You Can Run, But You Can’t Hide: The Inexorable March of Death by Fiat

The Gold Telegraph

(

Original

)

APR 2, 2018

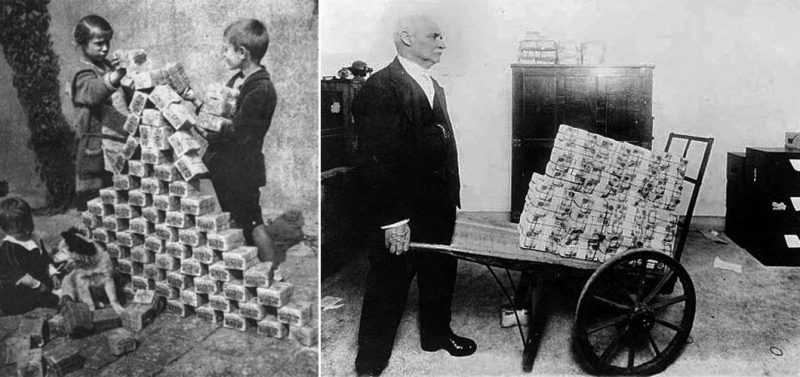

Too often these days, hyperinflation is referred to as an “them, not us” problem. Oft-cited third-world examples include Venezuela and Zimbabwe, which to most Americans, might as well be Neptune and Saturn.

But hyperinflation is not only the purview of desperate countries with no other quarter; it has marked the death of dynasties and empires throughout history. Fiat currency is always to blame. The seeming magic of having people treat worthless, printed money as if it retained value was always the irresistible allure.

Rome, China, Kublai Kahn, the Weimar Republic, France (three times), Greece. Systemic collapse has always been the end result.

At the start of the first century, the Roman denarius was a coin containing approximately 94 percent real silver. By the end of the century, the amount of silver was reduced to 85 percent. Devaluing the denarius meant Nero and succeeding emperors could pay off their bills more easily while becoming richer.

A hundred years later, the denarius contained less than 50 percent silver, and in 244 A.D., Emperor Philip the Arab devalued the currency down to 0.05 percent silver content. By the time the Roman empire collapsed, the denarius was made of 0.02 percent silver, and it became useless as a currency.

France has an interesting history with paper money. It may be the only country to face economic collapse not once, not twice, but three times by flooding the country with fiat currency.

High-living Sun King Louis XIV left a debt of 3 billion livres for his successor to deal with. Louis XV desperately needed incoming tax payments and demanded these be paid in paper currency. Predictably, the paper currency was quickly overprinted and became worthless.

In the 18th century, France began another attempt at printing paper currency called assignats. By the end of the century, the assignat suffered 13,000 percent inflation. Napoleon rode to the rescue by instituting the gold franc, which stabilized France’s erratic currency. One would think the French might have seen a connection between the stable economy and gold-backed currency. No such luck.

France reverted to paper currency in the 1930s, the paper franc. In just more than a decade, the fiat franc became devalued by 99 percent. France’s third attempt at printing worthless monopoly money proved to be a dismal failure.

ORIGINAL SOURCE: There is No Escaping History: Fiat Currency Eventually Fails by Alex Deluce at The Gold Telegraph on 4/2/18