability concerns — 62% of Americans say their everyday costs climbed over the past month, with nearly half saying those increases are hard to afford.

When consumers worry about both their paychecks and their bills, they tend to pull back on spending — which could slow economic growth and keep pressure on the Fed to cut rates.

Car Loan Delinquencies Hit Record — Echoing 2008 Warning Signs

Subprime auto loan delinquencies hit 6.65% in October — the highest level since 1994, according to Fitch Ratings. But here’s why this matters even if you’re up on your payments: economists call car loan delinquencies a “canary in the coal mine” for the broader economy.

Americans prioritize their car payments over almost everything else—including mortgages and rent—because they need vehicles to get to work. When people start defaulting on car loans, it signals they’ve already exhausted every other option. That’s exactly what happened in the lead-up to the 2008 financial crisis, when rising auto delinquencies served as an early warning that household finances were breaking down.

The parallels to 2008 are striking. The Consumer Federation of America notes that borrowers are “falling into delinquencies and defaults at a pace that exceeds pre-pandemic levels and rivals the years immediately preceding the 2008 economic crisis.” Car repossessions are now at their highest levels since the Great Recession.

Gold to Silver Ratio Drops Below 80:1

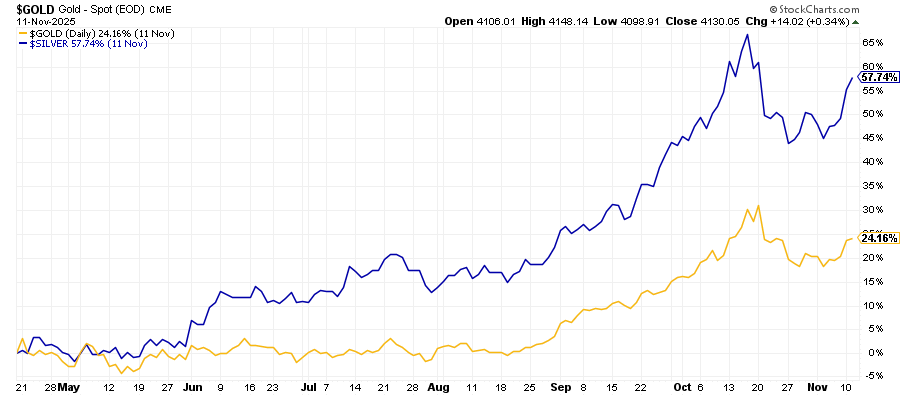

Back in April, we told readers the gold-to-silver ratio had hit an extreme level of 104:1 — well above its historical 50-year range of 60:1 to 80:1. We said this wouldn’t last, and that silver would likely outperform gold as the ratio normalized.

Fast forward to today: Gold has climbed an impressive 24% since April 21. But silver? It’s absolutely crushed those gains, surging 58% over the same period.

That extreme ratio we flagged has now dropped below 80:1, and silver holders who paid attention to that signal are sitting on gains nearly triple what gold delivered. When the ratio gets stretched to extremes, history shows it tends to snap back — and this time was no exception.