Gold and Silver Industry & Investing News

Today’s gold and silver market news, curated from the best of GoldSilver's team and around the web. Everything precious metals investors need to know including updates on big price swings, macro analysis, and breaking stories. Check back often or subscribe to get the highlights in your inbox. Monitor live spot prices on our charts page.

India's Import Bill Shrinks, Narrowing September Trade Gap

In September 2024, India's trade balance showed signs of improvement as the deficit narrowed to $20.78 billion, lower than economists' expectations of $24.63 billion. This positive shift was largely attributed to reduced gold imports, which helped moderate the overall import bill. Despite global economic challenges, India's exports maintained a slight growth, with sectors like engineering goods, plastics, and pharmaceuticals performing well.

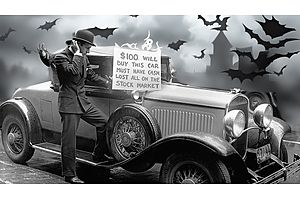

READ MORESurviving the Crash of 1929: How Gold Stocks Defied the Great Depression

Ninety-four years ago, the optimism and prosperity of the 'Roaring Twenties' ended abruptly with the Crash of 1929...

READ MOREElection Uncertainty Propels Gold to New Heights

Gold prices are rising towards new record highs as investors focus on the upcoming U.S. presidential election and potential Federal Reserve rate cuts. The precious metal's appeal as a safe-haven asset, combined with strong central bank buying, has driven its performance in 2024. Uncertainty surrounding the election outcome and potential policy changes are prompting investors to adjust their portfolios, further supporting gold's rally.

READ MOREPlaybook for the Next Crisis – Where These Experts Are Investing | Gammon, Maloney & Moss

In this eye-opening panel discussion, George Gammon, Mike Maloney and Mark Moss dive deep into the economic realities we face today.

READ MORECentral Banks Maintain Gold Appetite Despite Price Surge

Central banks continue to value gold as a key component of their reserves, despite recent price increases and a slowdown in purchases by some countries. Representatives from the Czech Republic, Mongolia, and Mexico emphasized the importance of gold for diversification and security at a recent bullion conference. While global central bank gold purchases have slowed in 2024, they remain significant, with a 6% increase to 183 tons in the second quarter.

READ MORECash Stays Put: Why Rate Cuts Don't Always Trigger Stock Market Inflows

Despite expectations that investors would move money from cash to stocks after interest rate cuts, historical data shows this isn't always the case. Even after the Federal Reserve began lowering rates, money continued to flow into money market funds. This trend suggests investor caution and uncertainty about the economic outlook, rather than a rush to put cash back into the stock market.

READ MORECentral Banks Signal Bullish Outlook on Gold Amid Global Uncertainties

Central banks worldwide are showing renewed interest in increasing their gold reserves, as highlighted by recent comments from officials representing Mexico, Mongolia, and the Czech Republic. These central bankers cited factors such as geopolitical tensions, lower interest rates, and economic uncertainty as reasons for potentially expanding their gold holdings. This shift in strategy comes amid a record-breaking rally in gold prices, which have surged over 25% in 2024, outperforming both US equities and bonds. The trend reflects a growing recognition of gold's role as a safe-haven asset and diversifier in national reserves.

READ MOREFed's Waller Urges Prudence in Rate Cut Decisions Amid Economic Strength

In response to recent economic indicators, Federal Reserve Governor Christopher Waller has advocated for increased caution in implementing interest rate cuts. Waller noted that while his overall outlook still supports gradual rate reductions, the latest data on inflation, employment, and economic activity suggest a need for a more measured approach to loosening monetary policy compared to the Fed's actions in September.

READ MOREGold Holds Ground as Dollar Strength Tests Recent Gains

Gold prices remain steady as the US dollar strengthens, with traders balancing profit-taking impulses against potential Federal Reserve rate cuts. The precious metal, hovering around $2,650 per ounce, faces headwinds from a robust dollar and higher Treasury yields but continues to be supported by expectations of future rate reductions. Despite these challenges, analysts anticipate gold could reach new record highs by the end of the year, building on its nearly 30% gain so far in 2024.

READ MOREWall Street Rallies as Earnings Season Takes Center Stage

The stock market is reaching new highs as investors anticipate positive earnings reports from major companies. Despite lower forecasts for third-quarter results, there's optimism that companies will surpass expectations, potentially validating the belief in a soft economic landing. With limited economic data available, corporate earnings are expected to be the primary driver of market sentiment in the coming days.

READ MOREChina Signals Economic Boost, Commodity Markets Respond

China's finance ministry has pledged increased support for the country's struggling economy, particularly focusing on the property sector and local government debt. While no specific fiscal stimulus measures were announced, the commitment to bolster growth has steadied commodity prices, with iron ore futures showing a notable recovery. Investors remain cautiously optimistic, hoping for more concrete actions to stimulate demand and counteract the ongoing real estate downturn.

READ MOREGold Holds Steady as China's Stimulus Falls Short of Expectations

Gold prices remained steady near one-week highs on Monday as China's underwhelming fiscal stimulus dampened risk appetite. Investors are now focusing on comments from U.S. Federal Reserve officials for insights into future interest rate decisions, while weak Chinese economic data presents a mixed outlook for gold demand.

READ MOREFed's Rate Cut Plan: What It Means for Gold Investors

Find out why gold investors are excited about the Fed's latest move... and what it could mean for you and your portfolio.

READ MORESurvey Reveals Gold's Enduring Popularity Among German Investors

Despite a recent decline in gold purchases, gold remains the third most popular investment in Germany after savings accounts and equities. A World Gold Council survey revealed that 28% of Germans currently invest in gold, with many viewing it as an accessible and inflation-resistant asset. The recent slump in demand is attributed to higher prices prompting some investors to sell rather than a loss of interest in gold.

READ MOREIndia's Gold Industry Navigates High Prices Ahead of Diwali Season

Gold dealers in India are charging premiums for the first time in two months as the festive season approaches, despite record-high prices dampening sales volume. While sentiment remains positive, consumers are opting for lighter, more affordable jewelry. In contrast, China's gold market sees weak demand post-holidays.

READ MOREUS Money-Market Funds Swell to $6.47 Trillion: A New Era of Cash Management

US money-market funds have reached a record $6.47 trillion in assets as investors seek high yields amid anticipated Federal Reserve rate cuts. The funds attracted $11 billion in the week ending October 9, bringing this year's inflows to over half a trillion dollars. Despite a recent Fed rate cut, these funds continue to draw investments due to their superior yields compared to other instruments, particularly bank deposits.

READ MOREForget $50 Silver, "$150 Is Appropriate": Mike Maloney's Bold Prediction

Join Mike Maloney and Alan Hibbard as they dive deep into the ‘last great precious metals bull market’.

READ MOREJobless Claims Hit 14-Month High, Challenging Fed's Labor Market Assessment

US unemployment benefit applications surged to a one-year high last week, with initial claims rising by 33,000 to 258,000. This increase was partly due to Hurricane Helene's impact on southeastern states and a significant jump in claims from Michigan. The surge in jobless claims may complicate the Federal Reserve's efforts to assess the labor market's underlying trends.

READ MOREUS Inflation Eases to 2.4% in September, Fed Rate Cuts on Track

The September US Consumer Price Index (CPI) report shows inflation at 2.4% annually, slightly above expectations. While this marks the smallest increase since February 2021, core inflation rose to 3.3%. The Federal Reserve is expected to continue with planned interest rate cuts, but at a more measured pace of quarter-point reductions.

READ MORESocial Security Payments to Rise 2.5% in 2025, Benefiting Millions

The Social Security Administration has announced a 2.5% cost-of-living adjustment (COLA) for 2025, which will increase monthly benefits for over 72 million Americans, including retirees and disabled workers. This adjustment, effective January 2025, will add approximately $48 to the average monthly benefit of $1,907, helping beneficiaries cope with inflation. While lower than the 3.2% increase in 2024, this COLA aligns with the average annual adjustments of recent years.

READ MORE