The gold and silver performance in 2025 wasn’t just impressive by historical standards — it marked one of the strongest relative showings for precious metals in decades.

Silver surged 146%.

Gold climbed 64%.

Those are are once-in-a-generation moves — especially for assets that most investors still think of as “boring” or “defensive.”

But just how exceptional was 2025?

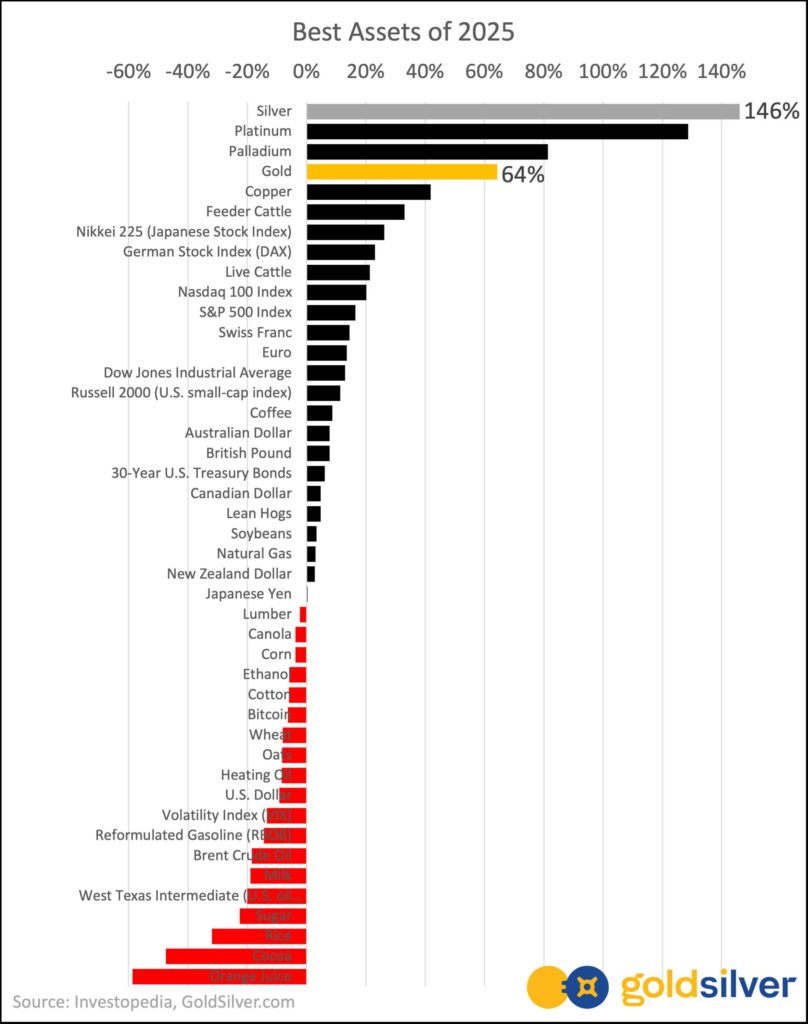

This chart from Alan Hibbard of ‘the best assets of 2025’ puts it into perspective.

Best Assets of 2025

Source: Investopedia, GoldSilver.com

When you line up every major asset class side by side, the story becomes impossible to ignore. Precious metals didn’t just perform well — they dominated.

Silver wasn’t merely the top performer. It obliterated the field. Gold didn’t just hedge risk — it outperformed the vast majority of stocks, bonds, currencies, and commodities.

And this wasn’t a one-metal fluke.

Metals Swept the Asset Leaderboard

Look at the top five assets of 2025:

- Silver — 146% gain

- Platinum — 129% gain

- Palladium — 81% gain

- Gold — 64% gain

- Copper — 42% gain

Every single one of them was a metal. That matters.

This wasn’t speculative froth chasing meme stocks or leverage-driven crypto rallies. It was capital flowing deliberately into hard, tangible assets — assets with no counterparty risk, real industrial demand, and centuries of monetary history behind them.

Meanwhile, many of the assets investors were told would protect them — long-duration bonds, fiat currencies, and broad equity indices — either lagged badly or outright lost ground.

The Financial System Isn’t Safer — And You Know It As risks mount, see why gold and silver are projected to keep shining in 2026 and beyond.

Why This Was a Structural Shift — Not a One-Off Rally

What made the gold and silver performance in 2025 so notable wasn’t just the magnitude of the gains, but how decisively metals outpaced nearly every major asset class.

2025 rewarded assets that:

- Can’t be printed

- Can’t be defaulted on

- Aren’t dependent on financial engineering or political promises

Inflation uncertainty, rising sovereign debt, geopolitical stress, and eroding confidence in monetary policy all played a role. But the bigger story is this:

Investors quietly changed what they trusted.

And when trust shifts, capital follows.

Gold and silver didn’t rise because of hype. They rose because, in an increasingly unstable system, they remain among the few assets that don’t rely on someone else’s ability — or willingness — to pay.

Old Money Beats New Money in Uncertain Times

One of the quieter lessons of 2025 is this:

When the system gets stressed, old money tends to beat new money.

Gold and silver aren’t new ideas. They don’t rely on complex financial structures, innovative narratives, or permanent liquidity. Precious metals don’t need to “work” for returns to exist.

They simply are.

That’s precisely why they tend to outperform during periods of transition — when confidence in paper claims, digital abstractions, and leveraged promises starts to erode.

New money thrives when trust is abundant. Old money survives when trust is questioned.

2025 was not a year defined by optimism. It was defined by uncertainty. And uncertainty has a way of exposing which assets depend on faith — and which ones stand on their own.

Counterparty Risk: The Risk No One Notices Until It Matters

At the heart of this shift is a concept most investors rarely think about during calm markets: counterparty risk.

Counterparty risk is simple:

It’s the risk that someone else has to perform — pay, deliver, honor, or remain solvent — for your asset to retain value.

Stocks have counterparty risk. Bonds have counterparty risk. Bank deposits, ETFs, derivatives, and even many “hard asset” proxies all depend on layers of institutions functioning exactly as promised.

Gold and silver don’t.

Physical precious metals carry no counterparty risk. They are not a claim on someone else’s balance sheet. Precious metals don’t require a functioning intermediary, a clearinghouse, a custodian, or a government guarantee to exist.

Gold and silver settle instantly. They are final payment. They don’t default.

That distinction tends to feel academic — right up until it isn’t.

When confidence is high, counterparty risk is invisible. When confidence cracks, it becomes everything.

The Takeaway Most Investors Will Miss

Many will look at 2025 and say, “Well, that was a great year for metals.”

The more important question is: Why weren’t you positioned before the move?

This chart isn’t just a recap of what happened. It’s a snapshot of what the market rewarded — and what it punished.

For investors focused on long-term preservation of purchasing power, 2025 delivered a very clear message:

Hard assets aren’t an alternative anymore. They’re essential.

The investors who understood that early didn’t just protect their wealth.

They grew it — substantially.

Ready to position your portfolio for the next market shift? Explore our educational resources on precious metals investing or speak with a precious metals specialist to discuss your strategy.

People Also Ask

What was the best performing asset in 2025?

Silver was the top-performing asset in 2025, surging 146% for the year. This once-in-a-generation gain outpaced every major asset class including stocks, bonds, real estate, and cryptocurrencies.

How much did gold go up in 2025?

Gold climbed 64% in 2025, securing the fourth spot among all major assets. Gold’s performance exceeded the S&P 500, Nasdaq, and most other traditional investments that year.

What were the top 5 performing assets in 2025?

The top five assets of 2025 were all metals: silver (146%), platinum, palladium, gold (64%), and copper. This unprecedented metal sweep reflected a major shift in investor confidence toward hard, tangible assets with no counterparty risk.

What is counterparty risk and why does it matter?

Counterparty risk is the risk that someone else must perform—pay, deliver, or remain solvent—for your asset to retain value. Physical gold and silver carry zero counterparty risk because they don’t depend on any institution, intermediary, or government promise to maintain their worth.

Are precious metals a good investment during economic uncertainty?

Precious metals historically perform well during economic uncertainty because they maintain value independent of government policy, currency strength, or financial system stability. The 2025 performance demonstrated this principle, with metals dominating as traditional assets struggled amid growing systemic concerns.