The precious metals market just delivered one of its most dramatic weeks in years — and it wasn’t random.

Gold briefly surged past $4,800 per ounce, setting another record high. Silver followed, pushing toward $95. This wasn’t a speculative blow-off or a technical breakout. It was a direct response to growing concern over the accelerating trend of foreign selling U.S. debt — a shift that’s quietly reshaping global capital flows.

When confidence in government bonds starts to crack, investors don’t wait for headlines. They move.

A Small Sale That Sent a Big Message

Last week, AkademikerPension — one of Denmark’s largest pension funds — announced it will sell its entire $100 million U.S. Treasury position by the end of the month. The reason was blunt: concerns about U.S. government finances.

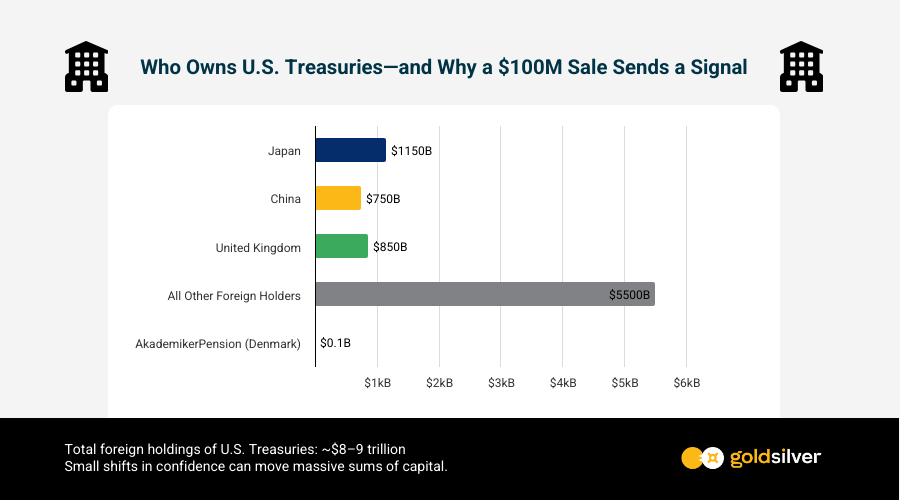

On the surface, $100 million sounds trivial. And in pure dollar terms, it is. Here’s what the global Treasury market actually looks like:

That tiny sliver at the bottom? That’s Denmark’s pension fund. It’s a rounding error in a market dominated by Japan ($1.15T), China ($750B), and thousands of other institutions holding a combined $9 trillion.

So why does this matter?

Institutional investors watch each other. When a conservative European pension fund publicly exits Treasuries over solvency concerns, it forces every other fund to ask: “Should we?”

If even a modest number follow-through — 2–3% of foreign holders — this could create massive ripple effects.

Why Foreign Selling U.S. Debt Matters More Than the Size

Markets don’t move on absolutes. They move on direction.

When a conservative European pension fund decides U.S. Treasuries no longer meet its risk standards — and acts on it through foreign selling of U.S. debt — it forces other institutions to ask the same question.

And if even a small fraction of foreign funds follow suit, the consequences could compound quickly:

- Higher borrowing costs for the U.S.

- Thinner market liquidity

- A weaker dollar

- Rising pressure on the Federal Reserve

Confidence, once shaken, rarely returns quietly. This is the backdrop gold is reacting to right now.

The Timing Isn’t Coincidental

This isn’t happening in a vacuum. The same week AkademikerPension announced its Treasury exit, diplomatic tensions between the U.S. and Europe reached a boiling point.

President Trump doubled down on his push to acquire Greenland while threatening 10% tariffs on eight European nations beginning February 1st — tariffs that could climb to 25% by June. French President Emmanuel Macron responded bluntly: Europe “will not be bullied.” German and Danish officials echoed the sentiment.

Trump later walked back the tariff threats, but the damage to confidence was already done.

For a Danish pension fund to cite concerns about U.S. government finances just days after watching its own government caught in diplomatic crossfire? That’s not coincidence. That’s a trust breakdown playing out in real-time capital allocation decisions.

Markets don’t wait for formal policy changes. They react to what confidence looks like when it starts to crack.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

The Path Toward $5,000 Gold

Major banks are starting to acknowledge what markets are already pricing in.

JP Morgan, Bank of America, and Goldman Sachs have recently floated $5,000 gold targets. After this week’s surge, those forecasts look less like speculation and more like lagging indicators.

Gold is benefiting from a structural shift — not a temporary panic:

- Persistent geopolitical instability

- A dollar facing long-term pressure

- Rising skepticism toward sovereign debt

Foreign selling of U.S. debt isn’t the cause by itself. It’s the symptom of a deeper loss of confidence in paper promises.

That’s precisely the environment where physical gold has historically done its best work.

What This Means for Investors

When global capital starts questioning the safety of government bonds, and foreign selling of U.S. debt accelerates as a result, diversification stops being a theory. It becomes a necessity.

Physical gold and silver aren’t dependent on fiscal discipline, political stability, or foreign confidence. They don’t require a counterparty to behave responsibly.

If you’ve been considering adding precious metals to your portfolio, this is the type of market signal long-term investors pay attention to — quietly, early, and deliberately.

Ready to explore how physical metals fit your portfolio? Our specialists are here to help you navigate this shift.

People Also Ask

Why are foreign countries selling U.S. Treasuries?

Foreign investors are reducing Treasury holdings due to concerns about U.S. fiscal sustainability, rising debt levels, and geopolitical tensions. The recent decision by Denmark’s AkademikerPension fund to exit its $100 million position cited explicit concerns about U.S. government finances. While individual sales may seem small, they signal a broader shift in confidence that can influence other institutional investors.

What happens if foreign countries stop buying U.S. debt?

If foreign demand for Treasuries weakens, the U.S. government would need to offer higher interest rates to attract buyers, increasing borrowing costs and straining the federal budget. This scenario typically leads to dollar weakness, thinner market liquidity, and upward pressure on inflation. Historically, declining confidence in sovereign debt has driven investors toward alternative stores of value like physical gold and silver.

How much U.S. debt do foreign countries own?

Foreign investors held approximately $8.5 trillion in U.S. Treasury securities as of December 2024, representing about 30% of publicly held debt. Japan leads with $1.06 trillion, followed by China ($759 billion) and the United Kingdom ($723 billion). Even small percentage shifts in these holdings can move hundreds of billions of dollars and significantly impact Treasury markets.

Why is gold surging when foreign investors sell U.S. Treasuries?

Gold responds to declining confidence in paper assets and sovereign debt. When institutions question the safety of government bonds—traditionally seen as risk-free—investors rotate into physical assets that don’t depend on government solvency or fiscal discipline. Gold’s recent surge past $4,800 per ounce reflects growing concern over Treasury market dynamics and long-term dollar stability.

What does Denmark’s pension fund selling Treasuries mean for the dollar?

While Denmark’s $100 million sale is small in absolute terms, it represents a public vote of no-confidence from a conservative European institution. If other pension funds, sovereign wealth funds, or central banks follow suit—even modestly—the cumulative effect pressures the dollar, raises U.S. borrowing costs, and accelerates the shift toward alternative reserve assets. Markets react to these signals before the full capital reallocation occurs.

![Why Metals Dominated Every Asset Class in 2025 [and What It Means for 2026]](https://goldsilver.com/wp-content/uploads/2026/01/gold-silver-performance-2025-300x200.jpg)