Dow in Silver

GoldSilver.com

MAR 7, 2011

The Dow Jones Industrial Average has had tremendous nominal growth since bottoming in March of 2009. Although the Dow has risen to over 12,000 it is important for investors to keep in perspective that nominal point gains of the Dow don't necessarily mean stock investors have increased their overall wealth and purchasing power versus other asset classes.

Here at GoldSilver.com, we don’t compare stocks to dollars as we know that monetary inflation simply gives one the illusion that nominal prices are the same as increases in value, this is not always so.

Investors must understand that an investment's nominal prices can climb even while its overall value versus other asset classes may drop. Point in case ---> Silver!

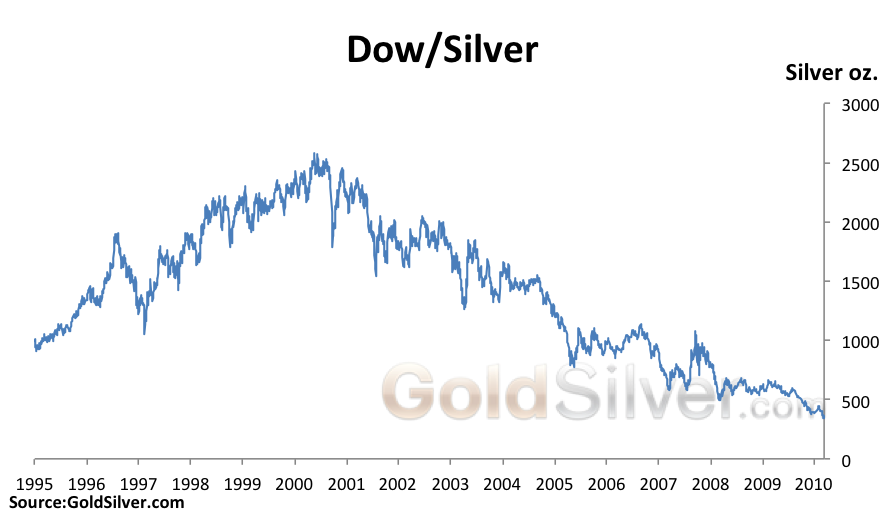

If we actually look at the Dow Jones in ounces of silver, we see that the Dow Jones Industrial Average has been spiraling downward in value since 2001.

Currently to buy 1 share of the Dow it takes less than a mint case of 500 US silver eagles!

In a span of 9 years the Dow has dropped below 500 oz per share from a high of above 2500 oz per share.

We expect this trend to continue with the Dow silver ratio further shrinking to even lower levels in the coming years.

We now must begin to ponder the following question: